MAY I MAKE PURCHASE PAYMENTS THROUGH A SALARY REDUCTION PROGRAM?These types of programs are only available with certain types of qualified investments. If your employer sponsors such a program, wemay agree to accept periodic Purchase Payments through a salary reduction program as long as the allocations are made only tovariable investment options and the periodic Purchase Payments received in the first year total at least $1,000.MANAGING YOUR ACCOUNT VALUEHOW AND WHEN ARE PURCHASE PAYMENTS INVESTED?(See "Valuing Your Investment" for a description of our procedure for pricing initial and subsequent Purchase Payments.)Initial Purchase Payment: Once we accept your application, we invest your net Purchase Payment in the Annuity. The net PurchasePayment is your initial Purchase Payment minus any tax charges that may apply. On your application we ask you to provide us withinstructions for allocating your Account Value. You can allocate Account Value to one or more variable investment options or FixedAllocations.In those states where we are required to return your Purchase Payment if you exercise your right to return the Annuity, we initiallyallocate all amounts that you choose to allocate to the variable investment options to the AST Money Market Sub-account. At the endof the right to cancel period we will reallocate your Account Value according to your most recent allocation instructions. Wherepermitted by law, we will allocate your Purchase Payments according to your initial instructions, without temporarily allocating to theAST Money Market Sub-account. To do this, we will ask that you execute our form called a "return waiver" that authorizes us toallocate your Purchase Payment to your chosen Sub-accounts immediately. If you submit the "return waiver" and then decide toreturn your Annuity during the right to cancel period, you will receive your current Account Value, minus the amount of any <strong>Credit</strong>s,which may be more or less than your initial Purchase Payment (see "May I Return the Annuity if I Change my Mind?").Subsequent Purchase Payments: We will allocate any additional Purchase Payments you make according to your current allocationinstructions. If any rebalancing or asset allocation programs are in effect, the allocation should conform with such a program. Weassume that your current allocation instructions are valid for subsequent Purchase Payments until you make a change to thoseallocations or request new allocations when you submit a new Purchase Payment.HOW DO I RECEIVE CREDITS?We apply a "<strong>Credit</strong>" to your Annuity’s Account Value each time you make a Purchase Payment. The amount of the <strong>Credit</strong> is payablefrom our general account. The amount of the <strong>Credit</strong> depends on the cumulative amount of Purchase Payments you have made to yourAnnuity, payable as a percentage of each specific Purchase Payment, according to the table below:Cumulative Purchase Payments<strong>Credit</strong>Between $1,000 and $9,999 1.5%Between $10,000 and $4,999,999 4.0%Greater than $5,000,000 5.0%<strong>Credit</strong>s Applied to Purchase Payments for Designated Class of Annuity OwnerWhere allowed by state law, on <strong>Annuities</strong> owned by a member of the class defined below, the table of <strong>Credit</strong>s we apply to PurchasePayments is deleted. The <strong>Credit</strong> applied to all Purchase Payments on such <strong>Annuities</strong> will be 8.5%.The designated class of Annuity Owners includes: (a) any parent company, affiliate or subsidiary of ours; (b) an officer, director,employee, retiree, sales representative, or in the case of an affiliated broker-dealer, registered representative of such company; (c) adirector, officer or trustee of any underlying mutual fund; (d) a director, officer or employee of any investment manager, sub-advisor,transfer agent, custodian, auditing, legal or administrative services provider that is providing investment management, advisory,transfer agency, custodianship, auditing, legal and/or administrative services to an underlying mutual fund or any affiliate of suchfirm; (e) a director, officer, employee or registered representative of a broker-dealer or insurance agency that has a then current sellingagreement with us and/or with American Skandia Marketing, Incorporated; (f) a director, officer, employee or authorizedrepresentative of any firm providing us or our affiliates with regular legal, actuarial, auditing, underwriting, claims, administrative,computer support, marketing, office or other services; (g) the then current spouse of any such person noted in (b) through (f), above;(h) the parents of any such person noted in (b) through (g), above; (i) the child(ren) or other legal dependent under the age of 21 of anysuch person noted in (b) through (h) above; and (j) the siblings of any such persons noted in (b) through (h) above.Contract described herein is no longer available for sale.All other terms and conditions of the Annuity apply to Owners in the designated class.31

