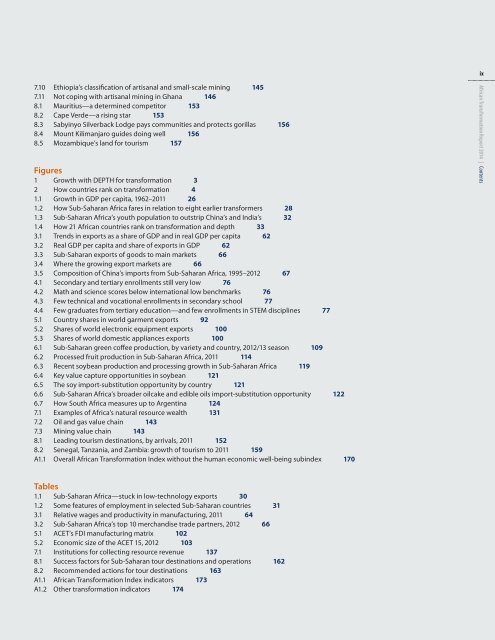

ix7.10 Ethiopia’s classification of artisanal and small-scale mining 1457.11 Not coping with artisanal mining in Ghana 1468.1 Mauritius—a determined competitor 1538.2 Cape Verde—a rising star 1538.3 Sabyinyo Silverback Lodge pays communities and protects gorillas 1568.4 Mount Kilimanjaro guides doing well 1568.5 Mozambique’s land for tourism 157Figures1 Growth with DEPTH for <strong>transformation</strong> 32 How countries rank on <strong>transformation</strong> 41.1 Growth in GDP per capita, 1962–2011 261.2 How Sub- Saharan Africa fares in relation to eight earlier transformers 281.3 Sub- Saharan Africa’s youth population to outstrip China’s and India’s 321.4 How 21 African countries rank on <strong>transformation</strong> and depth 333.1 Trends in exports as a share of GDP and in real GDP per capita 623.2 Real GDP per capita and share of exports in GDP 623.3 Sub- Saharan exports of goods to main markets 663.4 Where the growing export markets are 663.5 Composition of China’s imports from Sub- Saharan Africa, 1995–2012 674.1 Secondary and tertiary enrollments still very low 764.2 Math and science scores below international low benchmarks 764.3 Few technical and vocational enrollments in secondary school 774.4 Few graduates from tertiary education—and few enrollments in STEM disciplines 775.1 Country shares in world garment exports 925.2 Shares of world electronic equipment exports 1005.3 Shares of world domestic appliances exports 1006.1 Sub- Saharan green coffee production, by variety and country, 2012/13 season 1096.2 Processed fruit production in Sub- Saharan Africa, 2011 1146.3 Recent soybean production and processing growth in Sub- Saharan Africa 1196.4 Key value capture opportunities in soybean 1216.5 The soy import-substitution opportunity by country 1216.6 Sub- Saharan Africa’s broader oilcake and edible oils import-substitution opportunity 1226.7 How South Africa measures up to Argentina 1247.1 Examples of Africa’s natural resource wealth 1317.2 Oil and gas value chain 1437.3 Mining value chain 1438.1 Leading tourism destinations, by arrivals, 2011 1528.2 Senegal, Tanzania, and Zambia: growth of tourism to 2011 159A1.1 Overall African Transformation Index without the human economic well-being subindex 170African Transformation Report <strong>2014</strong> | ContentsTables1.1 Sub- Saharan Africa—stuck in low-technology exports 301.2 Some features of employment in selected Sub- Saharan countries 313.1 Relative wages and productivity in manufacturing, 2011 643.2 Sub- Saharan Africa’s top 10 merchandise trade partners, 2012 665.1 ACET’s FDI manufacturing matrix 1025.2 Economic size of the ACET 15, 2012 1037.1 Institutions for collecting resource revenue 1378.1 Success factors for Sub- Saharan tour destinations and operations 1628.2 Recommended actions for tour destinations 163A1.1 African Transformation Index indicators 173A1.2 Other <strong>transformation</strong> indicators 174

