STYLE/TYPEMID-CAPEQUITYSECTORSECTORSECTORSECTORGLOBALEQUITYINVESTMENT OBJECTIVES/POLICIESINVESCO Variable Investment Funds – Dynamics: seek long-term capital growth. ThePortfolio invests at least 65% of its assets in common stocks of mid-sized companies.INVESCO defines mid-sized companies as companies that are included in the Russell MidcapGrowth Index at the time of purchase, or if not included in that Index, have marketcapitalizations of between $2.5 billion and $15 billion at the time of purchase. The core of thePortfolio’s investments are in securities of established companies that are leaders in attractivegrowth markets with a history of strong returns. The remainder of the Portfolio is invested insecurities of companies that show accelerating growth, driven by product cycles, favorableindustry or sector conditions, and other factors that INVESCO believes will lead to rapid salesor earnings growth.INVESCO Variable Investment Funds – Technology: seeks capital growth. The Portfolionormally invests 80% of its net assets in the equity securities and equity-related instruments ofcompanies engaged in technology-related industries. These include, but are not limited to,various applied technologies, hardware, software, semiconductors, telecommunicationsequipment and services and service-related companies in information technology. Many ofthese products and services are subject to rapid obsolescence, which may lower market value ofthe securities of the companies in this sector. At any given time, 20% of the Portfolio's assets isnot required to be invested in the sector.INVESCO Variable Investment Funds – Health Sciences: seeks capital growth. ThePortfolio normally invests at least 80% of its net assets in the equity securities and equityrelatedinstrumentsof companies that develop, produce or distribute products or services relatedto health care. These companies include, but are not limited to, medical equipment or supplies,pharmaceuticals, biotechnology and healthcare providers and service companies. At any giventime, 20% of the Portfolio's assets is not required to be invested in the sector.INVESCO Variable Investment Funds – Financial Services: seeks capital growth. ThePortfolio normally invests at least 80% of its net assets in the equity securities and equityrelatedinstruments of companies involved in the financial services sector. These companiesinclude, but are not limited to, banks (regional and money-centers), insurance companies (life,property and casualty, and multiline), investment and miscellaneous industries (asset managers,brokerage firms, and government-sponsored agencies) and suppliers to financial servicescompanies. At any given time, 20% of the Portfolio's assets is not required to be invested in thesector.INVESCO Variable Investment Funds – Telecommunications: seeks capital growth andcurrent income. The Portfolio normally invests 80% of its net assets in the equity securities andequity-related instruments of companies engaged in the design, development, manufacture,distribution, or sale of communications services and equipment, and companies that areinvolved in supplying equipment or services to such companies. The telecommunicationssector includes, but is not limited to, companies that offer telephone services, wirelesscommunications, satellite communications, television and movie programming, broadcastingand Internet access. Many of these products and services are subject to rapid obsolescence,which may lower the market value of the securities of the companies in this sector. At anygiven time, 20% of the Portfolio's assets is not required to be invested in the sector.Evergreen VA Global Leaders: seeks to provide investors with long-term capital growth. ThePortfolio normally invests as least 65% of its assets in a diversified portfolio of U.S. and non-U.S. equity securities of companies located in the world's major industrialized countries. ThePortfolio will invest in no less than three countries, which may include the U.S., but may investmore than 25% of its assets in one country. The Portfolio invests only in the best 100companies, which are selected by the Portfolio's manager based on as high return on equity,consistent earnings growth, established market presence and industries or sectors withsignificant growth prospects.PORTFOLIOADVISOR/SUB-ADVISORINVESCO FundsGroup, Inc.INVESCO FundsGroup, Inc.INVESCO FundsGroup, Inc.INVESCO FundsGroup, Inc.INVESCO FundsGroup, Inc.Contract described herein is no longer available for sale.Evergreen InvestmentManagementCompany, LLC19

