MOL Hungarian Oil and Gas Public Limited Company

MOL Hungarian Oil and Gas Public Limited Company

MOL Hungarian Oil and Gas Public Limited Company

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

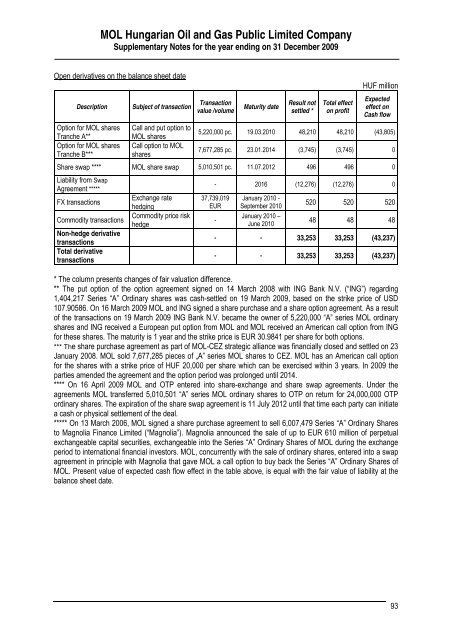

<strong>MOL</strong> <strong>Hungarian</strong> <strong>Oil</strong> <strong>and</strong> <strong>Gas</strong> <strong>Public</strong> <strong>Limited</strong> <strong>Company</strong>Supplementary Notes for the year ending on 31 December 2009Open derivatives on the balance sheet dateDescriptionOption for <strong>MOL</strong> sharesTranche A**Option for <strong>MOL</strong> sharesTranche B***Subject of transactionCall <strong>and</strong> put option to<strong>MOL</strong> sharesCall option to <strong>MOL</strong>sharesTransactionvalue /volumeMaturity dateResult notsettled *Total effecton profitHUF millionExpectedeffect onCash flow5,220,000 pc. 19.03.2010 48,210 48,210 (43,805)7,677,285 pc. 23.01.2014 (3,745) (3,745) 0Share swap **** <strong>MOL</strong> share swap 5,010,501 pc. 11.07.2012 496 496 0Liability from SwapAgreement *****FX transactionsCommodity transactionsNon-hedge derivativetransactionsTotal derivativetransactionsExchange ratehedgingCommodity price riskhedge- 2016 (12,276) (12,276) 037,739,019EUR-January 2010 -September 2010January 2010 –June 2010520 520 52048 48 48- - 33,253 33,253 (43,237)- - 33,253 33,253 (43,237)* The column presents changes of fair valuation difference.** The put option of the option agreement signed on 14 March 2008 with ING Bank N.V. (“ING”) regarding1,404,217 Series “A” Ordinary shares was cash-settled on 19 March 2009, based on the strike price of USD107.90586. On 16 March 2009 <strong>MOL</strong> <strong>and</strong> ING signed a share purchase <strong>and</strong> a share option agreement. As a resultof the transactions on 19 March 2009 ING Bank N.V. became the owner of 5,220,000 “A” series <strong>MOL</strong> ordinaryshares <strong>and</strong> ING received a European put option from <strong>MOL</strong> <strong>and</strong> <strong>MOL</strong> received an American call option from INGfor these shares. The maturity is 1 year <strong>and</strong> the strike price is EUR 30.9841 per share for both options.*** The share purchase agreement as part of <strong>MOL</strong>-CEZ strategic alliance was financially closed <strong>and</strong> settled on 23January 2008. <strong>MOL</strong> sold 7,677,285 pieces of „A” series <strong>MOL</strong> shares to CEZ. <strong>MOL</strong> has an American call optionfor the shares with a strike price of HUF 20,000 per share which can be exercised within 3 years. In 2009 theparties amended the agreement <strong>and</strong> the option period was prolonged until 2014.**** On 16 April 2009 <strong>MOL</strong> <strong>and</strong> OTP entered into share-exchange <strong>and</strong> share swap agreements. Under theagreements <strong>MOL</strong> transferred 5,010,501 “A” series <strong>MOL</strong> ordinary shares to OTP on return for 24,000,000 OTPordinary shares. The expiration of the share swap agreement is 11 July 2012 until that time each party can initiatea cash or physical settlement of the deal.***** On 13 March 2006, <strong>MOL</strong> signed a share purchase agreement to sell 6,007,479 Series “A” Ordinary Sharesto Magnolia Finance <strong>Limited</strong> (“Magnolia”). Magnolia announced the sale of up to EUR 610 million of perpetualexchangeable capital securities, exchangeable into the Series “A” Ordinary Shares of <strong>MOL</strong> during the exchangeperiod to international financial investors. <strong>MOL</strong>, concurrently with the sale of ordinary shares, entered into a swapagreement in principle with Magnolia that gave <strong>MOL</strong> a call option to buy back the Series “A” Ordinary Shares of<strong>MOL</strong>. Present value of expected cash flow effect in the table above, is equal with the fair value of liability at thebalance sheet date.93