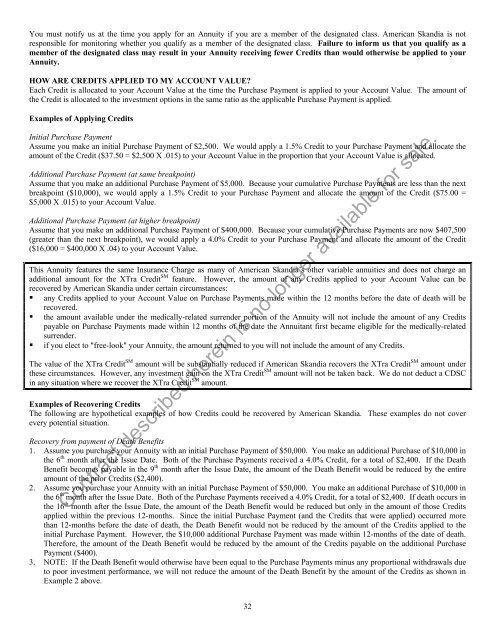

You must notify us at the time you apply for an Annuity if you are a member of the designated class. American Skandia is notresponsible for monitoring whether you qualify as a member of the designated class. Failure to inform us that you qualify as amember of the designated class may result in your Annuity receiving fewer <strong>Credit</strong>s than would otherwise be applied to yourAnnuity.HOW ARE CREDITS APPLIED TO MY ACCOUNT VALUE?Each <strong>Credit</strong> is allocated to your Account Value at the time the Purchase Payment is applied to your Account Value. The amount ofthe <strong>Credit</strong> is allocated to the investment options in the same ratio as the applicable Purchase Payment is applied.Examples of Applying <strong>Credit</strong>sInitial Purchase PaymentAssume you make an initial Purchase Payment of $2,500. We would apply a 1.5% <strong>Credit</strong> to your Purchase Payment and allocate theamount of the <strong>Credit</strong> ($37.50 = $2,500 X .015) to your Account Value in the proportion that your Account Value is allocated.Additional Purchase Payment (at same breakpoint)Assume that you make an additional Purchase Payment of $5,000. Because your cumulative Purchase Payments are less than the nextbreakpoint ($10,000), we would apply a 1.5% <strong>Credit</strong> to your Purchase Payment and allocate the amount of the <strong>Credit</strong> ($75.00 =$5,000 X .015) to your Account Value.Additional Purchase Payment (at higher breakpoint)Assume that you make an additional Purchase Payment of $400,000. Because your cumulative Purchase Payments are now $407,500(greater than the next breakpoint), we would apply a 4.0% <strong>Credit</strong> to your Purchase Payment and allocate the amount of the <strong>Credit</strong>($16,000 = $400,000 X .04) to your Account Value.This Annuity features the same Insurance Charge as many of American Skandia’s other variable annuities and does not charge anadditional amount for the <strong>XTra</strong> <strong>Credit</strong> SM feature. However, the amount of any <strong>Credit</strong>s applied to your Account Value can berecovered by American Skandia under certain circumstances:• any <strong>Credit</strong>s applied to your Account Value on Purchase Payments made within the 12 months before the date of death will berecovered.• the amount available under the medically-related surrender portion of the Annuity will not include the amount of any <strong>Credit</strong>spayable on Purchase Payments made within 12 months of the date the Annuitant first became eligible for the medically-relatedsurrender.• if you elect to "free-look" your Annuity, the amount returned to you will not include the amount of any <strong>Credit</strong>s.The value of the <strong>XTra</strong> <strong>Credit</strong> SM amount will be substantially reduced if American Skandia recovers the <strong>XTra</strong> <strong>Credit</strong> SM amount underthese circumstances. However, any investment gain on the <strong>XTra</strong> <strong>Credit</strong> SM amount will not be taken back. We do not deduct a CDSCin any situation where we recover the <strong>XTra</strong> <strong>Credit</strong> SM amount.Examples of Recovering <strong>Credit</strong>sThe following are hypothetical examples of how <strong>Credit</strong>s could be recovered by American Skandia. These examples do not coverevery potential situation.Recovery from payment of Death Benefits1. Assume you purchase your Annuity with an initial Purchase Payment of $50,000. You make an additional Purchase of $10,000 inthe 6 th month after the Issue Date. Both of the Purchase Payments received a 4.0% <strong>Credit</strong>, for a total of $2,400. If the DeathBenefit becomes payable in the 9 th month after the Issue Date, the amount of the Death Benefit would be reduced by the entireamount of the prior <strong>Credit</strong>s ($2,400).2. Assume you purchase your Annuity with an initial Purchase Payment of $50,000. You make an additional Purchase of $10,000 inthe 6 th month after the Issue Date. Both of the Purchase Payments received a 4.0% <strong>Credit</strong>, for a total of $2,400. If death occurs inthe 16 th month after the Issue Date, the amount of the Death Benefit would be reduced but only in the amount of those <strong>Credit</strong>sapplied within the previous 12-months. Since the initial Purchase Payment (and the <strong>Credit</strong>s that were applied) occurred morethan 12-months before the date of death, the Death Benefit would not be reduced by the amount of the <strong>Credit</strong>s applied to theinitial Purchase Payment. However, the $10,000 additional Purchase Payment was made within 12-months of the date of death.Therefore, the amount of the Death Benefit would be reduced by the amount of the <strong>Credit</strong>s payable on the additional PurchasePayment ($400).3. NOTE: If the Death Benefit would otherwise have been equal to the Purchase Payments minus any proportional withdrawals dueto poor investment performance, we will not reduce the amount of the Death Benefit by the amount of the <strong>Credit</strong>s as shown inExample 2 above.Contract described herein is no longer available for sale.32