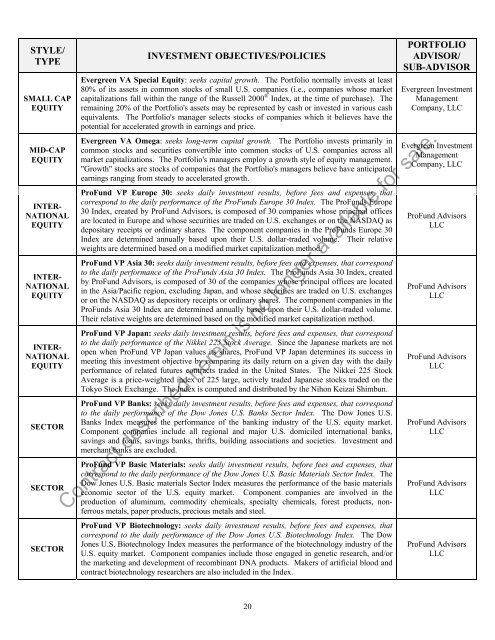

STYLE/TYPESMALL CAPEQUITYMID-CAPEQUITYINTER-NATIONALEQUITYINTER-NATIONALEQUITYINTER-NATIONALEQUITYSECTORSECTORSECTORINVESTMENT OBJECTIVES/POLICIESEvergreen VA Special Equity: seeks capital growth. The Portfolio normally invests at least80% of its assets in common stocks of small U.S. companies (i.e., companies whose marketcapitalizations fall within the range of the Russell 2000 ® Index, at the time of purchase). Theremaining 20% of the Portfolio's assets may be represented by cash or invested in various cashequivalents. The Portfolio's manager selects stocks of companies which it believes have thepotential for accelerated growth in earnings and price.Evergreen VA Omega: seeks long-term capital growth. The Portfolio invests primarily incommon stocks and securities convertible into common stocks of U.S. companies across allmarket capitalizations. The Portfolio's managers employ a growth style of equity management."Growth" stocks are stocks of companies that the Portfolio's managers believe have anticipatedearnings ranging from steady to accelerated growth.ProFund VP Europe 30: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the ProFunds Europe 30 Index. The ProFunds Europe30 Index, created by ProFund Advisors, is composed of 30 companies whose principal officesare located in Europe and whose securities are traded on U.S. exchanges or on the NASDAQ asdepositary receipts or ordinary shares. The component companies in the ProFunds Europe 30Index are determined annually based upon their U.S. dollar-traded volume. Their relativeweights are determined based on a modified market capitalization method.ProFund VP Asia 30: seeks daily investment results, before fees and expenses, that correspondto the daily performance of the ProFunds Asia 30 Index. The ProFunds Asia 30 Index, createdby ProFund Advisors, is composed of 30 of the companies whose principal offices are locatedin the Asia/Pacific region, excluding Japan, and whose securities are traded on U.S. exchangesor on the NASDAQ as depository receipts or ordinary shares. The component companies in theProFunds Asia 30 Index are determined annually based upon their U.S. dollar-traded volume.Their relative weights are determined based on the modified market capitalization method.ProFund VP Japan: seeks daily investment results, before fees and expenses, that correspondto the daily performance of the Nikkei 225 Stock Average. Since the Japanese markets are notopen when ProFund VP Japan values its shares, ProFund VP Japan determines its success inmeeting this investment objective by comparing its daily return on a given day with the dailyperformance of related futures contracts traded in the United States. The Nikkei 225 StockAverage is a price-weighted index of 225 large, actively traded Japanese stocks traded on theTokyo Stock Exchange. The Index is computed and distributed by the Nihon Keizai Shimbun.ProFund VP Banks: seeks daily investment results, before fees and expenses, that correspondto the daily performance of the Dow Jones U.S. Banks Sector Index. The Dow Jones U.S.Banks Index measures the performance of the banking industry of the U.S. equity market.Component companies include all regional and major U.S. domiciled international banks,savings and loans, savings banks, thrifts, building associations and societies. Investment andmerchant banks are excluded.ProFund VP Basic Materials: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the Dow Jones U.S. Basic Materials Sector Index. TheDow Jones U.S. Basic materials Sector Index measures the performance of the basic materialseconomic sector of the U.S. equity market. Component companies are involved in theproduction of aluminum, commodity chemicals, specialty chemicals, forest products, nonferrousmetals, paper products, precious metals and steel.PORTFOLIOADVISOR/SUB-ADVISOREvergreen InvestmentManagementCompany, LLCEvergreen InvestmentManagementCompany, LLCProFund AdvisorsLLCProFund AdvisorsLLCProFund AdvisorsLLCProFund AdvisorsLLCProFund AdvisorsLLCContract described herein is no longer available for sale.ProFund VP Biotechnology: seeks daily investment results, before fees and expenses, thatcorrespond to the daily performance of the Dow Jones U.S. Biotechnology Index. The DowJones U.S. Biotechnology Index measures the performance of the biotechnology industry of theU.S. equity market. Component companies include those engaged in genetic research, and/orthe marketing and development of recombinant DNA products. Makers of artificial blood andcontract biotechnology researchers are also included in the Index.ProFund AdvisorsLLC20

