Annual Report 30 June 2007 - One Horizon Group

Annual Report 30 June 2007 - One Horizon Group

Annual Report 30 June 2007 - One Horizon Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>30</strong><br />

NOTES TO THE FINANCIAL STATEMENTS (continued)<br />

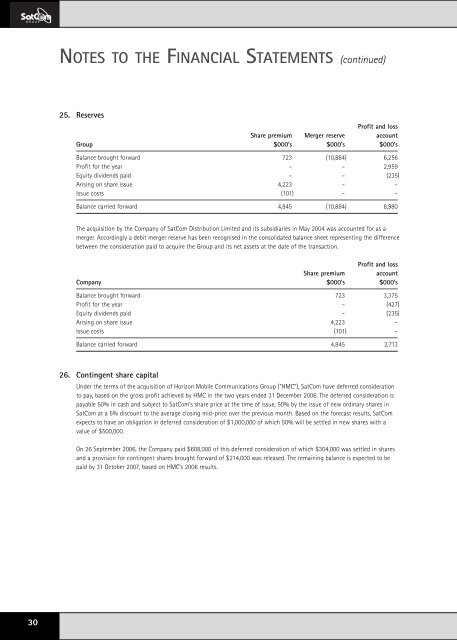

25. Reserves<br />

Profit and loss<br />

Share premium Merger reserve account<br />

<strong>Group</strong> $000’s $000’s $000’s<br />

Balance brought forward 723 (10,884) 6,256<br />

Profit for the year – – 2,959<br />

Equity dividends paid – – (235)<br />

Arising on share issue 4,223 – –<br />

Issue costs (101) – –<br />

Balance carried forward 4,845 (10,884) 8,980<br />

The acquisition by the Company of SatCom Distribution Limited and its subsidiaries in May 2004 was accounted for as a<br />

merger. Accordingly a debit merger reserve has been recognised in the consolidated balance sheet representing the difference<br />

between the consideration paid to acquire the <strong>Group</strong> and its net assets at the date of the transaction.<br />

Profit and loss<br />

Share premium account<br />

Company $000’s $000’s<br />

Balance brought forward 723 3,375<br />

Profit for the year – (427)<br />

Equity dividends paid – (235)<br />

Arising on share issue 4,223 –<br />

Issue costs (101) –<br />

Balance carried forward 4,845 2,713<br />

26. Contingent share capital<br />

Under the terms of the acquisition of <strong>Horizon</strong> Mobile Communications <strong>Group</strong> (“HMC”), SatCom have deferred consideration<br />

to pay, based on the gross profit achieved by HMC in the two years ended 31 December 2006. The deferred consideration is<br />

payable 50% in cash and subject to SatCom’s share price at the time of issue, 50% by the issue of new ordinary shares in<br />

SatCom at a 5% discount to the average closing mid-price over the previous month. Based on the forecast results, SatCom<br />

expects to have an obligation in deferred consideration of $1,000,000 of which 50% will be settled in new shares with a<br />

value of $500,000.<br />

On 26 September 2006, the Company paid $608,000 of this deferred consideration of which $<strong>30</strong>4,000 was settled in shares<br />

and a provision for contingent shares brought forward of $214,000 was released. The remaining balance is expected to be<br />

paid by 31 October <strong>2007</strong>, based on HMC’s 2006 results.