TIO 2007 Annual Report

TIO 2007 Annual Report

TIO 2007 Annual Report

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

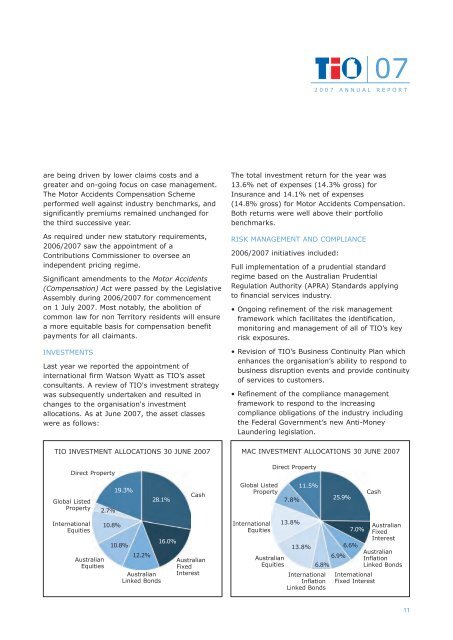

07<strong>2007</strong> ANNUAL REPORTare being driven by lower claims costs and agreater and on-going focus on case management.The Motor Accidents Compensation Schemeperformed well against industry benchmarks, andsignificantly premiums remained unchanged forthe third successive year.As required under new statutory requirements,2006/<strong>2007</strong> saw the appointment of aContributions Commissioner to oversee anindependent pricing regime.Significant amendments to the Motor Accidents(Compensation) Act were passed by the LegislativeAssembly during 2006/<strong>2007</strong> for commencementon 1 July <strong>2007</strong>. Most notably, the abolition ofcommon law for non Territory residents will ensurea more equitable basis for compensation benefitpayments for all claimants.INVESTMENTSLast year we reported the appointment ofinternational firm Watson Wyatt as <strong>TIO</strong>’s assetconsultants. A review of <strong>TIO</strong>'s investment strategywas subsequently undertaken and resulted inchanges to the organisation's investmentallocations. As at June <strong>2007</strong>, the asset classeswere as follows:<strong>TIO</strong> INVESTMENT ALLOCA<strong>TIO</strong>NS 30 JUNE <strong>2007</strong>Direct PropertyThe total investment return for the year was13.6% net of expenses (14.3% gross) forInsurance and 14.1% net of expenses(14.8% gross) for Motor Accidents Compensation.Both returns were well above their portfoliobenchmarks.RISK MANAGEMENT AND COMPLIANCE2006/<strong>2007</strong> initiatives included:Full implementation of a prudential standardregime based on the Australian PrudentialRegulation Authority (APRA) Standards applyingto financial services industry.• Ongoing refinement of the risk managementframework which facilitates the identification,monitoring and management of all of <strong>TIO</strong>’s keyrisk exposures.• Revision of <strong>TIO</strong>’s Business Continuity Plan whichenhances the organisation’s ability to respond tobusiness disruption events and provide continuityof services to customers.• Refinement of the compliance managementframework to respond to the increasingcompliance obligations of the industry includingthe Federal Government’s new Anti-MoneyLaundering legislation.MAC INVESTMENT ALLOCA<strong>TIO</strong>NS 30 JUNE <strong>2007</strong>Direct PropertyGlobal ListedProperty2.7%19.3%28.1%CashGlobal ListedProperty7.8%11.5%25.9%CashInternationalEquitiesAustralianEquities10.8%10.8%12.2%AustralianLinked Bonds16.0%AustralianFixedInterestInternationalEquities13.8%13.8%AustralianEquities6.8%InternationalInflationLinked BondsAustralian7.0%FixedInterest6.6%Australian6.9%InflationLinked BondsInternationalFixed Interest11