Annual Report 30 June 2007 - One Horizon Group

Annual Report 30 June 2007 - One Horizon Group

Annual Report 30 June 2007 - One Horizon Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

32<br />

NOTES TO THE FINANCIAL STATEMENTS (continued)<br />

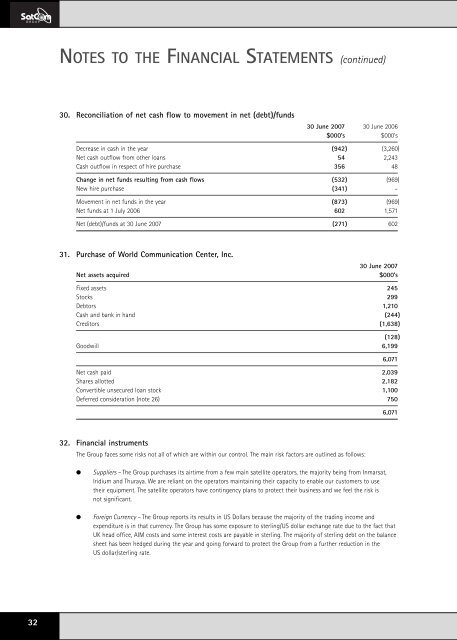

<strong>30</strong>. Reconciliation of net cash flow to movement in net (debt)/funds<br />

<strong>30</strong> <strong>June</strong> <strong>2007</strong> <strong>30</strong> <strong>June</strong> 2006<br />

$000’s $000’s<br />

Decrease in cash in the year (942) (3,260)<br />

Net cash outflow from other loans 54 2,243<br />

Cash outflow in respect of hire purchase 356 48<br />

Change in net funds resulting from cash flows (532) (969)<br />

New hire purchase (341) –<br />

Movement in net funds in the year (873) (969)<br />

Net funds at 1 July 2006 602 1,571<br />

Net (debt)/funds at <strong>30</strong> <strong>June</strong> <strong>2007</strong> (271) 602<br />

31. Purchase of World Communication Center, Inc.<br />

<strong>30</strong> <strong>June</strong> <strong>2007</strong><br />

Net assets acquired $000’s<br />

Fixed assets 245<br />

Stocks 299<br />

Debtors 1,210<br />

Cash and bank in hand (244)<br />

Creditors (1,638)<br />

(128)<br />

Goodwill 6,199<br />

Net cash paid 2,039<br />

Shares allotted 2,182<br />

Convertible unsecured loan stock 1,100<br />

Deferred consideration (note 26) 750<br />

32. Financial instruments<br />

The <strong>Group</strong> faces some risks not all of which are within our control. The main risk factors are outlined as follows:<br />

● Suppliers – The <strong>Group</strong> purchases its airtime from a few main satellite operators, the majority being from Inmarsat,<br />

Iridium and Thuraya. We are reliant on the operators maintaining their capacity to enable our customers to use<br />

their equipment. The satellite operators have contingency plans to protect their business and we feel the risk is<br />

not significant.<br />

● Foreign Currency – The <strong>Group</strong> reports its results in US Dollars because the majority of the trading income and<br />

expenditure is in that currency. The <strong>Group</strong> has some exposure to sterling/US dollar exchange rate due to the fact that<br />

UK head office, AIM costs and some interest costs are payable in sterling. The majority of sterling debt on the balance<br />

sheet has been hedged during the year and going forward to protect the <strong>Group</strong> from a further reduction in the<br />

US dollar/sterling rate.<br />

6,071<br />

6,071