- Page 1 and 2: Effective January 1, 2008, American

- Page 3: If you purchase this Annuity, we ap

- Page 8 and 9: The following table provides a summ

- Page 10 and 11: UNDERLYING MUTUAL FUND PORTFOLIO AN

- Page 12 and 13: INVESTMENT OPTIONSWHAT ARE THE INVE

- Page 14 and 15: STYLE/TYPESMALL CAPGROWTHSMALL CAPV

- Page 16 and 17: STYLE/TYPELARGE CAPGROWTHLARGE CAPG

- Page 18 and 19: STYLE/TYPEBALANCEDBALANCEDASSETALLO

- Page 20 and 21: STYLE/TYPEMID-CAPEQUITYSECTORSECTOR

- Page 22 and 23: STYLE/TYPESECTORSECTORSECTORSECTORS

- Page 24 and 25: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 26 and 27: STYLE/TYPEINVESTMENT OBJECTIVES/POL

- Page 28 and 29: Each Purchase Payment has its own C

- Page 30 and 31: Except as noted below, Purchase Pay

- Page 34 and 35: Recovery from Medically-Related Sur

- Page 36 and 37: changes in the value of the Sub-acc

- Page 38 and 39: Effective November 18, 2002, Americ

- Page 40 and 41: MVA ExamplesThe following hypotheti

- Page 42 and 43: "Growth" equals the current Account

- Page 44 and 45: WHAT IS A MEDICALLY-RELATED SURREND

- Page 46 and 47: payments until you choose an AIR. T

- Page 48 and 49: The amount calculated in Items 1 &

- Page 50 and 51: Who is eligible for the Annuity Rew

- Page 52 and 53: There is a Change in Daily Asset-Ba

- Page 54 and 55: Entity Ownership: If the Annuity is

- Page 56 and 57: Economic Growth and Tax Relief Reco

- Page 58 and 59: • distributions made as substanti

- Page 60 and 61: for each optional benefit offered u

- Page 62 and 63: not be designed for long-term inves

- Page 64 and 65: INDEMNIFICATIONInsofar as indemnifi

- Page 66 and 67: SELECTED FINANCIAL DATA (dollars in

- Page 68 and 69: Return credited to contract owners

- Page 70 and 71: with the overall decline in the equ

- Page 72 and 73: of premature death, estate planning

- Page 74 and 75: the value of the portfolio would de

- Page 76 and 77: To the Board of Directors and Share

- Page 78 and 79: REVENUESAMERICAN SKANDIA LIFE ASSUR

- Page 80 and 81: AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 82 and 83:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 84 and 85:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 86 and 87:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 88 and 89:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 90 and 91:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 92 and 93:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 94 and 95:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 96 and 97:

9. LEASESAMERICAN SKANDIA LIFE ASSU

- Page 98 and 99:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 100 and 101:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 102 and 103:

AMERICAN SKANDIA LIFE ASSURANCE COR

- Page 104 and 105:

APPENDIX B - CONDENSED FINANCIAL IN

- Page 106 and 107:

Year Ended December 31,Sub-account

- Page 108 and 109:

Year Ended December 31,Sub-account

- Page 110 and 111:

Year Ended December 31,Sub-account

- Page 112 and 113:

Year Ended December 31,Sub-account

- Page 114 and 115:

Year Ended December 31,Sub-account

- Page 116 and 117:

Year Ended December 31,Sub-account

- Page 118 and 119:

Year Ended December 31,Sub-account

- Page 120 and 121:

Year Ended December 31,Sub-account

- Page 122 and 123:

Year Ended December 31,Sub-account

- Page 124 and 125:

Year Ended December 31,Sub-account

- Page 126 and 127:

Year Ended December 31,Sub-account

- Page 128 and 129:

Year Ended December 31,Sub-account

- Page 130 and 131:

Year Ended December 31,Sub-account

- Page 132 and 133:

6. Effective December 10, 2001, Deu

- Page 134 and 135:

Example with market increase and wi

- Page 136 and 137:

coverage under the Rider, we will r

- Page 138 and 139:

APPENDIX E - SALE OF THE CONTRACTS

- Page 140 and 141:

Optional Death BenefitsThe Enhanced

- Page 142 and 143:

APPENDIX F - DESCRIPTION AND CALCUL

- Page 144 and 145:

We deduct the charge:1. on each ann

- Page 146 and 147:

PLEASE SEND ME A STATEMENT OF ADDIT

- Page 148 and 149:

NOTESContract described herein is n

- Page 150 and 151:

NOTESContract described herein is n

- Page 152 and 153:

American Skandia's Privacy PolicyAt