Form 656-B, Offer in Compromise Booklet - Internal Revenue Service

Form 656-B, Offer in Compromise Booklet - Internal Revenue Service

Form 656-B, Offer in Compromise Booklet - Internal Revenue Service

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

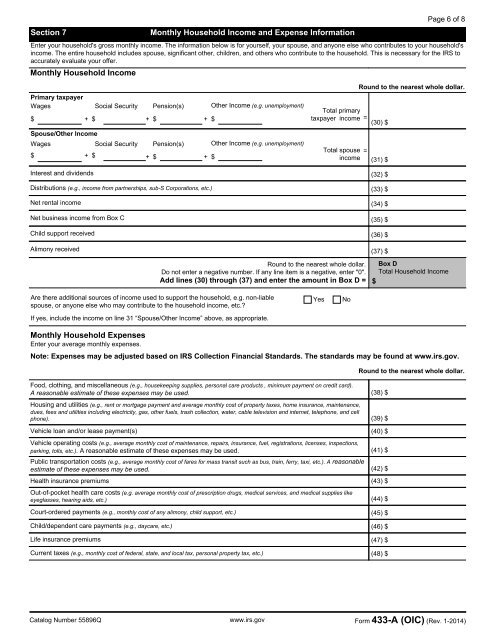

Section 7Monthly Household Income and Expense InformationPage 6 of 8Enter your household's gross monthly <strong>in</strong>come. The <strong>in</strong>formation below is for yourself, your spouse, and anyone else who contributes to your household's<strong>in</strong>come. The entire household <strong>in</strong>cludes spouse, significant other, children, and others who contribute to the household. This is necessary for the IRS toaccurately evaluate your offer.Monthly Household IncomeRound to the nearest whole dollar.Primary taxpayerWages$+ $Social SecurityPension(s)+ $Other Income (e.g. unemployment)+ $Total primarytaxpayer <strong>in</strong>come = (30) $Spouse/Other IncomeWages$Social Security+ $Pension(s)+ $Other Income (e.g. unemployment)+ $Total spouse =<strong>in</strong>come(31) $Interest and dividends (32) $Distributions (e.g., <strong>in</strong>come from partnerships, sub-S Corporations, etc.) (33) $Net rental <strong>in</strong>come (34) $Net bus<strong>in</strong>ess <strong>in</strong>come from Box C (35) $Child support received (36) $Alimony received (37) $Round to the nearest whole dollar.Do not enter a negative number. If any l<strong>in</strong>e item is a negative, enter "0".Add l<strong>in</strong>es (30) through (37) and enter the amount <strong>in</strong> Box D =Box DTotal Household Income$Are there additional sources of <strong>in</strong>come used to support the household, e.g. non-liablespouse, or anyone else who may contribute to the household <strong>in</strong>come, etc.?If yes, <strong>in</strong>clude the <strong>in</strong>come on l<strong>in</strong>e 31 “Spouse/Other Income” above, as appropriate.YesNoMonthly Household ExpensesEnter your average monthly expenses.Note: Expenses may be adjusted based on IRS Collection F<strong>in</strong>ancial Standards. The standards may be found at www.irs.gov.Food, cloth<strong>in</strong>g, and miscellaneous (e.g., housekeep<strong>in</strong>g supplies, personal care products , m<strong>in</strong>imum payment on credit card).A reasonable estimate of these expenses may be used. (38) $Hous<strong>in</strong>g and utilities (e.g., rent or mortgage payment and average monthly cost of property taxes, home <strong>in</strong>surance, ma<strong>in</strong>tenance,dues, fees and utilities <strong>in</strong>clud<strong>in</strong>g electricity, gas, other fuels, trash collection, water, cable television and <strong>in</strong>ternet, telephone, and cellphone). (39) $Vehicle loan and/or lease payment(s) (40) $Vehicle operat<strong>in</strong>g costs (e.g., average monthly cost of ma<strong>in</strong>tenance, repairs, <strong>in</strong>surance, fuel, registrations, licenses, <strong>in</strong>spections,park<strong>in</strong>g, tolls, etc.). A reasonable estimate of these expenses may be used. (41) $Public transportation costs (e.g., average monthly cost of fares for mass transit such as bus, tra<strong>in</strong>, ferry, taxi, etc.). A reasonableestimate of these expenses may be used. (42) $Health <strong>in</strong>surance premiums (43) $Out-of-pocket health care costs (e.g. average monthly cost of prescription drugs, medical services, and medical supplies likeeyeglasses, hear<strong>in</strong>g aids, etc.) (44) $Court-ordered payments (e.g., monthly cost of any alimony, child support, etc.) (45) $Child/dependent care payments (e.g., daycare, etc.) (46) $Life <strong>in</strong>surance premiums (47) $Current taxes (e.g., monthly cost of federal, state, and local tax, personal property tax, etc.) (48) $Round to the nearest whole dollar.Catalog Number 55896Q www.irs.gov <strong>Form</strong> 433-A (OIC) (Rev. 1-2014)

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)