MOL Hungarian Oil and Gas Public Limited Company

MOL Hungarian Oil and Gas Public Limited Company

MOL Hungarian Oil and Gas Public Limited Company

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

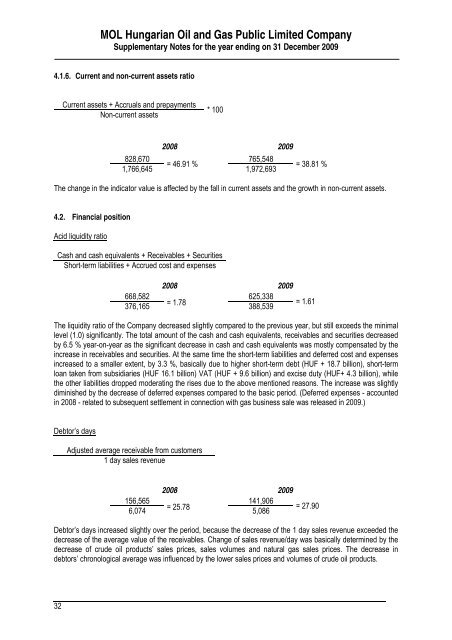

<strong>MOL</strong> <strong>Hungarian</strong> <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> <strong>Public</strong> <strong>Limited</strong> <strong>Company</strong>Supplementary Notes for the year ending on 31 December 20094.1.6. Current <strong>and</strong> non-current assets ratioCurrent assets + Accruals <strong>and</strong> prepaymentsNon-current assets* 1002008 2009828,670 765,548= 46.91 %1,766,6451,972,693= 38.81 %The change in the indicator value is affected by the fall in current assets <strong>and</strong> the growth in non-current assets.4.2. Financial positionAcid liquidity ratioCash <strong>and</strong> cash equivalents + Receivables + SecuritiesShort-term liabilities + Accrued cost <strong>and</strong> expenses2008 2009668,582 625,338376,165= 1.78388,539= 1.61The liquidity ratio of the <strong>Company</strong> decreased slightly compared to the previous year, but still exceeds the minimallevel (1.0) significantly. The total amount of the cash <strong>and</strong> cash equivalents, receivables <strong>and</strong> securities decreasedby 6.5 % year-on-year as the significant decrease in cash <strong>and</strong> cash equivalents was mostly compensated by theincrease in receivables <strong>and</strong> securities. At the same time the short-term liabilities <strong>and</strong> deferred cost <strong>and</strong> expensesincreased to a smaller extent, by 3.3 %, basically due to higher short-term debt (HUF + 18.7 billion), short-termloan taken from subsidiaries (HUF 16.1 billion) VAT (HUF + 9.6 billion) <strong>and</strong> excise duty (HUF+ 4.3 billion), whilethe other liabilities dropped moderating the rises due to the above mentioned reasons. The increase was slightlydiminished by the decrease of deferred expenses compared to the basic period. (Deferred expenses - accountedin 2008 - related to subsequent settlement in connection with gas business sale was released in 2009.)Debtor’s daysAdjusted average receivable from customers1 day sales revenue2008 2009156,565 141,9066,074= 25.785,086= 27.90Debtor’s days increased slightly over the period, because the decrease of the 1 day sales revenue exceeded thedecrease of the average value of the receivables. Change of sales revenue/day was basically determined by thedecrease of crude oil products’ sales prices, sales volumes <strong>and</strong> natural gas sales prices. The decrease indebtors’ chronological average was influenced by the lower sales prices <strong>and</strong> volumes of crude oil products.32