NOTES TO THE CONDENSED CONSOLIDATED<strong>INTERIM</strong> FINANCIAL INFORMATION1 Corporate information<strong>The</strong> <strong>Link</strong> Real Estate Investment Trust (“<strong>The</strong> <strong>Link</strong> <strong>REIT</strong>”) is a collective investment scheme authorised under section104 of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong). <strong>The</strong> <strong>Link</strong> <strong>REIT</strong> is governed by atrust deed entered into on 6 September 2005 (as amended and supplemented by the First Supplemental Deed dated4 November 2005, the Second Supplemental Deed dated 8 November 2005, the Third Supplemental Deed dated 16January 2006, the Fourth Supplemental Deed dated 21 November 2006, the Fifth Supplemental Deed dated 13 July2007, the Sixth Supplemental Deed dated 23 July 2007, the Seventh Supplemental Deed dated 5 October 2009 andthe Eighth Supplemental Deed dated 23 July 2010) (together the “Trust Deed”).<strong>The</strong> principal activity of <strong>The</strong> <strong>Link</strong> <strong>REIT</strong> and its subsidiaries (the “Group”) is investment in retail properties and carpark operations in Hong Kong. <strong>The</strong> addresses of the registered offices of the Manager, <strong>The</strong> <strong>Link</strong> ManagementLimited, and the trustee of <strong>The</strong> <strong>Link</strong> <strong>REIT</strong>, HSBC Institutional Trust Services (Asia) Limited, are 33/F., AXA Tower,Landmark East, 100 How Ming Street, Kwun Tong, Kowloon, Hong Kong and 1 Queen’s Road Central, Hong Kong,respectively.2 Basis of preparation<strong>The</strong> condensed consolidated interim financial information for the six months ended 30 September 2011 has beenprepared in accordance with Hong Kong Accounting Standard (“HKAS”) 34 “Interim Financial Reporting” issued bythe Hong Kong Institute of Certified Public Accountants (“HKICPA”). <strong>The</strong> condensed consolidated interim financialinformation should be read in conjunction with the audited consolidated financial statements for the year ended 31March 2011.As at 30 September 2011, the Group’s current liabilities exceeded its current assets by HK$1,541 million. Takinginto account the unutilised committed bank loan facilities of HK$2,310 million, the Group considers that its liquidityand financial position as a whole is healthy and it has a reasonable expectation that the Group has adequateresources to meet its liabilities and commitments as and when they fall due and to continue in operationalexistence for the foreseeable future. Accordingly, it continues to adopt the going concern basis in preparing thecondensed consolidated interim financial information.3 Accounting policies<strong>The</strong> accounting policies adopted are consistent with those set out in the audited consolidated financial statementsfor the year ended 31 March 2011, except for the adoption of the following new standards, amendments andinterpretations issued by the HKICPA which became effective for the six months ended 30 September 2011.HKFRS 1 AmendmentHK(IFRIC)-Int 14 AmendmentHK(IFRIC)-Int 19Improvements to HKFRSs 2010Limited Exemptions from Comparative HKFRS 7 Disclosures forFirst-time AdoptersPrepayments of a Minimum Funding RequirementExtinguishing Financial Liabilities with Equity Instruments<strong>The</strong> adoption of these new standards, amendments and interpretations has not had any significant effect on theaccounting policies or results and financial position of the Group.46<strong>The</strong> <strong>Link</strong> Real Estate Investment Trust

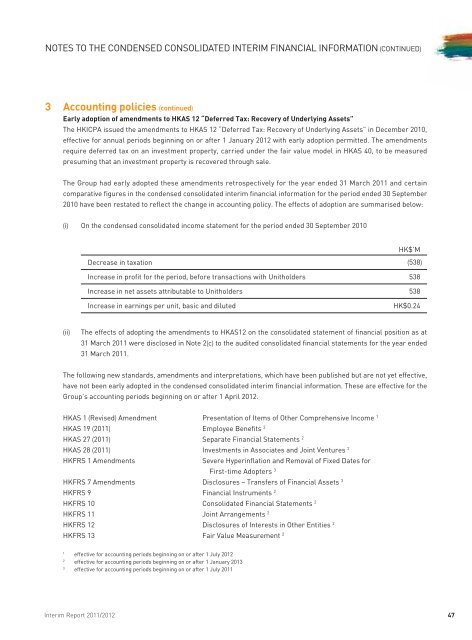

NOTES TO THE CONDENSED CONSOLIDATED <strong>INTERIM</strong> FINANCIAL INFORMATION (CONTINUED)3 Accounting policies (continued)Early adoption of amendments to HKAS 12 “Deferred Tax: Recovery of Underlying Assets”<strong>The</strong> HKICPA issued the amendments to HKAS 12 “Deferred Tax: Recovery of Underlying Assets” in December 2010,effective for annual periods beginning on or after 1 January 2012 with early adoption permitted. <strong>The</strong> amendmentsrequire deferred tax on an investment property, carried under the fair value model in HKAS 40, to be measuredpresuming that an investment property is recovered through sale.<strong>The</strong> Group had early adopted these amendments retrospectively for the year ended 31 March 2011 and certaincomparative figures in the condensed consolidated interim financial information for the period ended 30 September2010 have been restated to reflect the change in accounting policy. <strong>The</strong> effects of adoption are summarised below:(i) On the condensed consolidated income statement for the period ended 30 September 2010HK$’MDecrease in taxation (538)Increase in profit for the period, before transactions with Unitholders 538Increase in net assets attributable to Unitholders 538Increase in earnings per unit, basic and dilutedHK$0.24(ii)<strong>The</strong> effects of adopting the amendments to HKAS12 on the consolidated statement of financial position as at31 March 2011 were disclosed in Note 2(c) to the audited consolidated financial statements for the year ended31 March 2011.<strong>The</strong> following new standards, amendments and interpretations, which have been published but are not yet effective,have not been early adopted in the condensed consolidated interim financial information. <strong>The</strong>se are effective for theGroup’s accounting periods beginning on or after 1 April 2012.HKAS 1 (Revised) Amendment Presentation of Items of Other Comprehensive Income 1HKAS 19 (2011) Employee Benefits 2HKAS 27 (2011) Separate Financial Statements 2HKAS 28 (2011) Investments in Associates and Joint Ventures 2HKFRS 1 AmendmentsSevere Hyperinflation and Removal of Fixed Dates forFirst-time Adopters 3HKFRS 7 Amendments Disclosures – Transfers of Financial Assets 3HKFRS 9 Financial Instruments 2HKFRS 10 Consolidated Financial Statements 2HKFRS 11 Joint Arrangements 2HKFRS 12 Disclosures of Interests in Other Entities 2HKFRS 13 Fair Value Measurement 21effective for accounting periods beginning on or after 1 July 20122effective for accounting periods beginning on or after 1 January 20133effective for accounting periods beginning on or after 1 July 2011Interim Report 2011/201247