Guide for curators and tutors who must provide an annual ...

Guide for curators and tutors who must provide an annual ...

Guide for curators and tutors who must provide an annual ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

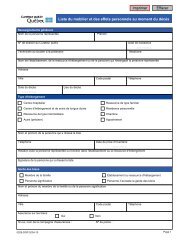

Line 109:SAAQ benefits <strong><strong>an</strong>d</strong> compensationLine 202:Tutor's remunerationEnter <strong>an</strong>y benefits <strong><strong>an</strong>d</strong> indemnities received on behalf ofthe minor from the Société de l’assur<strong>an</strong>ce automobile duQuébec during the period. For inst<strong>an</strong>ce, <strong>an</strong> allow<strong>an</strong>ce <strong>for</strong>a dependent should be declared on line 109, even if youhave declared it as <strong>an</strong> asset. The <strong>an</strong>nual total of SAAQbenefits <strong><strong>an</strong>d</strong> allow<strong>an</strong>ces <strong>must</strong> be entered but you do nothave to <strong>provide</strong> a breakdown.Line 110:Other <strong>an</strong>nuities (name of payer)Enter <strong>an</strong>y other benefits or pensions received by theminor during the period. These are usually privatepension benefits, <strong>for</strong> inst<strong>an</strong>ce, life insur<strong>an</strong>ce payments.Line 111:Income tax refunds <strong><strong>an</strong>d</strong> other tax credits(GST <strong><strong>an</strong>d</strong> QST)Enter <strong>an</strong>y refunds (income tax, GST <strong><strong>an</strong>d</strong> QST) receivedby the minor during the period.Line 112:Other incomeList <strong>an</strong>y other sources of the minor's income on lines 100to 111. This includes interest earnings other th<strong>an</strong> thoserelated to a lo<strong>an</strong> (this <strong>must</strong> be posted on line 103 of the<strong>an</strong>nual report). Enter the total amount (after all itemshave been calculated). If you have more th<strong>an</strong> one item toenter under this heading, please break them down(description <strong><strong>an</strong>d</strong> amount) on a separate sheet <strong><strong>an</strong>d</strong> attachit to the completed <strong>an</strong>nual report.Line 120:Total incomeEnter the total of the amounts entered on lines 100 to113.6) EXPENSESAll amounts entered in this section <strong>must</strong> correspond toexpenses paid during the period. For more detailedin<strong>for</strong>mation, refer to Section C of the <strong>Guide</strong> <strong>for</strong> legal (ordative) <strong>tutors</strong> to a minor <strong><strong>an</strong>d</strong> <strong>tutors</strong>hip councils.Line 200: B<strong>an</strong>k charges <strong><strong>an</strong>d</strong> investmentexpensesEnter all b<strong>an</strong>k charges <strong><strong>an</strong>d</strong> other investment expenses(broker’s fees, rental of a safety deposit box, interest paidon bond purchases, etc.).Line 201:Tutor's expensesEnter <strong>an</strong>y expenses you paid using the minor's assets ifyou c<strong>an</strong> prove they resulted from the fact that you are hisor her legal representative. Not to be confused withremuneration (box 202).Enter the remuneration gr<strong>an</strong>ted to you by judgment of thecourt to per<strong>for</strong>m your duties as legal representative. Noremuneration <strong>for</strong> the tutor other th<strong>an</strong> that gr<strong>an</strong>ted in theCourt's judgment may be withdrawn from the minor'spatrimony.Line 203:Professional feesEnter expenses or professional charges incurred <strong>for</strong> thebenefit of the minor, excepting medical costs (e.g., fees<strong><strong>an</strong>d</strong> costs related to the <strong>for</strong>mation of the <strong>tutors</strong>hipcouncil).Line 204:Curateur public supervision feesThe Curateur public charges no fee <strong>for</strong> monitoring theadministration of private protective supervision. However,in cases where it <strong>must</strong> complete the process of institutingprivate protective supervision, costs are charged <strong><strong>an</strong>d</strong> thetotal paid <strong>for</strong> out of the minor's patrimony <strong>must</strong> be postedunder this heading.Line 205:Insur<strong>an</strong>ce premiums, excluding propertyinsur<strong>an</strong>ceEnter the amounts paid during the period to paypremiums if the minor holds insur<strong>an</strong>ce policies, exceptpolicies <strong>for</strong> real estate (e.g., life insur<strong>an</strong>ce, autoinsur<strong>an</strong>ce).Line 206: Property expenses (taxes, insur<strong>an</strong>ce,mainten<strong>an</strong>ce, etc.)Enter costs related to the buildings owned by the minor(taxes, insur<strong>an</strong>ce premiums, mainten<strong>an</strong>ce, repairs,heating, electricity, etc.).If costs related to Hydro, heating, or other services <strong>for</strong> themainten<strong>an</strong>ce of a building belonging to the minor <strong>must</strong> bepaid out of the minor's patrimony, they should be postedunder this heading.If interest payments on a mortgage have been incurred,they <strong>must</strong> be posted on line 207 of the <strong>an</strong>nual report, notunder this heading.Line 207:Interest on a mortgageor other lo<strong>an</strong>sEnter the portion of the mortgage payments thatconstitutes interest. In addition, if lo<strong>an</strong>s other th<strong>an</strong> amortgage (e.g., student or personal lo<strong>an</strong>, line of credit,credit card, etc.) have been partially or fully repaid, theseamounts <strong>must</strong> be posted under this heading.Line 208:Rent paidIf applicable, enter the amounts paid to house the minor.The minor is not required to pay rent to his or herparents.