Download 2004 Annual Report - Polymetal

Download 2004 Annual Report - Polymetal

Download 2004 Annual Report - Polymetal

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

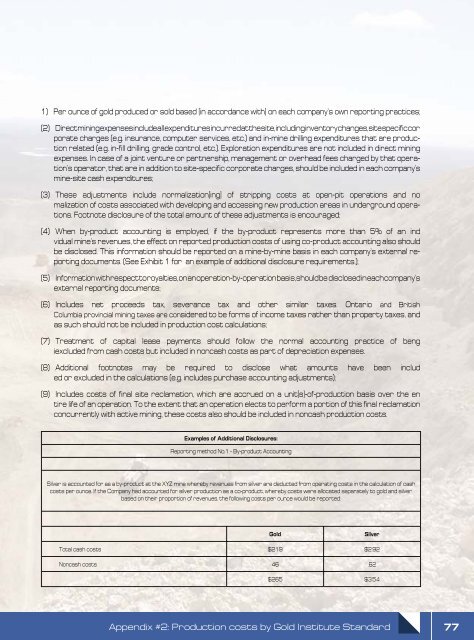

1) Per ounce of gold produced or sold based [in accordance with] on each company’s own reporting practices;(2) Direct mining expenses include all expenditures incurred at the site, including inventory changes, site specific corporate charges (e.g. insurance, computer services, etc.) and in−mine drilling expenditures that are produc−tion related (e.g. in−fill drilling, grade control, etc.). Exploration expenditures are not included in direct miningexpenses. In case of a joint venture or partnership, management or overhead fees charged by that opera−tion’s operator, that are in addition to site−specific corporate charges, should be included in each company’smine−site cash expenditures;(3) These adjustments include normalization[ing] of stripping costs at open−pit operations and nomalization of costs associated with developing and accessing new production areas in underground opera−tions. Footnote disclosure of the total amount of these adjustments is encouraged;(4) When by−product accounting is employed, if the by−product represents more than 5% of an indvidual mine’s revenues, the effect on reported production costs of using co−product accounting also shouldbe disclosed. This information should be reported on a mine−by−mine basis in each company’s external re−porting documents. (See Exhibit 1 for an example of additional disclosure requirements.);(5) Information with respect to royalties, on an operation−by−operation basis, should be disclosed in each company’sexternal reporting documents;(6) Includes net proceeds tax, severance tax and other similar taxes. Ontario and BritishColumbia provincial mining taxes are considered to be forms of income taxes rather than property taxes, andas such should not be included in production cost calculations;(7) Treatment of capital lease payments should follow the normal accounting practice of bengiexcluded from cash costs but included in noncash costs as part of depreciation expenses.(8) Additional footnotes may be required to disclose what amounts have been included or excluded in the calculations (e.g. includes purchase accounting adjustments);(9) Includes costs of final site reclamation, which are accrued on a unit[s]−of−production basis over the entire life of an operation. To the extent that an operation elects to perform a portion of this final reclamationconcurrently with active mining, these costs also should be included in noncash production costs.Examples of Additional Disclosures:<strong>Report</strong>ing method No.1 − By−product AccountingSilver is accounted for as a by−product at the XYZ mine whereby revenues from silver are deducted from operating costs in the calculation of cashcosts per ounce. If the Company had accounted for silver production as a co−product, whereby costs were allocated separately to gold and silverbased on their proportion of revenues, the following costs per ounce would be reported:GoldSilverTotal cash costs $219 $2.92Noncash costs 46 .62$265 $3.54Appendix #2: Production costs by Gold Institute Standard77