STYLE/TYPEINVESTMENT OBJECTIVES/POLICIESPORTFOLIOADVISOR/SUB-ADVISORTHE PROFUND VP PORTFOLIOS DESCRIBED BELOW ARE AVAILABLE AS SUB-ACCOUNTS TO ALL ANNUITYOWNERS. EACH PORTFOLIO PURSUES AN INVESTMENT STRATEGY THAT SEEKS TO PROVIDE DAILYINVESTMENT RESULTS, BEFORE FEES AND EXPENSES, THAT MATCH A WIDELY FOLLOWED INDEX, INCREASEBY A SPECIFIED FACTOR RELATIVE TO THE INDEX, MATCH THE INVERSE OF THE INDEX OR THE INVERSE OFTHE INDEX MULTIPLIED BY A SPECIFIED FACTOR. THE INVESTMENT STRATEGY OF SOME OF THEPORTFOLIOS MAY MAGNIFY (BOTH POSITIVELY AND NEGATIVELY) THE DAILY INVESTMENT RESULTS OF THEAPPLICABLE INDEX. IT IS RECOMMENDED THAT ONLY THOSE ANNUITY OWNERS WHO ENGAGE A FINANCIALADVISOR TO ALLOCATE THEIR ACCOUNT VALUE USING A STRATEGIC OR TACTICAL ASSET ALLOCATIONSTRATEGY INVEST IN THESE PORTFOLIOS. WE HAVE ARRANGED THE PORTFOLIOS BASED ON THE INDEX ONWHICH IT’S INVESTMENT STRATEGY IS BASED.The S&P 500 Index ® is a widely used measure of large-cap U.S. stock market performance. It includes a representative sample ofleading companies in leading industries. Companies are selected for inclusion in the Index by Standard & Poor's ® for being U.S.companies with adequate liquidity, appropriate market capitalization financial viability and public float.S&P 500S&P 500S&P 500ProFund VP Bull: seeks daily investment results, before fees and expenses, that correspond tothe daily performance of the S&P 500 ® Index.ProFund VP Bear: seeks daily investment results, before fees and expenses, that correspond tothe inverse (opposite) of the daily performance of the S&P 500 ® Index. If ProFund VP Bear issuccessful in meeting its objective, its net asset value should gain approximately the same, on apercentage basis, as any decrease in the S&P 500 ® Index when the Index declines on a givenday. Conversely, its net asset value should lose approximately the same, on a percentage basis,as any increase in the Index when the Index rises on a given day.ProFund VP UltraBull (f/k/a ProFund VP Bull Plus): seeks daily investment results, beforefees and expenses, that correspond to twice (200%) the daily performance of the S&P 500 ®Index. If the ProFund VP UltraBull is successful in meeting its objective, its net asset valueshould gain approximately twice as much, on a percentage basis, as the S&P 500 ® Index whenthe Index rises on a given day. Conversely, its net asset value should lose approximately twiceas much, on a percentage basis, as the Index when the Index declines on a given day. Prior toMay 1, 2003, ProFund VP UltraBull was named "ProFund VP Bull Plus" and sought dailyinvestment results that corresponded to one and one-half times the daily performance of theS&P 500 ® IndexProFund AdvisorsLLCProFund AdvisorsLLCProFund AdvisorsLLCThe NASDAQ-100 Index ® is a market capitalization weighted index that includes 100 of the largest domestic and internationalnon-financial companies listed on The NASDAQ Stock Market.NASDAQ 100NASDAQ 100ProFund VP OTC: seeks daily investment results, before fees and expenses, that correspondto the daily performance of the NASDAQ-100 Index ® . "OTC" in the name of ProFund VP OTCreflers to securities that do not trade on a U.S. securities exchange, as registered under theSecurities Exchange Act of 1934.ProFund VP Short OTC: seeks daily investment results, before fees and expenses, thatcorrespond to the inverse (opposite) of the daily performance of the NASDAQ-100 Index ® . IfProFund VP Short OTC is successful in meeting its objective, its net asset value should gainapproximately the same, on a percentage basis, as any decrease in the NASDAQ-100 Index ®when the Index declines on a given day. Conversely, its net asset value should loseapproximately the same, on a percentage basis, as any increase in the Index when the Indexrises on a given day. "OTC" in the name of ProFund VP Short OTC refers to securities that donot trade on a U.S. securities exchange, as registered under the Securities Exchange Act of1934.ProFund AdvisorsLLCProFund AdvisorsLLCContract described herein is no longer available for sale.23

