Form 656-B, Offer in Compromise Booklet - Internal Revenue Service

Form 656-B, Offer in Compromise Booklet - Internal Revenue Service

Form 656-B, Offer in Compromise Booklet - Internal Revenue Service

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

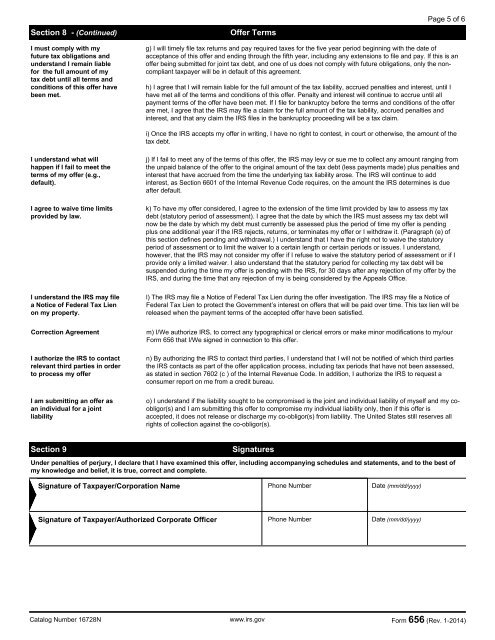

Section 8 - (Cont<strong>in</strong>ued)<strong>Offer</strong> TermsPage 5 of 6I must comply with myfuture tax obligations andunderstand I rema<strong>in</strong> liablefor the full amount of mytax debt until all terms andconditions of this offer havebeen met.g) I will timely file tax returns and pay required taxes for the five year period beg<strong>in</strong>n<strong>in</strong>g with the date ofacceptance of this offer and end<strong>in</strong>g through the fifth year, <strong>in</strong>clud<strong>in</strong>g any extensions to file and pay. If this is anoffer be<strong>in</strong>g submitted for jo<strong>in</strong>t tax debt, and one of us does not comply with future obligations, only the noncomplianttaxpayer will be <strong>in</strong> default of this agreement.h) I agree that I will rema<strong>in</strong> liable for the full amount of the tax liability, accrued penalties and <strong>in</strong>terest, until Ihave met all of the terms and conditions of this offer. Penalty and <strong>in</strong>terest will cont<strong>in</strong>ue to accrue until allpayment terms of the offer have been met. If I file for bankruptcy before the terms and conditions of the offerare met, I agree that the IRS may file a claim for the full amount of the tax liability, accrued penalties and<strong>in</strong>terest, and that any claim the IRS files <strong>in</strong> the bankruptcy proceed<strong>in</strong>g will be a tax claim.i) Once the IRS accepts my offer <strong>in</strong> writ<strong>in</strong>g, I have no right to contest, <strong>in</strong> court or otherwise, the amount of thetax debt.I understand what willhappen if I fail to meet theterms of my offer (e.g.,default).I agree to waive time limitsprovided by law.I understand the IRS may filea Notice of Federal Tax Lienon my property.j) If I fail to meet any of the terms of this offer, the IRS may levy or sue me to collect any amount rang<strong>in</strong>g fromthe unpaid balance of the offer to the orig<strong>in</strong>al amount of the tax debt (less payments made) plus penalties and<strong>in</strong>terest that have accrued from the time the underly<strong>in</strong>g tax liability arose. The IRS will cont<strong>in</strong>ue to add<strong>in</strong>terest, as Section 6601 of the <strong>Internal</strong> <strong>Revenue</strong> Code requires, on the amount the IRS determ<strong>in</strong>es is dueafter default.k) To have my offer considered, I agree to the extension of the time limit provided by law to assess my taxdebt (statutory period of assessment). I agree that the date by which the IRS must assess my tax debt willnow be the date by which my debt must currently be assessed plus the period of time my offer is pend<strong>in</strong>gplus one additional year if the IRS rejects, returns, or term<strong>in</strong>ates my offer or I withdraw it. (Paragraph (e) ofthis section def<strong>in</strong>es pend<strong>in</strong>g and withdrawal.) I understand that I have the right not to waive the statutoryperiod of assessment or to limit the waiver to a certa<strong>in</strong> length or certa<strong>in</strong> periods or issues. I understand,however, that the IRS may not consider my offer if I refuse to waive the statutory period of assessment or if Iprovide only a limited waiver. I also understand that the statutory period for collect<strong>in</strong>g my tax debt will besuspended dur<strong>in</strong>g the time my offer is pend<strong>in</strong>g with the IRS, for 30 days after any rejection of my offer by theIRS, and dur<strong>in</strong>g the time that any rejection of my is be<strong>in</strong>g considered by the Appeals Office.l) The IRS may file a Notice of Federal Tax Lien dur<strong>in</strong>g the offer <strong>in</strong>vestigation. The IRS may file a Notice ofFederal Tax Lien to protect the Government’s <strong>in</strong>terest on offers that will be paid over time. This tax lien will bereleased when the payment terms of the accepted offer have been satisfied.Correction AgreementI authorize the IRS to contactrelevant third parties <strong>in</strong> orderto process my offerm) I/We authorize IRS, to correct any typographical or clerical errors or make m<strong>in</strong>or modifications to my/our<strong>Form</strong> <strong>656</strong> that I/We signed <strong>in</strong> connection to this offer.n) By authoriz<strong>in</strong>g the IRS to contact third parties, I understand that I will not be notified of which third partiesthe IRS contacts as part of the offer application process, <strong>in</strong>clud<strong>in</strong>g tax periods that have not been assessed,as stated <strong>in</strong> section 7602 (c ) of the <strong>Internal</strong> <strong>Revenue</strong> Code. In addition, I authorize the IRS to request aconsumer report on me from a credit bureau.I am submitt<strong>in</strong>g an offer asan <strong>in</strong>dividual for a jo<strong>in</strong>tliabilityo) I understand if the liability sought to be compromised is the jo<strong>in</strong>t and <strong>in</strong>dividual liability of myself and my coobligor(s)and I am submitt<strong>in</strong>g this offer to compromise my <strong>in</strong>dividual liability only, then if this offer isaccepted, it does not release or discharge my co-obligor(s) from liability. The United States still reserves allrights of collection aga<strong>in</strong>st the co-obligor(s).Section 9SignaturesUnder penalties of perjury, I declare that I have exam<strong>in</strong>ed this offer, <strong>in</strong>clud<strong>in</strong>g accompany<strong>in</strong>g schedules and statements, and to the best ofmy knowledge and belief, it is true, correct and complete.Signature of Taxpayer/Corporation Name Phone Number Date (mm/dd/yyyy)Signature of Taxpayer/Authorized Corporate Officer Phone Number Date (mm/dd/yyyy)Catalog Number 16728N www.irs.gov <strong>Form</strong> <strong>656</strong> (Rev. 1-2014)

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)