View - Centru E-learning de Instruire al Resurselor Umane din ...

View - Centru E-learning de Instruire al Resurselor Umane din ...

View - Centru E-learning de Instruire al Resurselor Umane din ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

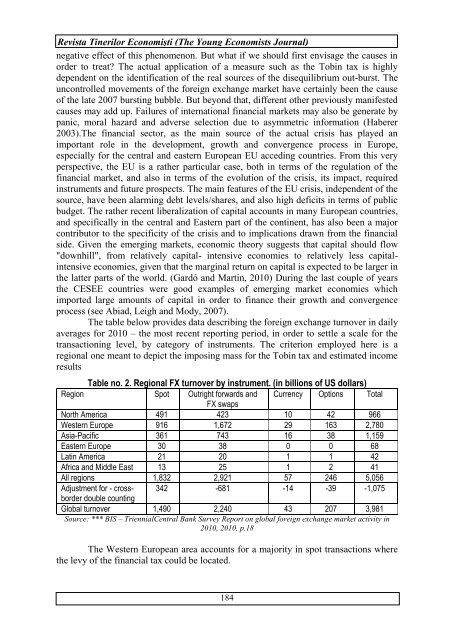

Revista Tinerilor Economişti (The Young Economists Journ<strong>al</strong>)negative effect of this phenomenon. But what if we should first envisage the causes inor<strong>de</strong>r to treat? The actu<strong>al</strong> application of a measure such as the Tobin tax is highly<strong>de</strong>pen<strong>de</strong>nt on the i<strong>de</strong>ntification of the re<strong>al</strong> sources of the disequilibrium out-burst. Theuncontrolled movements of the foreign exchange market have certainly been the causeof the late 2007 bursting bubble. But beyond that, different other previously manifestedcauses may add up. Failures of internation<strong>al</strong> financi<strong>al</strong> markets may <strong>al</strong>so be generate bypanic, mor<strong>al</strong> hazard and adverse selection due to asymmetric information (Haberer2003).The financi<strong>al</strong> sector, as the main source of the actu<strong>al</strong> crisis has played animportant role in the <strong>de</strong>velopment, growth and convergence process in Europe,especi<strong>al</strong>ly for the centr<strong>al</strong> and eastern European EU acce<strong>din</strong>g countries. From this veryperspective, the EU is a rather particular case, both in terms of the regulation of thefinanci<strong>al</strong> market, and <strong>al</strong>so in terms of the evolution of the crisis, its impact, require<strong>din</strong>struments and future prospects. The main features of the EU crisis, in<strong>de</strong>pen<strong>de</strong>nt of thesource, have been <strong>al</strong>arming <strong>de</strong>bt levels/shares, and <strong>al</strong>so high <strong>de</strong>ficits in terms of publicbudget. The rather recent liber<strong>al</strong>ization of capit<strong>al</strong> accounts in many European countries,and specific<strong>al</strong>ly in the centr<strong>al</strong> and Eastern part of the continent, has <strong>al</strong>so been a majorcontributor to the specificity of the crisis and to implications drawn from the financi<strong>al</strong>si<strong>de</strong>. Given the emerging markets, economic theory suggests that capit<strong>al</strong> should flow"downhill", from relatively capit<strong>al</strong>- intensive economies to relatively less capit<strong>al</strong>intensiveeconomies, given that the margin<strong>al</strong> return on capit<strong>al</strong> is expected to be larger inthe latter parts of the world. (Gardó and Martin, 2010) During the last couple of yearsthe CESEE countries were good examples of emerging market economies whichimported large amounts of capit<strong>al</strong> in or<strong>de</strong>r to finance their growth and convergenceprocess (see Abiad, Leigh and Mody, 2007).The table below provi<strong>de</strong>s data <strong>de</strong>scribing the foreign exchange turnover in dailyaverages for 2010 – the most recent reporting period, in or<strong>de</strong>r to settle a sc<strong>al</strong>e for thetransactioning level, by category of instruments. The criterion employed here is aregion<strong>al</strong> one meant to <strong>de</strong>pict the imposing mass for the Tobin tax and estimated incomeresultsTable no. 2. Region<strong>al</strong> FX turnover by instrument. (in billions of US dollars)Region Spot Outright forwards and Currency Options Tot<strong>al</strong>FX swapsNorth America 491 423 10 42 966Western Europe 916 1,672 29 163 2,780Asia-Pacific 361 743 16 38 1,159Eastern Europe 30 38 0 0 68Latin America 21 20 1 1 42Africa and Middle East 13 25 1 2 41All regions 1,832 2,921 57 246 5,056Adjustment for - crossbor<strong>de</strong>rdouble counting342 -681 -14 -39 -1,075Glob<strong>al</strong> turnover 1,490 2,240 43 207 3,981Source: *** BIS – Trienni<strong>al</strong>Centr<strong>al</strong> Bank Survey Report on glob<strong>al</strong> foreign exchange market activity in2010, 2010, p.18The Western European area accounts for a majority in spot transactions wherethe levy of the financi<strong>al</strong> tax could be located.184