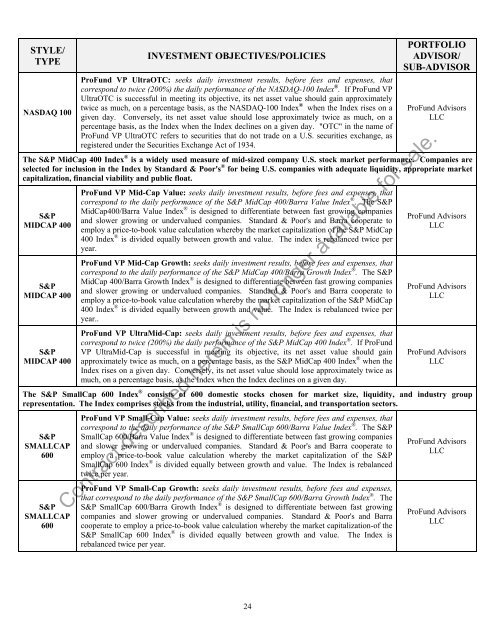

STYLE/TYPENASDAQ 100INVESTMENT OBJECTIVES/POLICIESProFund VP UltraOTC: seeks daily investment results, before fees and expenses, thatcorrespond to twice (200%) the daily performance of the NASDAQ-100 Index ® . If ProFund VPUltraOTC is successful in meeting its objective, its net asset value should gain approximatelytwice as much, on a percentage basis, as the NASDAQ-100 Index ® when the Index rises on agiven day. Conversely, its net asset value should lose approximately twice as much, on apercentage basis, as the Index when the Index declines on a given day. "OTC" in the name ofProFund VP UltraOTC refers to securities that do not trade on a U.S. securities exchange, asregistered under the Securities Exchange Act of 1934.PORTFOLIOADVISOR/SUB-ADVISORProFund AdvisorsLLCThe S&P MidCap 400 Index ® is a widely used measure of mid-sized company U.S. stock market performance. Companies areselected for inclusion in the Index by Standard & Poor's ® for being U.S. companies with adequate liquidity, appropriate marketcapitalization, financial viability and public float.S&PMIDCAP 400S&PMIDCAP 400S&PMIDCAP 400ProFund VP Mid-Cap Value: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the S&P MidCap 400/Barra Value Index ® . The S&PMidCap400/Barra Value Index ® is designed to differentiate between fast growing companiesand slower growing or undervalued companies. Standard & Poor's and Barra cooperate toemploy a price-to-book value calculation whereby the market capitalization of the S&P MidCap400 Index ® is divided equally between growth and value. The index is rebalanced twice peryear.ProFund VP Mid-Cap Growth: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the S&P MidCap 400/Barra Growth Index ® . The S&PMidCap 400/Barra Growth Index ® is designed to differentiate between fast growing companiesand slower growing or undervalued companies. Standard & Poor's and Barra cooperate toemploy a price-to-book value calculation whereby the market capitalization of the S&P MidCap400 Index ® is divided equally between growth and value. The Index is rebalanced twice peryear..ProFund VP UltraMid-Cap: seeks daily investment results, before fees and expenses, thatcorrespond to twice (200%) the daily performance of the S&P MidCap 400 Index ® . If ProFundVP UltraMid-Cap is successful in meeting its objective, its net asset value should gainapproximately twice as much, on a percentage basis, as the S&P MidCap 400 Index ® when theIndex rises on a given day. Conversely, its net asset value should lose approximately twice asmuch, on a percentage basis, as the Index when the Index declines on a given day.ProFund AdvisorsLLCProFund AdvisorsLLCProFund AdvisorsLLCThe S&P SmallCap 600 Index ® consists of 600 domestic stocks chosen for market size, liquidity, and industry grouprepresentation. The Index comprises stocks from the industrial, utility, financial, and transportation sectors.S&PSMALLCAP600S&PSMALLCAP600ProFund VP Small-Cap Value: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the S&P SmallCap 600/Barra Value Index ® . The S&PSmallCap 600/Barra Value Index ® is designed to differentiate between fast growing companiesand slower growing or undervalued companies. Standard & Poor's and Barra cooperate toemploy a price-to-book value calculation whereby the market capitalization of the S&PSmallCap 600 Index ® is divided equally between growth and value. The Index is rebalancedtwice per year.ProFund VP Small-Cap Growth: seeks daily investment results, before fees and expenses,that correspond to the daily performance of the S&P SmallCap 600/Barra Growth Index ® . TheS&P SmallCap 600/Barra Growth Index ® is designed to differentiate between fast growingcompanies and slower growing or undervalued companies. Standard & Poor's and Barracooperate to employ a price-to-book value calculation whereby the market capitalization-of theS&P SmallCap 600 Index ® is divided equally between growth and value. The Index isrebalanced twice per year.ProFund AdvisorsLLCContract described herein is no longer available for sale.ProFund AdvisorsLLC24

