June 2007 - Nordea Bank Lietuva

June 2007 - Nordea Bank Lietuva

June 2007 - Nordea Bank Lietuva

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

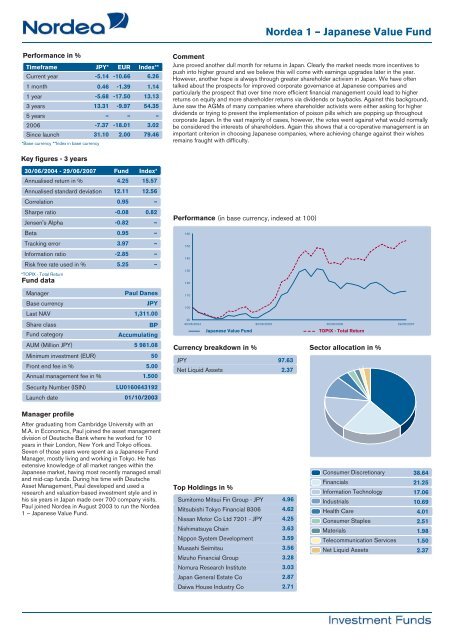

<strong>Nordea</strong> 1 – Japanese Value FundPerformance in %TimeframeJPY* EUR Index**Current year1 month1 year3 years5 years-5.140.46-5.6813.31–-10.66-1.39-17.50-9.97–6.261.1413.1354.35–2006 -7.37 -18.01 3.02Since launch31.10 2.00 79.46*Base currency **Index in base currencyComment<strong>June</strong> proved another dull month for returns in Japan. Clearly the market needs more incentives topush into higher ground and we believe this will come with earnings upgrades later in the year.However, another hope is always through greater shareholder activism in Japan. We have oftentalked about the prospects for improved corporate governance at Japanese companies andparticularly the prospect that over time more efficient financial management could lead to higherreturns on equity and more shareholder returns via dividends or buybacks. Against this background,<strong>June</strong> saw the AGMs of many companies where shareholder activists were either asking for higherdividends or trying to prevent the implementation of poison pills which are popping up throughoutcorporate Japan. In the vast majority of cases, however, the votes went against what would normallybe considered the interests of shareholders. Again this shows that a co-operative management is animportant criterion in choosing Japanese companies, where achieving change against their wishesremains fraught with difficulty.Key figures - 3 years30/06/2004 - 29/06/<strong>2007</strong>Annualised return in %Fund4.25Index*15.57Annualised standard deviation12.1112.56Correlation0.95–Sharpe ratioJensen's Alpha-0.08-0.820.82–Performance (in base currency, indexed at 100)Beta0.95–160Tracking errorInformation ratioRisk free rate used in %*TOPIX - Total ReturnFund data3.97-2.855.25–––150140130120ManagerBase currencyLast NAVShare classFund categoryAUM (Million JPY)Minimum investment (EUR)Front end fee in %Annual management fee in %Security Number (ISIN)Launch datePaul DanesJPY1,311.00BPAccumulating5 981.08505.001.500LU016064319201/10/20031101009030/06/2004 30/06/2005 30/06/2006 29/06/<strong>2007</strong>Japanese Value FundTOPIX - Total ReturnCurrency breakdown in % Sector allocation in %JPY 97.63Net Liquid Assets 2.37Manager profileAfter graduating from Cambridge University with anM.A. in Economics, Paul joined the asset managementdivision of Deutsche <strong>Bank</strong> where he worked for 10years in their London, New York and Tokyo offices.Seven of those years were spent as a Japanese FundManager, mostly living and working in Tokyo. He hasextensive knowledge of all market ranges within theJapanese market, having most recently managed smalland mid-cap funds. During his time with DeutscheAsset Management, Paul developed and used aresearch and valuation-based investment style and inhis six years in Japan made over 700 company visits.Paul joined <strong>Nordea</strong> in August 2003 to run the <strong>Nordea</strong>1 – Japanese Value Fund.Top Holdings in %Sumitomo Mitsui Fin Group - JPY 4.96Mitsubishi Tokyo Financial 8306 4.62Nissan Motor Co Ltd 7201 - JPY 4.25Nishimatsuya Chain 3.63Nippon System Development 3.59Musashi Seimitsu 3.56Mizuho Financial Group 3.28Nomura Research Institute 3.03Japan General Estate Co 2.87Daiwa House Industry Co 2.71Consumer Discretionary 38.64Financials 21.25Information Technology 17.06Industrials 10.69Health Care 4.01Consumer Staples 2.51Materials 1.98Telecommunication Services 1.50Net Liquid Assets 2.37Empty 20.00Empty 20.00Empty 20.00Empty 20.00