Form 656-B, Offer in Compromise Booklet - Internal Revenue Service

Form 656-B, Offer in Compromise Booklet - Internal Revenue Service

Form 656-B, Offer in Compromise Booklet - Internal Revenue Service

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

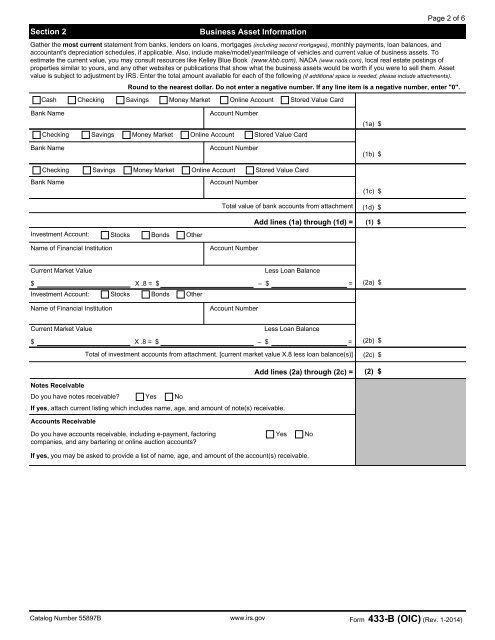

Section 2Bus<strong>in</strong>ess Asset InformationPage 2 of 6Gather the most current statement from banks, lenders on loans, mortgages (<strong>in</strong>clud<strong>in</strong>g second mortgages), monthly payments, loan balances, andaccountant's depreciation schedules, if applicable. Also, <strong>in</strong>clude make/model/year/mileage of vehicles and current value of bus<strong>in</strong>ess assets. Toestimate the current value, you may consult resources like Kelley Blue Book (www.kbb.com), NADA (www.nada.com), local real estate post<strong>in</strong>gs ofproperties similar to yours, and any other websites or publications that show what the bus<strong>in</strong>ess assets would be worth if you were to sell them. Assetvalue is subject to adjustment by IRS. Enter the total amount available for each of the follow<strong>in</strong>g (if additional space is needed, please <strong>in</strong>clude attachments).Round to the nearest dollar. Do not enter a negative number. If any l<strong>in</strong>e item is a negative number, enter "0".Cash Check<strong>in</strong>g Sav<strong>in</strong>gs Money Market Onl<strong>in</strong>e Account Stored Value CardBank NameAccount NumberCheck<strong>in</strong>g Sav<strong>in</strong>gs Money Market Onl<strong>in</strong>e Account Stored Value Card(1a) $Bank NameAccount Number(1b) $Check<strong>in</strong>g Sav<strong>in</strong>gs Money Market Onl<strong>in</strong>e Account Stored Value CardBank NameAccount Number(1c) $Total value of bank accounts from attachment (1d) $Add l<strong>in</strong>es (1a) through (1d) = (1) $Investment Account: Stocks Bonds OtherName of F<strong>in</strong>ancial InstitutionAccount NumberCurrent Market Value$ X .8 = $Investment Account: Stocks Bonds OtherLess Loan Balance– $ = (2a) $Name of F<strong>in</strong>ancial InstitutionAccount NumberCurrent Market Value$ X .8 = $Less Loan Balance– $ = (2b) $Total of <strong>in</strong>vestment accounts from attachment. [current market value X.8 less loan balance(s)] (2c) $Add l<strong>in</strong>es (2a) through (2c) = (2) $Notes ReceivableDo you have notes receivable? Yes NoIf yes, attach current list<strong>in</strong>g which <strong>in</strong>cludes name, age, and amount of note(s) receivable.Accounts ReceivableDo you have accounts receivable, <strong>in</strong>clud<strong>in</strong>g e-payment, factor<strong>in</strong>gcompanies, and any barter<strong>in</strong>g or onl<strong>in</strong>e auction accounts?YesNoIf yes, you may be asked to provide a list of name, age, and amount of the account(s) receivable.Catalog Number 55897B www.irs.gov <strong>Form</strong> 433-B (OIC) (Rev. 1-2014)

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)