- Page 1 and 2: Effective January 1, 2008, American

- Page 3: If you purchase this Annuity, we ap

- Page 8 and 9: The following table provides a summ

- Page 10 and 11: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 12 and 13: INVESTMENT OPTIONSWHAT ARE THE INVE

- Page 14 and 15: STYLE/TYPESMALL CAPGROWTHSMALL CAPV

- Page 16 and 17: STYLE/TYPELARGE CAPGROWTHLARGE CAPG

- Page 18 and 19: STYLE/TYPEBALANCEDBALANCEDASSETALLO

- Page 20 and 21: STYLE/TYPEMID-CAPEQUITYSECTORSECTOR

- Page 22 and 23: STYLE/TYPESECTORSECTORSECTORSECTORS

- Page 26 and 27: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 28 and 29: Each Purchase Payment has its own C

- Page 30 and 31: Except as noted below, Purchase Pay

- Page 32 and 33: MAY I MAKE PURCHASE PAYMENTS THROUG

- Page 34 and 35: Recovery from Medically-Related Sur

- Page 36 and 37: changes in the value of the Sub-acc

- Page 38 and 39: Effective November 18, 2002, Americ

- Page 40 and 41: MVA ExamplesThe following hypotheti

- Page 42 and 43: "Growth" equals the current Account

- Page 44 and 45: WHAT IS A MEDICALLY-RELATED SURREND

- Page 46 and 47: payments until you choose an AIR. T

- Page 48 and 49: The amount calculated in Items 1 &

- Page 50 and 51: Who is eligible for the Annuity Rew

- Page 52 and 53: There is a Change in Daily Asset-Ba

- Page 54 and 55: Entity Ownership: If the Annuity is

- Page 56 and 57: Economic Growth and Tax Relief Reco

- Page 58 and 59: • distributions made as substanti

- Page 60 and 61: for each optional benefit offered u

- Page 62 and 63: not be designed for long-term inves

- Page 64 and 65: INDEMNIFICATIONInsofar as indemnifi

- Page 66 and 67: SELECTED FINANCIAL DATA (dollars in

- Page 68 and 69: Return credited to contract owners

- Page 70 and 71: with the overall decline in the equ

- Page 72 and 73: of premature death, estate planning

- Page 74 and 75:

the value of the portfolio would de

- Page 76 and 77:

To the Board of Directors and Share

- Page 78 and 79:

REVENUESAMERICAN SKANDIA LIFE ASSUR

- Page 80 and 81:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 82 and 83:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 84 and 85:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 86 and 87:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 88 and 89:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 90 and 91:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 92 and 93:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 94 and 95:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 96 and 97:

9. LEASESAMERICAN SKANDIA LIFE ASSU

- Page 98 and 99:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 100 and 101:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 102 and 103:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 104 and 105:

APPENDIX B - CONDENSED FINANCIAL IN

- Page 106 and 107:

Year Ended December 31,Sub-account

- Page 108 and 109:

Year Ended December 31,Sub-account

- Page 110 and 111:

Year Ended December 31,Sub-account

- Page 112 and 113:

Year Ended December 31,Sub-account

- Page 114 and 115:

Year Ended December 31,Sub-account

- Page 116 and 117:

Year Ended December 31,Sub-account

- Page 118 and 119:

Year Ended December 31,Sub-account

- Page 120 and 121:

Year Ended December 31,Sub-account

- Page 122 and 123:

Year Ended December 31,Sub-account

- Page 124 and 125:

Year Ended December 31,Sub-account

- Page 126 and 127:

Year Ended December 31,Sub-account

- Page 128 and 129:

Year Ended December 31,Sub-account

- Page 130 and 131:

Year Ended December 31,Sub-account

- Page 132 and 133:

6. Effective December 10, 2001, Deu

- Page 134 and 135:

Example with market increase and wi

- Page 136 and 137:

coverage under the Rider, we will r

- Page 138 and 139:

APPENDIX E - SALE OF THE CONTRACTS

- Page 140 and 141:

Optional Death BenefitsThe Enhanced

- Page 142 and 143:

APPENDIX F - DESCRIPTION AND CALCUL

- Page 144 and 145:

We deduct the charge:1. on each ann

- Page 146 and 147:

PLEASE SEND ME A STATEMENT OF ADDIT

- Page 148 and 149:

NOTESContract described herein is n

- Page 150 and 151:

NOTESContract described herein is n

- Page 152 and 153:

American Skandia's Privacy PolicyAt