NAVANA REAL ESTATE LIMITED - Dhaka Stock Exchange

NAVANA REAL ESTATE LIMITED - Dhaka Stock Exchange

NAVANA REAL ESTATE LIMITED - Dhaka Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

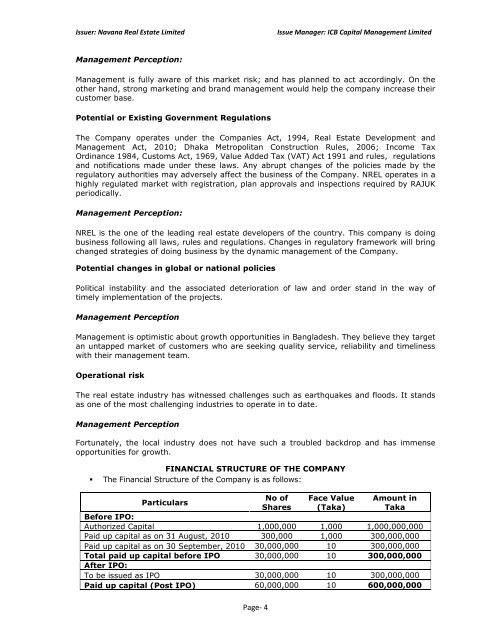

Issuer: Navana Real Estate LimitedIssue Manager: ICB Capital Management LimitedManagement Perception:Management is fully aware of this market risk; and has planned to act accordingly. On theother hand, strong marketing and brand management would help the company increase theircustomer base.Potential or Existing Government RegulationsThe Company operates under the Companies Act, 1994, Real Estate Development andManagement Act, 2010; <strong>Dhaka</strong> Metropolitan Construction Rules, 2006; Income TaxOrdinance 1984, Customs Act, 1969, Value Added Tax (VAT) Act 1991 and rules, regulationsand notifications made under these laws. Any abrupt changes of the policies made by theregulatory authorities may adversely affect the business of the Company. NREL operates in ahighly regulated market with registration, plan approvals and inspections required by RAJUKperiodically.Management Perception:NREL is the one of the leading real estate developers of the country. This company is doingbusiness following all laws, rules and regulations. Changes in regulatory framework will bringchanged strategies of doing business by the dynamic management of the Company.Potential changes in global or national policiesPolitical instability and the associated deterioration of law and order stand in the way oftimely implementation of the projects.Management PerceptionManagement is optimistic about growth opportunities in Bangladesh. They believe they targetan untapped market of customers who are seeking quality service, reliability and timelinesswith their management team.Operational riskThe real estate industry has witnessed challenges such as earthquakes and floods. It standsas one of the most challenging industries to operate in to date.Management PerceptionFortunately, the local industry does not have such a troubled backdrop and has immenseopportunities for growth.FINANCIAL STRUCTURE OF THE COMPANYThe Financial Structure of the Company is as follows:ParticularsPage- 4No ofSharesFace Value(Taka)Amount inTakaBefore IPO:Authorized Capital 1,000,000 1,000 1,000,000,000Paid up capital as on 31 August, 2010 300,000 1,000 300,000,000Paid up capital as on 30 September, 2010 30,000,000 10 300,000,000Total paid up capital before IPO 30,000,000 10 300,000,000After IPO:To be issued as IPO 30,000,000 10 300,000,000Paid up capital (Post IPO) 60,000,000 10 600,000,000