Illicit Financial Flows from Developing Countries ... - culturaRSC.com

Illicit Financial Flows from Developing Countries ... - culturaRSC.com

Illicit Financial Flows from Developing Countries ... - culturaRSC.com

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

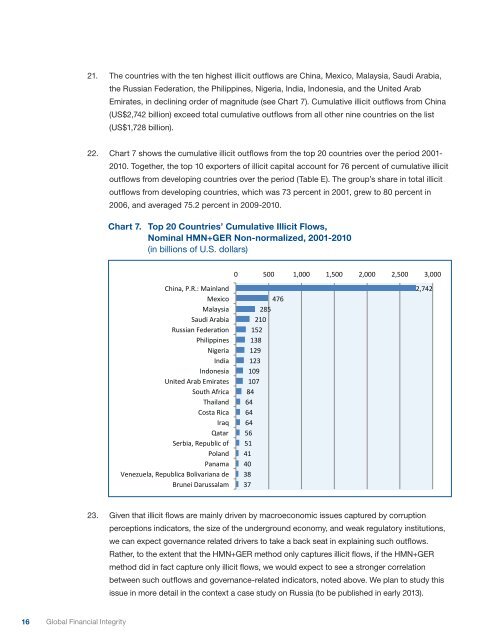

21. The countries with the ten highest illicit outflows are China, Mexico, Malaysia, Saudi Arabia,the Russian Federation, the Philippines, Nigeria, India, Indonesia, and the United ArabEmirates, in declining order of magnitude (see Chart 7). Cumulative illicit outflows <strong>from</strong> China(US$2,742 billion) exceed total cumulative outflows <strong>from</strong> all other nine countries on the list(US$1,728 billion).22. Chart 7 shows the cumulative illicit outflows <strong>from</strong> the top 20 countries over the period 2001-2010. Together, the top 10 exporters of illicit capital account for 76 percent of cumulative illicitoutflows <strong>from</strong> developing countries over the period (Table E). The group’s share in total illicitoutflows <strong>from</strong> developing countries, which was 73 percent in 2001, grew to 80 percent in2006, and averaged 75.2 percent in 2009-2010.Chart 7. Top 20 <strong>Countries</strong>’ Cumulative <strong>Illicit</strong> <strong>Flows</strong>,Nominal !"#$%&'(&)*+&,-&!*./%$0123&!.4.5#671&855090%&:5*;2?=@ABC&=*/D/*$4#50E1F>/10%D989B1E%G/H9B/1%I08/1%I08/1%J0/K98%AB1C%LM/B1K9>%?171M%$#&%!'(%!)*%)(!%)+'%)!,%)!+%)*,%)*#%'$%&$%&$%&$%(&%()%$)%$*%+'%+#%!"#$!%23. Given that illicit flows are mainly driven by macroeconomic issues captured by corruptionperceptions indicators, the size of the underground economy, and weak regulatory institutions,we can expect governance related drivers to take a back seat in explaining such outflows.Rather, to the extent that the HMN+GER method only captures illicit flows, if the HMN+GERmethod did in fact capture only illicit flows, we would expect to see a stronger correlationbetween such outflows and governance-related indicators, noted above. We plan to study thisissue in more detail in the context a case study on Russia (to be published in early 2013).16 Global <strong>Financial</strong> Integrity