XTra Credit FOUR - Prudential Annuities

XTra Credit FOUR - Prudential Annuities

XTra Credit FOUR - Prudential Annuities

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

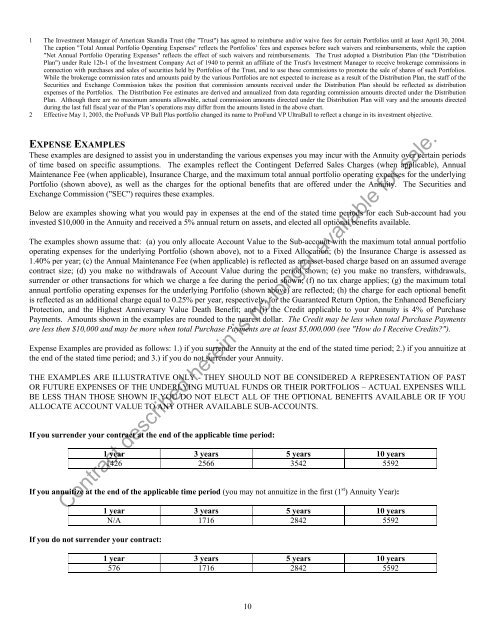

1 The Investment Manager of American Skandia Trust (the "Trust") has agreed to reimburse and/or waive fees for certain Portfolios until at least April 30, 2004.The caption "Total Annual Portfolio Operating Expenses" reflects the Portfolios’ fees and expenses before such waivers and reimbursements, while the caption"Net Annual Portfolio Operating Expenses" reflects the effect of such waivers and reimbursements. The Trust adopted a Distribution Plan (the "DistributionPlan") under Rule 12b-1 of the Investment Company Act of 1940 to permit an affiliate of the Trust's Investment Manager to receive brokerage commissions inconnection with purchases and sales of securities held by Portfolios of the Trust, and to use these commissions to promote the sale of shares of such Portfolios.While the brokerage commission rates and amounts paid by the various Portfolios are not expected to increase as a result of the Distribution Plan, the staff of theSecurities and Exchange Commission takes the position that commission amounts received under the Distribution Plan should be reflected as distributionexpenses of the Portfolios. The Distribution Fee estimates are derived and annualized from data regarding commission amounts directed under the DistributionPlan. Although there are no maximum amounts allowable, actual commission amounts directed under the Distribution Plan will vary and the amounts directedduring the last full fiscal year of the Plan’s operations may differ from the amounts listed in the above chart.2 Effective May 1, 2003, the ProFunds VP Bull Plus portfolio changed its name to ProFund VP UltraBull to reflect a change in its investment objective.EXPENSE EXAMPLESThese examples are designed to assist you in understanding the various expenses you may incur with the Annuity over certain periodsof time based on specific assumptions. The examples reflect the Contingent Deferred Sales Charges (when applicable), AnnualMaintenance Fee (when applicable), Insurance Charge, and the maximum total annual portfolio operating expenses for the underlyingPortfolio (shown above), as well as the charges for the optional benefits that are offered under the Annuity. The Securities andExchange Commission ("SEC") requires these examples.Below are examples showing what you would pay in expenses at the end of the stated time periods for each Sub-account had youinvested $10,000 in the Annuity and received a 5% annual return on assets, and elected all optional benefits available.The examples shown assume that: (a) you only allocate Account Value to the Sub-account with the maximum total annual portfoliooperating expenses for the underlying Portfolio (shown above), not to a Fixed Allocation; (b) the Insurance Charge is assessed as1.40% per year; (c) the Annual Maintenance Fee (when applicable) is reflected as an asset-based charge based on an assumed averagecontract size; (d) you make no withdrawals of Account Value during the period shown; (e) you make no transfers, withdrawals,surrender or other transactions for which we charge a fee during the period shown; (f) no tax charge applies; (g) the maximum totalannual portfolio operating expenses for the underlying Portfolio (shown above) are reflected; (h) the charge for each optional benefitis reflected as an additional charge equal to 0.25% per year, respectively, for the Guaranteed Return Option, the Enhanced BeneficiaryProtection, and the Highest Anniversary Value Death Benefit; and (i) the <strong>Credit</strong> applicable to your Annuity is 4% of PurchasePayments. Amounts shown in the examples are rounded to the nearest dollar. The <strong>Credit</strong> may be less when total Purchase Paymentsare less then $10,000 and may be more when total Purchase Payments are at least $5,000,000 (see "How do I Receive <strong>Credit</strong>s?").Expense Examples are provided as follows: 1.) if you surrender the Annuity at the end of the stated time period; 2.) if you annuitize atthe end of the stated time period; and 3.) if you do not surrender your Annuity.THE EXAMPLES ARE ILLUSTRATIVE ONLY - THEY SHOULD NOT BE CONSIDERED A REPRESENTATION OF PASTOR FUTURE EXPENSES OF THE UNDERLYING MUTUAL FUNDS OR THEIR PORTFOLIOS – ACTUAL EXPENSES WILLBE LESS THAN THOSE SHOWN IF YOU DO NOT ELECT ALL OF THE OPTIONAL BENEFITS AVAILABLE OR IF YOUALLOCATE ACCOUNT VALUE TO ANY OTHER AVAILABLE SUB-ACCOUNTS.If you surrender your contract at the end of the applicable time period:1 year 3 years 5 years 10 years1426 2566 3542 5592If you annuitize at the end of the applicable time period (you may not annuitize in the first (1 st ) Annuity Year):Contract described herein is no longer available for sale.If you do not surrender your contract:1 year 3 years 5 years 10 yearsN/A 1716 2842 55921 year 3 years 5 years 10 years576 1716 2842 559210