Annual Report 2010 - Royal New Zealand Ballet

Annual Report 2010 - Royal New Zealand Ballet

Annual Report 2010 - Royal New Zealand Ballet

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

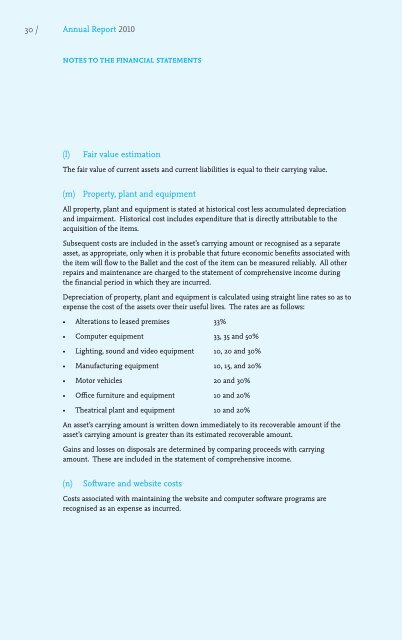

30 /<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>NOTES TO THE FINANCIAL STATEMENTS(l)Fair value estimationThe fair value of current assets and current liabilities is equal to their carrying value.(m) Property, plant and equipmentAll property, plant and equipment is stated at historical cost less accumulated depreciationand impairment. Historical cost includes expenditure that is directly attributable to theacquisition of the items.Subsequent costs are included in the asset’s carrying amount or recognised as a separateasset, as appropriate, only when it is probable that future economic benefits associated withthe item will flow to the <strong>Ballet</strong> and the cost of the item can be measured reliably. All otherrepairs and maintenance are charged to the statement of comprehensive income duringthe financial period in which they are incurred.Depreciation of property, plant and equipment is calculated using straight line rates so as toexpense the cost of the assets over their useful lives. The rates are as follows:• Alterations to leased premises 33%• Computer equipment 33, 35 and 50%• Lighting, sound and video equipment 10, 20 and 30%• Manufacturing equipment 10, 15, and 20%• Motor vehicles 20 and 30%• Office furniture and equipment 10 and 20%• Theatrical plant and equipment 10 and 20%An asset’s carrying amount is written down immediately to its recoverable amount if theasset’s carrying amount is greater than its estimated recoverable amount.Gains and losses on disposals are determined by comparing proceeds with carryingamount. These are included in the statement of comprehensive income.(n)Software and website costsCosts associated with maintaining the website and computer software programs arerecognised as an expense as incurred.