New York State and Local Sales and Use Tax Return for ... - FormSend

New York State and Local Sales and Use Tax Return for ... - FormSend

New York State and Local Sales and Use Tax Return for ... - FormSend

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

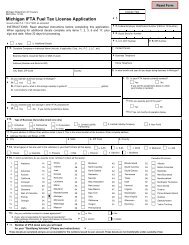

12345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789012Page 4 of 4 ST-810 (11/02) 0903 QuarterlyStep 6 of 9 Calculate taxes dueAdd <strong>Sales</strong> <strong>and</strong> use tax column total (box 15) to Total specialtaxes (box 16) <strong>and</strong> subtract Total tax credits <strong>and</strong> advancepayments (box 17).<strong>Tax</strong>es dueBox 15 Box 16 Box 17amount $ + amount $ amount $ = 18Step 7 of 9 Calculate vendor collection creditor pay penalty <strong>and</strong> interest7AIf you are not required to file any schedules,start at the asterisk (*) in 7B.Schedule B, Part 4, box 4Schedule B, Part 4, box 6 +Schedule B-ATT +Schedule H +Schedule N +Schedule Q +Schedule T-ATT +Total adjustment =7BYou are eligible <strong>for</strong> vendor collection credit ONLY if you file byDecember 20, 2002, <strong>and</strong> you pay the full amount due with the return.If you are not eligible, enter “0” in box 19 <strong>and</strong> go to 7D.Schedule FR, Part 3, box 7Form ST-810, page 3, box 13* +Total adjustment from 7A -Form ST-810, page 3, box 9 -Form ST-810, page 3, box 9a -Eligible sales amount (move to 7C) =12345678901234567890123456789012123456789012345678901234567890127COR7DEligible sales amount from 7B above <strong>State</strong> tax rate Credit rate$ x 4% = (subtotal a) $Schedule B, Part 4, box 6 from 7A above$ x 1% = (subtotal b) $12345678901234567890123456789012Vendor collection creditVE 770219(add subtotals a <strong>and</strong> b) $ x 3½% = $ **** In box 19, enter the amount calculated, but not more than $150Pay penalty <strong>and</strong> interest if you are filing latePenalty <strong>and</strong> interest20Call 1 800 972-1233 or access our Web site at www.tax.state.ny.us/salespi/salespi.asp <strong>for</strong> an estimate of the penalty <strong>and</strong>interest due on the amount shown in box 18, <strong>Tax</strong>es due. Enter this amount in box 20.Step 8 of 9 Calculate total amount dueMake check or money order payable to <strong>New</strong> <strong>York</strong> <strong>State</strong> <strong>Sales</strong> <strong>Tax</strong>.Write on your check your sales tax ID#, ST-810, <strong>and</strong> 11/30/02.Total amount dueFinal calculation:Taking vendor collection credit? Subtract box 19 from box 18.Paying penalty <strong>and</strong> interest? Add box 20 to box 18.Step 9 of 9 Sign <strong>and</strong> mail this returnPlease be sure to keep a completed copy <strong>for</strong> your records.Must be postmarked by Friday, December 20, 2002, to be consideredfiled on time. See below <strong>for</strong> complete mailing in<strong>for</strong>mation.Printed name of taxpayerSignature of taxpayerPrinted name of preparer, if other than taxpayerPreparer’s addressSignature of preparer, if other than taxpayerDateTitleDaytime telephone ( )Daytime telephone ( )Where to mailyour return <strong>and</strong>attachmentsIf using a private deliveryservice rather than the U.S.Postal Service, see ininstructions <strong>for</strong>the correct address.Do you participate in the <strong>New</strong> Jersey/<strong>New</strong> <strong>York</strong> or theConnecticut/<strong>New</strong> <strong>York</strong> Reciprocal <strong>Tax</strong> Agreement?NoAddress envelope to:NYS SALES TAX PROCESSINGJAF BUILDINGPO BOX 1208NEW YORK NY 10116-1208Address envelope to:NYS SALES TAX PROCESSINGRECIPROCAL TAX AGREEMENTJAF BUILDINGPO BOX 1209NEW YORK NY 10116-1209If you are enrolled in the Promp<strong>Tax</strong> program, please use the preaddressed envelope provided.Need help?Internet access: www.tax.state.ny.usTelephone assistance is available from 8 a.m. to 5:55 p.m.(eastern time), Monday through Friday.Business tax in<strong>for</strong>mation: 1 800 972-1233Forms <strong>and</strong> publications: 1 800 462-8100From areas outside the U.S. <strong>and</strong> outside Canada: (518) 485-6800Fax-on-dem<strong>and</strong> <strong>for</strong>ms: 1 800 748-3676Hearing <strong>and</strong> speech impaired (telecommunications device <strong>for</strong> the deafPersons with disabilities: In compliance with the Americans withDisabilities Act, we will ensure that our lobbies, offices, meetingrooms, <strong>and</strong> other facilities are accessible to persons with disabilities. Ifyou have questions about special accommodations <strong>for</strong> persons withdisabilities, please call 1 800 225-5829.(TDD) callers only): 1 800 634-2110 (8 a.m. to 5:55 p.m., eastern time).Refer to the instructions (Form ST-810-I) if you have questions or need further help.Yes<strong>New</strong> <strong>York</strong> <strong>State</strong> <strong>Sales</strong> <strong>Tax</strong>One Thous<strong>and</strong> <strong>and</strong> 00/10000-0000000 ST-810 11/30/02Don’t <strong>for</strong>get to write your sales tax ID#,ST-810, <strong>and</strong> 11/30/02.December 10, 2002$1000Don’t <strong>for</strong>get tosign your checkIf you need to write, address your letter to: NYS <strong>Tax</strong> Department,<strong>Tax</strong>payer Contact Center, W A Harriman Campus, Albany NY 12227.