INTERIM REPORT - The Link REIT

INTERIM REPORT - The Link REIT

INTERIM REPORT - The Link REIT

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

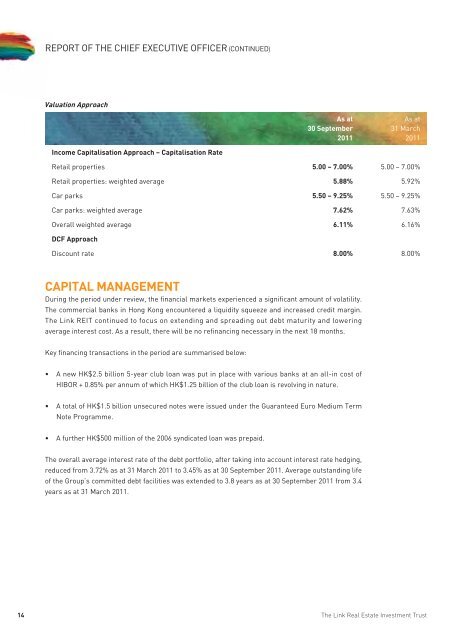

<strong>REPORT</strong> OF THE CHIEF EXECUTIVE OFFICER (CONTINUED)Valuation ApproachAs at30 September2011As at31 March2011Income Capitalisation Approach – Capitalisation RateRetail properties 5.00 – 7.00% 5.00 – 7.00%Retail properties: weighted average 5.88% 5.92%Car parks 5.50 – 9.25% 5.50 – 9.25%Car parks: weighted average 7.62% 7.63%Overall weighted average 6.11% 6.16%DCF ApproachDiscount rate 8.00% 8.00%CAPITAL MANAGEMENTDuring the period under review, the financial markets experienced a significant amount of volatility.<strong>The</strong> commercial banks in Hong Kong encountered a liquidity squeeze and increased credit margin.<strong>The</strong> <strong>Link</strong> <strong>REIT</strong> continued to focus on extending and spreading out debt maturity and loweringaverage interest cost. As a result, there will be no refinancing necessary in the next 18 months.Key financing transactions in the period are summarised below:• A new HK$2.5 billion 5-year club loan was put in place with various banks at an all-in cost ofHIBOR + 0.85% per annum of which HK$1.25 billion of the club loan is revolving in nature.• A total of HK$1.5 billion unsecured notes were issued under the Guaranteed Euro Medium TermNote Programme.• A further HK$500 million of the 2006 syndicated loan was prepaid.<strong>The</strong> overall average interest rate of the debt portfolio, after taking into account interest rate hedging,reduced from 3.72% as at 31 March 2011 to 3.45% as at 30 September 2011. Average outstanding lifeof the Group’s committed debt facilities was extended to 3.8 years as at 30 September 2011 from 3.4years as at 31 March 2011.14<strong>The</strong> <strong>Link</strong> Real Estate Investment Trust