TIO 2007 Annual Report

TIO 2007 Annual Report

TIO 2007 Annual Report

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

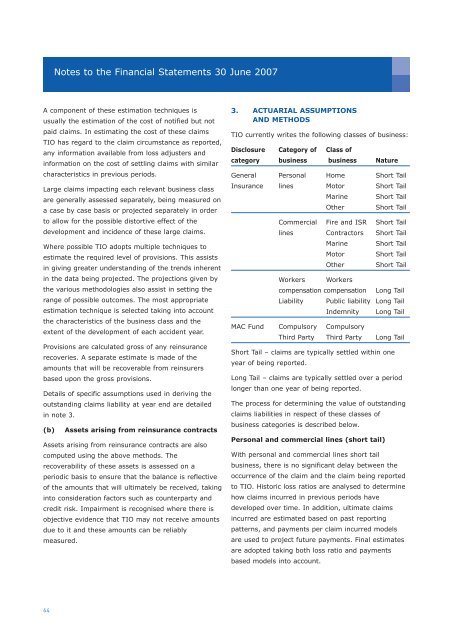

Notes to the Financial Statements 30 June <strong>2007</strong>A component of these estimation techniques isusually the estimation of the cost of notified but notpaid claims. In estimating the cost of these claims<strong>TIO</strong> has regard to the claim circumstance as reported,any information available from loss adjusters andinformation on the cost of settling claims with similarcharacteristics in previous periods.Large claims impacting each relevant business classare generally assessed separately, being measured ona case by case basis or projected separately in orderto allow for the possible distortive effect of thedevelopment and incidence of these large claims.Where possible <strong>TIO</strong> adopts multiple techniques toestimate the required level of provisions. This assistsin giving greater understanding of the trends inherentin the data being projected. The projections given bythe various methodologies also assist in setting therange of possible outcomes. The most appropriateestimation technique is selected taking into accountthe characteristics of the business class and theextent of the development of each accident year.Provisions are calculated gross of any reinsurancerecoveries. A separate estimate is made of theamounts that will be recoverable from reinsurersbased upon the gross provisions.Details of specific assumptions used in deriving theoutstanding claims liability at year end are detailedin note 3.(b) Assets arising from reinsurance contractsAssets arising from reinsurance contracts are alsocomputed using the above methods. Therecoverability of these assets is assessed on aperiodic basis to ensure that the balance is reflectiveof the amounts that will ultimately be received, takinginto consideration factors such as counterparty andcredit risk. Impairment is recognised where there isobjective evidence that <strong>TIO</strong> may not receive amountsdue to it and these amounts can be reliablymeasured.3. ACTUARIAL ASSUMP<strong>TIO</strong>NSAND METHODS<strong>TIO</strong> currently writes the following classes of business:Disclosure Category of Class ofcategory business business NatureGeneral Personal Home Short TailInsurance lines Motor Short TailMarine Short TailOther Short TailCommercial Fire and ISR Short Taillines Contractors Short TailMarine Short TailMotor Short TailOther Short TailWorkers Workerscompensation compensation Long TailLiability Public liability Long TailIndemnity Long TailMAC Fund Compulsory CompulsoryThird Party Third Party Long TailShort Tail – claims are typically settled within oneyear of being reported.Long Tail – claims are typically settled over a periodlonger than one year of being reported.The process for determining the value of outstandingclaims liabilities in respect of these classes ofbusiness categories is described below.Personal and commercial lines (short tail)With personal and commercial lines short tailbusiness, there is no significant delay between theoccurrence of the claim and the claim being reportedto <strong>TIO</strong>. Historic loss ratios are analysed to determinehow claims incurred in previous periods havedeveloped over time. In addition, ultimate claimsincurred are estimated based on past reportingpatterns, and payments per claim incurred modelsare used to project future payments. Final estimatesare adopted taking both loss ratio and paymentsbased models into account.64