xAfrican Transformation Report <strong>2014</strong> | AcknowledgmentsAcknowledgmentsYaw Ansu, ACET’s Chief Economist, led the team preparingthis first African Transformation Report and comprisingFrancis Abebrese, Nana Amma Afari-Gyan, KobinaAidoo, Joe Amoako-Tuffour, Mina Ballamoune, EdwardBrown, Kwaku Damoah, Nicolas Chauvin Depetris, JuliusGatune, Sheila Khama, Eugenie Maiga, Abdul Mijiyawa,and Francis Mulangu.Many leading development thinkers offered perspectiveson Africa’s economic <strong>transformation</strong> during theApril 2011 discussions at the Rockefeller ConferenceCenter in Bellagio, Italy: Shankar Acharya (formerChief Economic Advisor to the Government of India),Kwesi Botchwey (former Finance Minister, Ghana), HelaCheikhrouhou (Director of Infrastructure, AfDB), LuisaVitoria Dias Diogo (Minister of Public Service, Mozambique),Wagner Guerra (Head, Department of InternationalAffairs, Central Bank of Brazil), Donald Kaberuka(President, AfDB), Rosalind Kainyah (Vice-President,Tullow Oil), Amara Konneh (Minister of Planning andEconomic Affairs, Liberia), Wonhyuk Lim (Director ofPolicy Research, Korean Development Institute), JustinYifu Lin (Chief Economist, World Bank), David Ma(former Director, Institute of Public Administration andManagement, Singapore), Ali Mansoor (Financial Secretary,Government of Mauritius), Mekonnen Manyazewal(Minister of Industry, Ethiopia), Tito Mboweni (formerGovernor of the Reserve Bank of South Africa and Chairmanof AngloGold Ashanti), Greg J.B. Mills (Director, TheBrenthurst Foundation, South Africa), Celestin Monga(Senior Economic Advisor, World Bank), Akbar Noman(Columbia University and Initiative for Policy Dialogue),Steve Radelet (Chief Economist, USAID), Charles Soludo(former Governor of the Central Bank, Nigeria), AnverVersi (Editor, African Business magazine, London),Michel Wormser (Director of Strategy and Operations,Africa Region, World Bank), and Shahid Yusuf (independentconsultant). The <strong>report</strong> also profited from theinsights of James Mwangi and Edwin Macharia, GlobalManaging Partner and Partner, respectively, of DalbergGlobal Development Advisors.The <strong>report</strong> benefited from background studies by anumber of external experts: David Ashton (skills development);Dalberg Global Development Advisors (agroprocessing)and Aly-Khan Jamal (formerly with DalbergGlobal Development Advisors, agroprocessing); Eric NgPing Cheun of PluriConseil Ltd, Mauritius (textiles andgarments); Iain Christie (tourism); Robert Liebenthal(tourism in Zambia); Rafael Macatangay and others ofthe University of Dundee’s Centre for Energy, Petroleumand Mineral Law and Policy (extractives); Marysue Shoreof Global Business Strategies (CEO interviews and manufacturingmatrix); and Joseph Kwasi Ansu (manufacturingmatrix).Country case studies were conducted by think tanks andresearchers in 15 African countries led by Haile Taye andGrace Kgakge of the Botswana Institute for DevelopmentPolicy and Analysis (Botswana); Boubié Bassolet andIdrissa Ouedraogo of Université Ouaga 2 (Burkina Faso);Henri Ngoa Tabi of the Center of Research and Studiesin Economics and Management and Etienne M.A. Assigaof the Office of the Prime Minister (Cameroon); TadeleFerede of Addis Ababa University and GebrehiwotAgeba of the Ethiopian Development Research Institute(Ethiopia); Kofi O. Nti, independent consultant (Ghana);Moses Ikiara of the Kenya Institute for Public PolicyResearch and Analysis (Kenya); Eric Ng Ping Cheun ofPluriConseil Ltd, Mauritius (Mauritius); Eduardo Nevesand Vasco C. Nhabinde of the Eduardo Mondlane University’sCenter for Economics and Management Studies(Mozambique); Osita Ogbu of African DevelopmentSolutions (and former Economic Advisor to the Presidentand Minister of Planning, Nigeria) and John Adeoti of theUniversity of Nigeria, Nsukka (Nigeria); Dickson Malundaand Serge Musana of the Institute of Policy Analysisand Research (Rwanda); El Hadji A. Camara of the Consortiumpour la Recherche Economique et Sociale(Senegal); Haroon Bhorat and Morne Oosthuizen of theUniversity of Cape Town’s Development Policy ResearchUnit (South Africa); H. Bohela Lunogelo and MonicaHangi of the Economic and Social Research Foundation(Tanzania); Lawrence Bategeka of the Economic PolicyResearch Centre (Uganda); and Caesar C. Cheelo andLilian Muchimba of the Zambia Institute for Policy Analysisand Research (Zambia).Report chapters benefited from reviews by AkbarNoman (Columbia University); Shanta Devarajan,Peter Materu, and Jee-Peng Tan (World Bank); BirgerJ. Fredriksen, Sarwar Lateef, Evelyn Herfkens, CostasMicholopoulos, and Peter Miovic (independent consultants);Alan Gelb (Center for Global Development); JohnPage (The Brookings Institution); and Marysue Shore(Global Business Strategies).Background studies, country case studies, and theAfrican Transformation Index benefited from reviews byMelvin Ayogu (University of Cape Town, The Brookings

- Page 1 and 2: 2014 African Transformation ReportG

- Page 3: The African Center for Economic Tra

- Page 7: viAfrican Transformation Report 201

- Page 14 and 15: OVERVIEWTransforming Africaneconomi

- Page 16 and 17: share of manufacturing value addedi

- Page 18 and 19: 5South Africa, Côte d’Ivoire, Se

- Page 20 and 21: 7capability to become competitivesu

- Page 22 and 23: 9be made public periodically. Incou

- Page 24 and 25: 11Box 1Four pathways to transformat

- Page 27 and 28: 14African Transformation Report 201

- Page 29 and 30: 16African Transformation Report 201

- Page 31 and 32: 18African Transformation Report 201

- Page 33 and 34: 20African Transformation Report 201

- Page 35 and 36: 22African Transformation Report 201

- Page 38 and 39: CHAPTER 1Tracking economictransform

- Page 40 and 41: 27learn how to produce new goodsand

- Page 42 and 43: 29Apart from broadening the range o

- Page 44 and 45: 31few and far between. Reportedunem

- Page 46 and 47: improved their competitivenessrank

- Page 48 and 49: 35likely to increase. So it would m

- Page 50 and 51: 37African Transformation Report 201

- Page 52: What the graphs showThe top figure

- Page 55 and 56: 42African Transformation Report 201

- Page 57 and 58: 44African Transformation Report 201

- Page 59 and 60:

