Annual Report 30 June 2007 - One Horizon Group

Annual Report 30 June 2007 - One Horizon Group

Annual Report 30 June 2007 - One Horizon Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

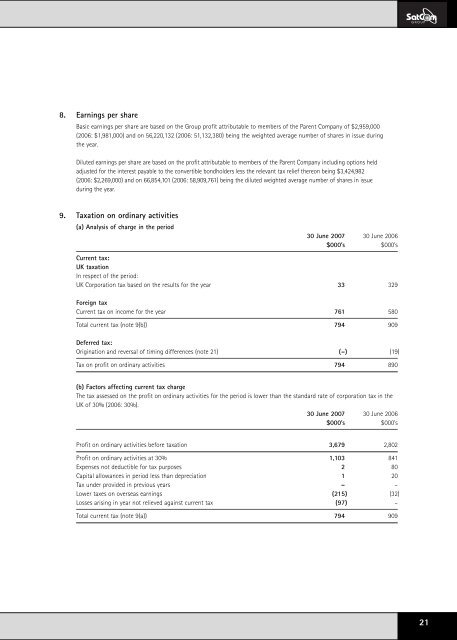

8. Earnings per share<br />

Basic earnings per share are based on the <strong>Group</strong> profit attributable to members of the Parent Company of $2,959,000<br />

(2006: $1,981,000) and on 56,220,132 (2006: 51,132,380) being the weighted average number of shares in issue during<br />

the year.<br />

Diluted earnings per share are based on the profit attributable to members of the Parent Company including options held<br />

adjusted for the interest payable to the convertible bondholders less the relevant tax relief thereon being $3,424,982<br />

(2006: $2,269,000) and on 66,854,101 (2006: 58,909,761) being the diluted weighted average number of shares in issue<br />

during the year.<br />

9. Taxation on ordinary activities<br />

(a) Analysis of charge in the period<br />

<strong>30</strong> <strong>June</strong> <strong>2007</strong> <strong>30</strong> <strong>June</strong> 2006<br />

$000’s $000’s<br />

Current tax:<br />

UK taxation<br />

In respect of the period:<br />

UK Corporation tax based on the results for the year 33 329<br />

Foreign tax<br />

Current tax on income for the year 761 580<br />

Total current tax (note 9(b)) 794 909<br />

Deferred tax:<br />

Origination and reversal of timing differences (note 21) (–) (19)<br />

Tax on profit on ordinary activities 794 890<br />

(b) Factors affecting current tax charge<br />

The tax assessed on the profit on ordinary activities for the period is lower than the standard rate of corporation tax in the<br />

UK of <strong>30</strong>% (2006: <strong>30</strong>%).<br />

<strong>30</strong> <strong>June</strong> <strong>2007</strong> <strong>30</strong> <strong>June</strong> 2006<br />

$000’s $000’s<br />

Profit on ordinary activities before taxation 3,679 2,802<br />

Profit on ordinary activities at <strong>30</strong>% 1,103 841<br />

Expenses not deductible for tax purposes 2 80<br />

Capital allowances in period less than depreciation 1 20<br />

Tax under provided in previous years – –<br />

Lower taxes on overseas earnings (215) (32)<br />

Losses arising in year not relieved against current tax (97) –<br />

Total current tax (note 9(a)) 794 909<br />

21