Form 656-B, Offer in Compromise Booklet - Internal Revenue Service

Form 656-B, Offer in Compromise Booklet - Internal Revenue Service

Form 656-B, Offer in Compromise Booklet - Internal Revenue Service

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

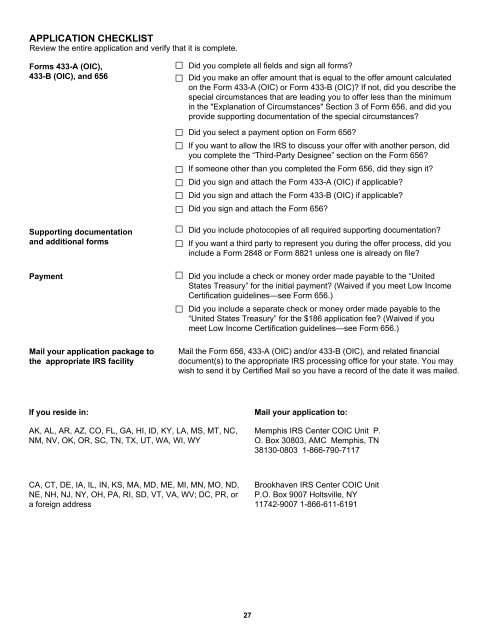

APPLICATION CHECKLISTReview the entire application and verify that it is complete.<strong>Form</strong>s 433-A (OIC),433-B (OIC), and <strong>656</strong>Support<strong>in</strong>g documentationand additional formsPaymentMail your application package tothe appropriate IRS facility□ Did you complete all fields and sign all forms?□ Did you make an offer amount that is equal to the offer amount calculatedon the <strong>Form</strong> 433-A (OIC) or <strong>Form</strong> 433-B (OIC)? If not, did you describe thespecial circumstances that are lead<strong>in</strong>g you to offer less than the m<strong>in</strong>imum<strong>in</strong> the "Explanation of Circumstances" Section 3 of <strong>Form</strong> <strong>656</strong>, and did youprovide support<strong>in</strong>g documentation of the special circumstances?□ Did you select a payment option on <strong>Form</strong> <strong>656</strong>?□ If you want to allow the IRS to discuss your offer with another person, didyou complete the “Third-Party Designee” section on the <strong>Form</strong> <strong>656</strong>?□ If someone other than you completed the <strong>Form</strong> <strong>656</strong>, did they sign it?□ Did you sign and attach the <strong>Form</strong> 433-A (OIC) if applicable?□ Did you sign and attach the <strong>Form</strong> 433-B (OIC) if applicable?□ Did you sign and attach the <strong>Form</strong> <strong>656</strong>?□ Did you <strong>in</strong>clude photocopies of all required support<strong>in</strong>g documentation?□ If you want a third party to represent you dur<strong>in</strong>g the offer process, did you<strong>in</strong>clude a <strong>Form</strong> 2848 or <strong>Form</strong> 8821 unless one is already on file?□ Did you <strong>in</strong>clude a check or money order made payable to the “UnitedStates Treasury” for the <strong>in</strong>itial payment? (Waived if you meet Low IncomeCertification guidel<strong>in</strong>es—see <strong>Form</strong> <strong>656</strong>.)□ Did you <strong>in</strong>clude a separate check or money order made payable to the“United States Treasury” for the $186 application fee? (Waived if youmeet Low Income Certification guidel<strong>in</strong>es—see <strong>Form</strong> <strong>656</strong>.)Mail the <strong>Form</strong> <strong>656</strong>, 433-A (OIC) and/or 433-B (OIC), and related f<strong>in</strong>ancialdocument(s) to the appropriate IRS process<strong>in</strong>g office for your state. You maywish to send it by Certified Mail so you have a record of the date it was mailed.If you reside <strong>in</strong>:Mail your application to:AK, AL, AR, AZ, CO, FL, GA, HI, ID, KY, LA, MS, MT, NC,NM, NV, OK, OR, SC, TN, TX, UT, WA, WI, WYMemphis IRS Center COIC Unit P.O. Box 30803, AMC Memphis, TN38130-0803 1-866-790-7117CA, CT, DE, IA, IL, IN, KS, MA, MD, ME, MI, MN, MO, ND,NE, NH, NJ, NY, OH, PA, RI, SD, VT, VA, WV; DC, PR, ora foreign addressBrookhaven IRS Center COIC UnitP.O. Box 9007 Holtsville, NY11742-9007 1-866-611-619127

![l..l.l.L. 4DB.DI3-l]t] xxxxxxxxxxxxxxxx - Internal Revenue Service](https://img.yumpu.com/51302394/1/190x245/llll-4dbdi3-lt-xxxxxxxxxxxxxxxx-internal-revenue-service.jpg?quality=85)