INTERIM REPORT - The Link REIT

INTERIM REPORT - The Link REIT

INTERIM REPORT - The Link REIT

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

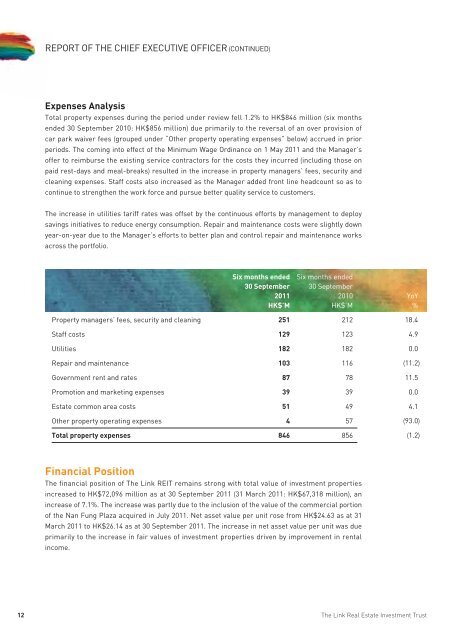

<strong>REPORT</strong> OF THE CHIEF EXECUTIVE OFFICER (CONTINUED)Expenses AnalysisTotal property expenses during the period under review fell 1.2% to HK$846 million (six monthsended 30 September 2010: HK$856 million) due primarily to the reversal of an over provision ofcar park waiver fees (grouped under “Other property operating expenses” below) accrued in priorperiods. <strong>The</strong> coming into effect of the Minimum Wage Ordinance on 1 May 2011 and the Manager’soffer to reimburse the existing service contractors for the costs they incurred (including those onpaid rest-days and meal-breaks) resulted in the increase in property managers’ fees, security andcleaning expenses. Staff costs also increased as the Manager added front line headcount so as tocontinue to strengthen the work force and pursue better quality service to customers.<strong>The</strong> increase in utilities tariff rates was offset by the continuous efforts by management to deploysavings initiatives to reduce energy consumption. Repair and maintenance costs were slightly downyear-on-year due to the Manager’s efforts to better plan and control repair and maintenance worksacross the portfolio.Six months ended30 September2011HK$’MSix months ended30 September2010HK$’MYoY%Property managers’ fees, security and cleaning 251 212 18.4Staff costs 129 123 4.9Utilities 182 182 0.0Repair and maintenance 103 116 (11.2)Government rent and rates 87 78 11.5Promotion and marketing expenses 39 39 0.0Estate common area costs 51 49 4.1Other property operating expenses 4 57 (93.0)Total property expenses 846 856 (1.2)Financial Position<strong>The</strong> financial position of <strong>The</strong> <strong>Link</strong> <strong>REIT</strong> remains strong with total value of investment propertiesincreased to HK$72,096 million as at 30 September 2011 (31 March 2011: HK$67,318 million), anincrease of 7.1%. <strong>The</strong> increase was partly due to the inclusion of the value of the commercial portionof the Nan Fung Plaza acquired in July 2011. Net asset value per unit rose from HK$24.63 as at 31March 2011 to HK$26.14 as at 30 September 2011. <strong>The</strong> increase in net asset value per unit was dueprimarily to the increase in fair values of investment properties driven by improvement in rentalincome.12<strong>The</strong> <strong>Link</strong> Real Estate Investment Trust