Annual Report 30 June 2007 - One Horizon Group

Annual Report 30 June 2007 - One Horizon Group

Annual Report 30 June 2007 - One Horizon Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

26<br />

NOTES TO THE FINANCIAL STATEMENTS (continued)<br />

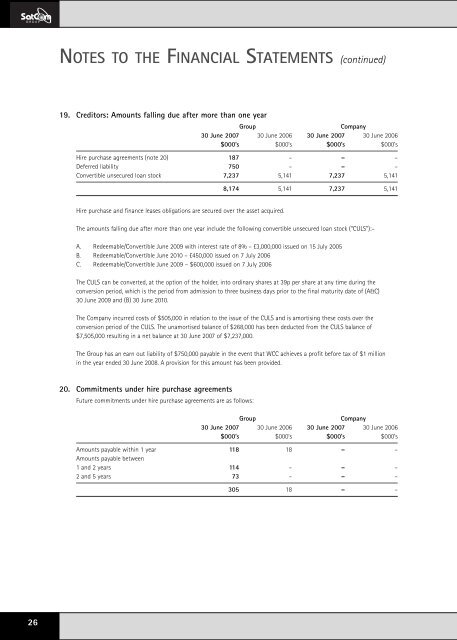

19. Creditors: Amounts falling due after more than one year<br />

<strong>Group</strong> Company<br />

<strong>30</strong> <strong>June</strong> <strong>2007</strong> <strong>30</strong> <strong>June</strong> 2006 <strong>30</strong> <strong>June</strong> <strong>2007</strong> <strong>30</strong> <strong>June</strong> 2006<br />

$000’s $000’s $000’s $000’s<br />

Hire purchase agreements (note 20) 187 – – –<br />

Deferred liability 750 – – –<br />

Convertible unsecured loan stock 7,237 5,141 7,237 5,141<br />

Hire purchase and finance leases obligations are secured over the asset acquired.<br />

8,174 5,141 7,237 5,141<br />

The amounts falling due after more than one year include the following convertible unsecured loan stock (“CULS”):–<br />

A. Redeemable/Convertible <strong>June</strong> 2009 with interest rate of 8% – £3,000,000 issued on 15 July 2005<br />

B. Redeemable/Convertible <strong>June</strong> 2010 – £450,000 issued on 7 July 2006<br />

C. Redeemable/Convertible <strong>June</strong> 2009 – $600,000 issued on 7 July 2006<br />

The CULS can be converted, at the option of the holder, into ordinary shares at 39p per share at any time during the<br />

conversion period, which is the period from admission to three business days prior to the final maturity date of (A&C)<br />

<strong>30</strong> <strong>June</strong> 2009 and (B) <strong>30</strong> <strong>June</strong> 2010.<br />

The Company incurred costs of $505,000 in relation to the issue of the CULS and is amortising these costs over the<br />

conversion period of the CULS. The unamortised balance of $268,000 has been deducted from the CULS balance of<br />

$7,505,000 resulting in a net balance at <strong>30</strong> <strong>June</strong> <strong>2007</strong> of $7,237,000.<br />

The <strong>Group</strong> has an earn out liability of $750,000 payable in the event that WCC achieves a profit before tax of $1 million<br />

in the year ended <strong>30</strong> <strong>June</strong> 2008. A provision for this amount has been provided.<br />

20. Commitments under hire purchase agreements<br />

Future commitments under hire purchase agreements are as follows:<br />

<strong>Group</strong> Company<br />

<strong>30</strong> <strong>June</strong> <strong>2007</strong> <strong>30</strong> <strong>June</strong> 2006 <strong>30</strong> <strong>June</strong> <strong>2007</strong> <strong>30</strong> <strong>June</strong> 2006<br />

$000’s $000’s $000’s $000’s<br />

Amounts payable within 1 year 118 18 – –<br />

Amounts payable between<br />

1 and 2 years 114 – – –<br />

2 and 5 years 73 – – –<br />

<strong>30</strong>5 18 – –