UBL Financial Statements - United Bank Limited

UBL Financial Statements - United Bank Limited

UBL Financial Statements - United Bank Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

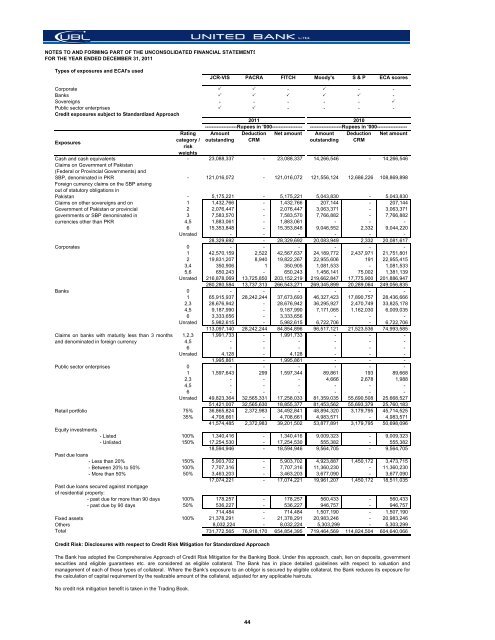

NOTES TO AND FORMING PART OF THE UNCONSOLIDATED FINANCIAL STATEMENTSFOR THE YEAR ENDED DECEMBER 31, 2011Types of exposures and ECAI's usedJCR-VIS PACRA FITCH Moody's S & P ECA scoresCorporate - - -<strong>Bank</strong>s -Sovereigns - - - - - Public sector enterprises - - - -Credit exposures subject to Standardized ApproachExposuresRatingcategory /riskweightsAmountoutstandingDeductionCRMAmountoutstandingDeductionCRMCash and cash equivalents - 23,088,337 - 23,088,337 14,266,546 - 14,266,546Claims on Government of Pakistan(Federal or Provincial Governments) andSBP, denominated in PKR - 121,016,072 - 121,016,072 121,556,124 12,686,226 108,869,898Foreign currency claims on the SBP arisingout of statutory obligations inPakistan - 5,175,221 - 5,175,221 5,043,830 - 5,043,830Claims on other sovereigns and on 1 1,432,766 - 1,432,766 207,144 - 207,144Government of Pakistan or provincial 2 2,076,447 - 2,076,447 3,063,371 - 3,063,371governments or SBP denominated in 3 7,583,570 - 7,583,570 7,766,882 - 7,766,882currencies other than PKR 4,5 1,883,061 - 1,883,061 - - -6 15,353,848 - 15,353,848 9,046,552 2,332 9,044,220Unrated - - - - - -28,329,692 - 28,329,692 20,083,949 2,332 20,081,617Corporates 0 - - - - - -1 42,570,159 2,522 42,567,637 24,189,772 2,437,971 21,751,8012 19,831,207 8,940 19,822,267 22,955,606 191 22,955,4153,4 350,906 1 350,905 1,081,533 - 1,081,5335,6 650,243 - 650,243 1,456,141 75,002 1,381,139Unrated 216,878,069 13,725,850 203,152,219 219,662,847 17,775,900 201,886,947280,280,584 13,737,313 266,543,271 269,345,899 20,289,064 249,056,835<strong>Bank</strong>s 0 - - - - - -1 65,915,937 28,242,244 37,673,693 46,327,423 17,890,757 28,436,6662,3 28,676,942 - 28,676,942 36,295,927 2,470,749 33,825,1784,5 9,187,990 - 9,187,990 7,171,065 1,162,030 6,009,0356 3,333,656 - 3,333,656 - - -Unrated 5,982,615 - 5,982,615 6,722,706 - 6,722,706Claims on banks with maturity less than 3 monthsand denominated in foreign currency113,097,140 28,242,244 84,854,896 96,517,121 21,523,536 74,993,5851,2,3 1,991,733 - 1,991,733 - - -4,5 - - - - - -6 - - - - - -Unrated 4,128 - 4,128 - - -1,995,861 - 1,995,861 - - -Public sector enterprises 0 - - - - - -1 1,597,643 299 1,597,344 89,861 193 89,6682,3 - - - 4,666 2,678 1,9884,5 - - - - - -6 - - - - - -Unrated 49,823,364 32,565,331 17,258,033 81,359,035 55,690,508 25,668,52751,421,007 32,565,630 18,855,377 81,453,562 55,693,379 25,760,183Retail portfolio 75% 36,865,824 2,372,983 34,492,841 48,894,320 3,179,795 45,714,52535% 4,708,661 - 4,708,661 4,983,571 - 4,983,57141,574,485 2,372,983 39,201,502 53,877,891 3,179,795 50,698,096Equity investments- Listed 100% 1,340,416 - 1,340,416 9,009,323 - 9,009,323- Unlisted 150% 17,254,530 - 17,254,530 555,382 - 555,38218,594,946 - 18,594,946 9,564,705 - 9,564,705Past due loans- Less than 20% 150% 5,903,702 - 5,903,702 4,923,887 1,450,172 3,473,715- Between 20% to 50% 100% 7,707,316 - 7,707,316 11,360,230 - 11,360,230- More than 50% 50% 3,463,203 - 3,463,203 3,677,090 - 3,677,09017,074,221 - 17,074,221 19,961,207 1,450,172 18,511,035Past due loans secured against mortgageof residential property:- past due for more than 90 days 100% 178,257 - 178,257 560,433 - 560,433- past due by 90 days 50% 536,227 - 536,227 946,757 - 946,757714,484 - 714,484 1,507,190 - 1,507,190Fixed assets 100% 21,378,291 - 21,378,291 20,983,246 - 20,983,246Others 8,032,224 - 8,032,224 5,303,299 - 5,303,299Total 731,772,565 76,918,170 654,854,395 719,464,569 114,824,504 604,640,066Credit Risk: Disclosures with respect to Credit Risk Mitigation for Standardized ApproachNo credit risk mitigation benefit is taken in the Trading Book.2011-------------------Rupees in '000------------------Net amount2010-------------------Rupees in '000------------------Net amountThe <strong>Bank</strong> has adopted the Comprehensive Approach of Credit Risk Mitigation for the <strong>Bank</strong>ing Book. Under this approach, cash, lien on deposits, governmentsecurities and eligible guarantees etc. are considered as eligible collateral. The <strong>Bank</strong> has in place detailed guidelines with respect to valuation andmanagement of each of these types of collateral. Where the <strong>Bank</strong>’s exposure to an obligor is secured by eligible collateral, the <strong>Bank</strong> reduces its exposure forthe calculation of capital requirement by the realizable amount of the collateral, adjusted for any applicable haircuts.44