June 2007 - Nordea Bank Lietuva

June 2007 - Nordea Bank Lietuva

June 2007 - Nordea Bank Lietuva

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

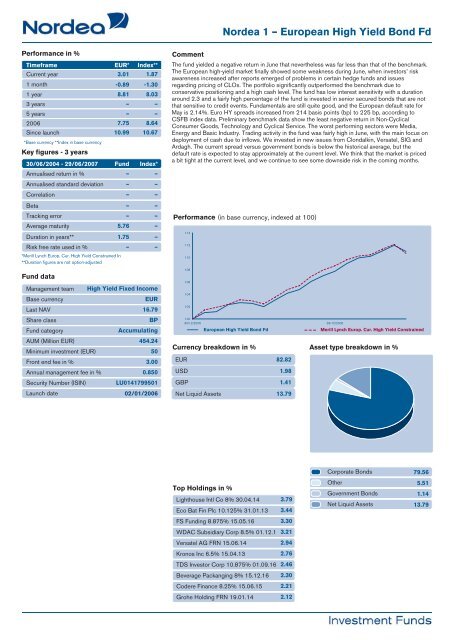

<strong>Nordea</strong> 1 – European High Yield Bond FdPerformance in %TimeframeEUR* Index**Current year3.01 1.871 month-0.89 -1.301 year8.81 8.033 years– –5 years– –2006 7.75 8.64Since launch10.99 10.67*Base currency **Index in base currencyKey figures - 3 years30/06/2004 - 29/06/<strong>2007</strong> Fund Index*Annualised return in %Annualised standard deviationCorrelationBetaTracking errorAverage maturity–––––5.76––––––Duration in years**1.75 –Risk free rate used in %– –*Merill Lynch Europ. Cur. High Yield Constrained In**Duration figures are not option-adjustedFund dataManagement teamBase currencyLast NAVShare classFund categoryAUM (Million EUR)Minimum investment (EUR)Front end fee in %Annual management fee in %Security Number (ISIN)Launch dateHigh Yield Fixed IncomeEUR16.79BPAccumulating454.24503.000.850LU014179950102/01/2006CommentThe fund yielded a negative return in <strong>June</strong> that nevertheless was far less than that of the benchmark.The European high-yield market finally showed some weakness during <strong>June</strong>, when investors’ riskawareness increased after reports emerged of problems in certain hedge funds and issuesregarding pricing of CLOs. The portfolio significantly outperformed the benchmark due toconservative positioning and a high cash level. The fund has low interest sensitivity with a durationaround 2.3 and a fairly high percentage of the fund is invested in senior secured bonds that are notthat sensitive to credit events. Fundamentals are still quite good, and the European default rate forMay is 2.14%. Euro HY spreads increased from 214 basis points (bp) to 225 bp, according toCSFB index data. Preliminary benchmark data show the least negative return in Non-CyclicalConsumer Goods, Technology and Cyclical Service. The worst performing sectors were Media,Energy and Basic Industry. Trading activity in the fund was fairly high in <strong>June</strong>, with the main focus ondeployment of cash due to inflows. We invested in new issues from Clondalkin, Versatel, SIG andArdagh. The current spread versus government bonds is below the historical average, but thedefault rate is expected to stay approximately at the current level. We think that the market is priceda bit tight at the current level, and we continue to see some downside risk in the coming months.Performance (in base currency, indexed at 100)11411211010810610410210030/12/2005 29/12/2006European High Yield Bond FdCurrency breakdown in %EUR 82.82USD 1.98GBP 1.41Net Liquid Assets 13.79Merill Lynch Europ. Cur. High Yield ConstrainedAsset type breakdown in %Corporate Bonds 79.56Top Holdings in %Lighthouse Intl Co 8% 30.04.14 3.79Eco Bat Fin Plc 10.125% 31.01.13 3.44FS Funding 8.875% 15.05.16 3.30WDAC Subsidiary Corp 8.5% 01.12.1 3.21Versatel AG FRN 15.06.14 2.94Kronos Inc 6.5% 15.04.13 2.76TDS Investor Corp 10.875% 01.09.16 2.46Beverage Packanging 8% 15.12.16 2.30Codere Finance 8.25% 15.06.15 2.21Grohe Holding FRN 19.01.14 2.12Other 5.51Government Bonds 1.14Net Liquid Assets 13.79Empty 20.00Empty 20.00Empty 20.00Empty 20.00Empty 20.00Empty 20.00Empty 20.00Empty 20.00