June 2007 - Nordea Bank Lietuva

June 2007 - Nordea Bank Lietuva

June 2007 - Nordea Bank Lietuva

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

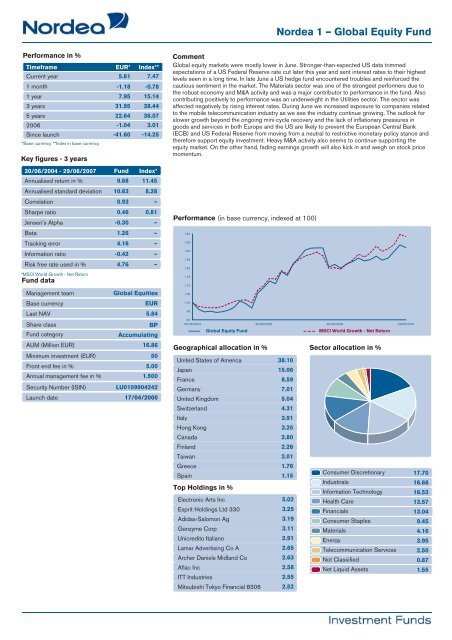

<strong>Nordea</strong> 1 – Global Equity FundPerformance in %TimeframeEUR* Index**Current year5.61 7.471 month-1.18 -0.781 year7.95 15.143 years31.95 38.445 years22.64 36.072006 -1.04 3.01Since launch-41.60 -14.25*Base currency **Index in base currencyKey figures - 3 years30/06/2004 - 29/06/<strong>2007</strong>Annualised return in %Annualised standard deviationCorrelationSharpe ratioJensen's AlphaBetaTracking errorInformation ratioRisk free rate used in %*MSCI World Growth - Net ReturnFund dataManagement teamBase currencyLast NAVShare classFund categoryAUM (Million EUR)Minimum investment (EUR)Front end fee in %Annual management fee in %Security Number (ISIN)Launch dateFund9.6810.630.930.46-0.301.264.16-0.424.76Index*11.458.28–0.81–––––Global EquitiesEUR5.84BPAccumulating16.86505.001.500LU010990424217/04/2000CommentGlobal equity markets were mostly lower in <strong>June</strong>. Stronger-than-expected US data trimmedexpectations of a US Federal Reserve rate cut later this year and sent interest rates to their highestlevels seen in a long time. In late <strong>June</strong> a US hedge fund encountered troubles and reinforced thecautious sentiment in the market. The Materials sector was one of the strongest performers due tothe robust economy and M&A activity and was a major contributor to performance in the fund. Alsocontributing positively to performance was an underweight in the Utilities sector. The sector wasaffected negatively by rising interest rates. During <strong>June</strong> we increased exposure to companies relatedto the mobile telecommunication industry as we see the industry continue growing. The outlook forslower growth beyond the ongoing mini-cycle recovery and the lack of inflationary pressures ingoods and services in both Europe and the US are likely to prevent the European Central <strong>Bank</strong>(ECB) and US Federal Reserve from moving from a neutral to restrictive monetary policy stance andtherefore support equity investment. Heavy M&A activity also seems to continue supporting theequity market. On the other hand, fading earnings growth will also kick in and weigh on stock pricemomentum.Performance (in base currency, indexed at 100)140135130125120115110105100959030/06/2004 30/06/2005 30/06/2006 29/06/<strong>2007</strong>Global Equity FundUnited States of America 38.10Japan 15.06France 8.59Germany 7.01United Kingdom 5.04Switzerland 4.31Italy 3.91Hong Kong 3.25Canada 2.80Finland 2.26Taiwan 2.01Greece 1.76Spain 1.15Top Holdings in %Electronic Arts Inc 5.02Esprit Holdings Ltd 330 3.25Adidas-Salomon Ag 3.19Genzyme Corp 3.11Unicredito Italiano 2.91Lamar Advertising Co A 2.65Archer Daniels Midland Co 2.63Aflac Inc 2.58ITT Industries 2.55Mitsubishi Tokyo Financial 8306 2.52MSCI World Growth - Net ReturnGeographical allocation in % Sector allocation in %Consumer Discretionary 17.70Industrials 16.68Information Technology 16.53Health Care 13.57Financials 13.04Consumer Staples 9.45Materials 4.16Energy 3.95Telecommunication Services 2.50Not Classified 0.87Net Liquid Assets 1.55Empty 20.00Empty 20.00