46African Transformation Report 201

- Page 61 and 62:

48African Transformation Report 201

- Page 63 and 64:

50African Transformation Report 201

- Page 65 and 66:

52African Transformation Report 201

- Page 67 and 68:

54African Transformation Report 201

- Page 69 and 70:

56African Transformation Report 201

- Page 71 and 72:

58African Transformation Report 201

- Page 74 and 75:

CHAPTER 3Promoting exports—essent

- Page 76 and 77:

63import-substitution industries. B

- Page 78 and 79:

65poor infrastructure and onerousre

- Page 80 and 81:

67makes it very difficult for count

- Page 82 and 83:

69and Industry and the Export Promo

- Page 84 and 85:

71There is no merit in a poor count

- Page 86:

73Success Story: Botswana.” In In

- Page 89 and 90:

76African Transformation Report 201

- Page 91 and 92:

78African Transformation Report 201

- Page 93 and 94:

80African Transformation Report 201

- Page 95 and 96:

82African Transformation Report 201

- Page 97 and 98:

84African Transformation Report 201

- Page 99 and 100:

86African Transformation Report 201

- Page 101 and 102:

88African Transformation Report 201

- Page 104 and 105:

CHAPTER 5Leveraging abundantlabor f

- Page 106 and 107:

93receive the protection envisaged.

- Page 108 and 109:

95the domestic market, startedand s

- Page 110 and 111:

97shirts, tracksuits, and fleece),

- Page 112 and 113:

Box 5.2Riding African designs into

- Page 114 and 115:

101Box 5.3ACET’s FDI manufacturin

- Page 116 and 117:

103Table 5.2 Economic size of the A

- Page 118:

105Experience and Possible Lessons

- Page 121 and 122:

108African Transformation Report 20

- Page 123 and 124:

110African Transformation Report 20

- Page 125 and 126:

112African Transformation Report 20

- Page 127 and 128:

114African Transformation Report 20

- Page 129 and 130:

116African Transformation Report 20

- Page 131 and 132:

118African Transformation Report 20

- Page 133 and 134:

120African Transformation Report 20

- Page 135 and 136:

122African Transformation Report 20

- Page 137 and 138:

124African Transformation Report 20

- Page 139 and 140:

126African Transformation Report 20

- Page 142 and 143:

CHAPTER 7Managing oil, gas,and mine

- Page 144 and 145:

Figure 7.1Examples of Africa’s na

- Page 146 and 147:

Box 7.1Botswana’s political leade

- Page 148 and 149:

Box 7.2 Executive control and parli

- Page 150 and 151:

Table 7.1CountryInstitutions for co

- Page 154 and 155:

141created. One certified firm supp

- Page 156 and 157:

143iron ore is about one-tenth of t

- Page 158 and 159:

145• Get help. In industry expert

- Page 160 and 161:

14725. UNCTAD 2012.26. UNCTAD 2012.

- Page 162:

149African Transformation Report 20

- Page 165 and 166:

152African Transformation Report 20

- Page 167 and 168:

154African Transformation Report 20

- Page 169 and 170:

156African Transformation Report 20

- Page 171 and 172:

158African Transformation Report 20

- Page 173 and 174:

160African Transformation Report 20

- Page 175 and 176:

162African Transformation Report 20

- Page 177 and 178:

164African Transformation Report 20

- Page 180 and 181:

ANNEX 1Technical note on theconstru

- Page 182 and 183:

169includes many other factors). GD

- Page 184 and 185:

171well-being index, which includes

- Page 186 and 187:

173Table A1.1IndicatorAfrican Trans

- Page 188:

175African Transformation Report 20

- Page 191 and 192:

178African Transformation Report 20

- Page 193 and 194:

180African Transformation Report 20

- Page 195 and 196:

182African Transformation Report 20

- Page 197 and 198:

184African Transformation Report 20

- Page 199 and 200:

186African Transformation Report 20

- Page 201 and 202:

188African Transformation Report 20

- Page 203 and 204:

190African Transformation Report 20

- Page 205 and 206:

192African Transformation Report 20

- Page 207 and 208:

194African Transformation Report 20

- Page 209 and 210:

196African Transformation Report 20

- Page 211 and 212:

198African Transformation Report 20

- Page 213 and 214:

200African Transformation Report 20

- Page 215 and 216:

202African Transformation Report 20

- Page 217 and 218:

204African Transformation Report 20

- Page 219 and 220:

206African Transformation Report 20