June 2007 - Nordea Bank Lietuva

June 2007 - Nordea Bank Lietuva

June 2007 - Nordea Bank Lietuva

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

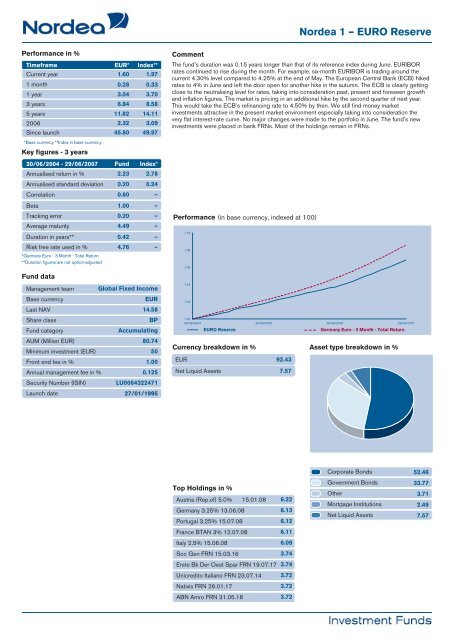

<strong>Nordea</strong> 1 – EURO ReservePerformance in %TimeframeEUR* Index**Current year1.60 1.971 month0.28 0.331 year3.04 3.703 years6.84 8.585 years11.82 14.112006 2.32 3.09Since launch45.80 49.97*Base currency **Index in base currencyKey figures - 3 years30/06/2004 - 29/06/<strong>2007</strong> Fund Index*Annualised return in %Annualised standard deviationCorrelationBetaTracking errorAverage maturity2.230.200.601.000.204.492.780.24––––Duration in years**0.42 –Risk free rate used in %*Germany Euro - 3 Month - Total Return**Duration figures are not option-adjusted4.76 –Fund dataManagement teamBase currencyLast NAVShare classFund categoryGlobal Fixed IncomeEUR14.58BPAccumulatingAUM (Million EUR)80.74Minimum investment (EUR)Front end fee in %501.00Annual management fee in %0.125Security Number (ISIN)Launch dateLU006432247127/01/1995CommentThe fund’s duration was 0.15 years longer than that of its reference index during <strong>June</strong>. EURIBORrates continued to rise during the month. For example, six-month EURIBOR is trading around thecurrent 4.30% level compared to 4.25% at the end of May. The European Central <strong>Bank</strong> (ECB) hikedrates to 4% in <strong>June</strong> and left the door open for another hike in the autumn. The ECB is clearly gettingclose to the neutralising level for rates, taking into consideration past, present and foreseen growthand inflation figures. The market is pricing in an additional hike by the second quarter of next year.This would take the ECB’s refinancing rate to 4.50% by then. We still find money marketinvestments attractive in the present market environment especially taking into consideration thevery flat interest-rate curve. No major changes were made to the portfolio in <strong>June</strong>. The fund’s newinvestments were placed in bank FRNs. Most of the holdings remain in FRNs.Performance (in base currency, indexed at 100)11010810610410210030/06/2004 30/06/2005 30/06/2006 29/06/<strong>2007</strong>EURO ReserveCurrency breakdown in %EUR 92.43Net Liquid Assets 7.57Germany Euro - 3 Month - Total ReturnAsset type breakdown in %Corporate Bonds 52.46Top Holdings in %Austria (Rep.of) 5.0% 15.01.08 6.22Germany 3.25% 13.06.08 6.13Portugal 3.25% 15.07.08 6.12France BTAN 3% 12.07.08 6.11Italy 2.5% 15.06.08 6.09Soc Gen FRN 15.03.16 3.74Erste Bk Der Oest Spar FRN 19.07.17 3.74Unicredito Italiano FRN 23.07.14 3.72Natixis FRN 26.01.17 3.72ABN Amro FRN 31.05.18 3.72Government Bonds 33.77Other 3.71Mortgage Institutions 2.49Net Liquid Assets 7.57Empty 20.00Empty 20.00Empty 20.00Empty 20.00Empty 20.00Empty 20.00Empty 20.00