- Page 1 and 2: Effective January 1, 2008, American

- Page 3: If you purchase this Annuity, we ap

- Page 8 and 9: The following table provides a summ

- Page 10 and 11: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 12 and 13: INVESTMENT OPTIONSWHAT ARE THE INVE

- Page 14 and 15: STYLE/TYPESMALL CAPGROWTHSMALL CAPV

- Page 16 and 17: STYLE/TYPELARGE CAPGROWTHLARGE CAPG

- Page 18 and 19: STYLE/TYPEBALANCEDBALANCEDASSETALLO

- Page 22 and 23: STYLE/TYPESECTORSECTORSECTORSECTORS

- Page 24 and 25: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 26 and 27: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 28 and 29: Each Purchase Payment has its own C

- Page 30 and 31: Except as noted below, Purchase Pay

- Page 32 and 33: MAY I MAKE PURCHASE PAYMENTS THROUG

- Page 34 and 35: Recovery from Medically-Related Sur

- Page 36 and 37: changes in the value of the Sub-acc

- Page 38 and 39: Effective November 18, 2002, Americ

- Page 40 and 41: MVA ExamplesThe following hypotheti

- Page 42 and 43: "Growth" equals the current Account

- Page 44 and 45: WHAT IS A MEDICALLY-RELATED SURREND

- Page 46 and 47: payments until you choose an AIR. T

- Page 48 and 49: The amount calculated in Items 1 &

- Page 50 and 51: Who is eligible for the Annuity Rew

- Page 52 and 53: There is a Change in Daily Asset-Ba

- Page 54 and 55: Entity Ownership: If the Annuity is

- Page 56 and 57: Economic Growth and Tax Relief Reco

- Page 58 and 59: • distributions made as substanti

- Page 60 and 61: for each optional benefit offered u

- Page 62 and 63: not be designed for long-term inves

- Page 64 and 65: INDEMNIFICATIONInsofar as indemnifi

- Page 66 and 67: SELECTED FINANCIAL DATA (dollars in

- Page 68 and 69: Return credited to contract owners

- Page 70 and 71:

with the overall decline in the equ

- Page 72 and 73:

of premature death, estate planning

- Page 74 and 75:

the value of the portfolio would de

- Page 76 and 77:

To the Board of Directors and Share

- Page 78 and 79:

REVENUESAMERICAN SKANDIA LIFE ASSUR

- Page 80 and 81:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 82 and 83:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 84 and 85:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 86 and 87:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 88 and 89:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 90 and 91:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 92 and 93:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 94 and 95:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 96 and 97:

9. LEASESAMERICAN SKANDIA LIFE ASSU

- Page 98 and 99:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 100 and 101:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 102 and 103:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 104 and 105:

APPENDIX B - CONDENSED FINANCIAL IN

- Page 106 and 107:

Year Ended December 31,Sub-account

- Page 108 and 109:

Year Ended December 31,Sub-account

- Page 110 and 111:

Year Ended December 31,Sub-account

- Page 112 and 113:

Year Ended December 31,Sub-account

- Page 114 and 115:

Year Ended December 31,Sub-account

- Page 116 and 117:

Year Ended December 31,Sub-account

- Page 118 and 119:

Year Ended December 31,Sub-account

- Page 120 and 121:

Year Ended December 31,Sub-account

- Page 122 and 123:

Year Ended December 31,Sub-account

- Page 124 and 125:

Year Ended December 31,Sub-account

- Page 126 and 127:

Year Ended December 31,Sub-account

- Page 128 and 129:

Year Ended December 31,Sub-account

- Page 130 and 131:

Year Ended December 31,Sub-account

- Page 132 and 133:

6. Effective December 10, 2001, Deu

- Page 134 and 135:

Example with market increase and wi

- Page 136 and 137:

coverage under the Rider, we will r

- Page 138 and 139:

APPENDIX E - SALE OF THE CONTRACTS

- Page 140 and 141:

Optional Death BenefitsThe Enhanced

- Page 142 and 143:

APPENDIX F - DESCRIPTION AND CALCUL

- Page 144 and 145:

We deduct the charge:1. on each ann

- Page 146 and 147:

PLEASE SEND ME A STATEMENT OF ADDIT

- Page 148 and 149:

NOTESContract described herein is n

- Page 150 and 151:

NOTESContract described herein is n

- Page 152 and 153:

American Skandia's Privacy PolicyAt