Errors in good faith: recovering NICs

Errors in good faith: recovering NICs

Errors in good faith: recovering NICs

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

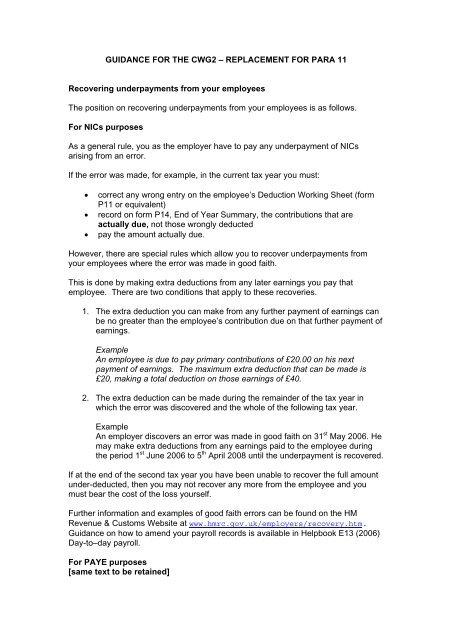

GUIDANCE FOR THE CWG2 – REPLACEMENT FOR PARA 11Recover<strong>in</strong>g underpayments from your employeesThe position on recover<strong>in</strong>g underpayments from your employees is as follows.For <strong>NICs</strong> purposesAs a general rule, you as the employer have to pay any underpayment of <strong>NICs</strong>aris<strong>in</strong>g from an error.If the error was made, for example, <strong>in</strong> the current tax year you must:• correct any wrong entry on the employee’s Deduction Work<strong>in</strong>g Sheet (formP11 or equivalent)• record on form P14, End of Year Summary, the contributions that areactually due, not those wrongly deducted• pay the amount actually due.However, there are special rules which allow you to recover underpayments fromyour employees where the error was made <strong>in</strong> <strong>good</strong> <strong>faith</strong>.This is done by mak<strong>in</strong>g extra deductions from any later earn<strong>in</strong>gs you pay thatemployee. There are two conditions that apply to these recoveries.1. The extra deduction you can make from any further payment of earn<strong>in</strong>gs canbe no greater than the employee’s contribution due on that further payment ofearn<strong>in</strong>gs.ExampleAn employee is due to pay primary contributions of £20.00 on his nextpayment of earn<strong>in</strong>gs. The maximum extra deduction that can be made is£20, mak<strong>in</strong>g a total deduction on those earn<strong>in</strong>gs of £40.2. The extra deduction can be made dur<strong>in</strong>g the rema<strong>in</strong>der of the tax year <strong>in</strong>which the error was discovered and the whole of the follow<strong>in</strong>g tax year.ExampleAn employer discovers an error was made <strong>in</strong> <strong>good</strong> <strong>faith</strong> on 31 st May 2006. Hemay make extra deductions from any earn<strong>in</strong>gs paid to the employee dur<strong>in</strong>gthe period 1 st June 2006 to 5 th April 2008 until the underpayment is recovered.If at the end of the second tax year you have been unable to recover the full amountunder-deducted, then you may not recover any more from the employee and youmust bear the cost of the loss yourself.Further <strong>in</strong>formation and examples of <strong>good</strong> <strong>faith</strong> errors can be found on the HMRevenue & Customs Website at www.hmrc.gov.uk/employers/recovery.htm.Guidance on how to amend your payroll records is available <strong>in</strong> Helpbook E13 (2006)Day-to–day payroll.For PAYE purposes[same text to be reta<strong>in</strong>ed]