Download - CIC Insurance Group Limited

Download - CIC Insurance Group Limited

Download - CIC Insurance Group Limited

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

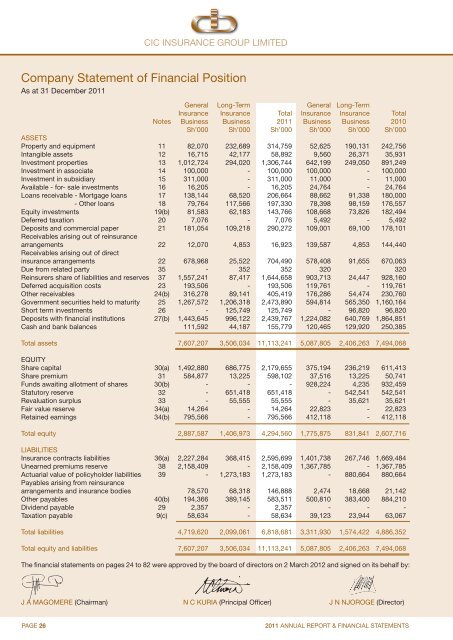

<strong>CIC</strong> INSURANCE GROUP LIMITEDCompany Statement of Financial PositionAs at 31 December 2011General Long-Term General Long-Term<strong>Insurance</strong> <strong>Insurance</strong> Total <strong>Insurance</strong> <strong>Insurance</strong> TotalNotes Business Business 2011 Business Business 2010Sh’000 Sh’000 Sh’000 Sh’000 Sh’000 Sh’000ASSETSProperty and equipment 11 82,070 232,689 314,759 52,625 190,131 242,756Intangible assets 12 16,715 42,177 58,892 9,560 26,371 35,931Investment properties 13 1,012,724 294,020 1,306,744 642,199 249,050 891,249Investment in associate 14 100,000 - 100,000 100,000 - 100,000Investment in subsidiary 15 311,000 - 311,000 11,000 - 11,000Available - for- sale investments 16 16,205 - 16,205 24,764 - 24,764Loans receivable - Mortgage loans 17 138,144 68,520 206,664 88,662 91,338 180,000- Other loans 18 79,764 117,566 197,330 78,398 98,159 176,557Equity investments 19(b) 81,583 62,183 143,766 108,668 73,826 182,494Deferred taxation 20 7,076 - 7,076 5,492 - 5,492Deposits and commercial paper 21 181,054 109,218 290,272 109,001 69,100 178,101Receivables arising out of reinsurancearrangements 22 12,070 4,853 16,923 139,587 4,853 144,440Receivables arising out of directinsurance arrangements 22 678,968 25,522 704,490 578,408 91,655 670,063Due from related party 35 - 352 352 320 - 320Reinsurers share of liabilities and reserves 37 1,557,241 87,417 1,644,658 903,713 24,447 928,160Deferred acquisition costs 23 193,506 - 193,506 119,761 - 119,761Other receivables 24(b) 316,278 89,141 405,419 176,286 54,474 230,760Government securities held to maturity 25 1,267,572 1,206,318 2,473,890 594,814 565,350 1,160,164Short term investments 26 - 125,749 125,749 - 96,820 96,820Deposits with financial institutions 27(b) 1,443,645 996,122 2,439,767 1,224,082 640,769 1,864,851Cash and bank balances 111,592 44,187 155,779 120,465 129,920 250,385Total assets 7,607,207 3,506,034 11,113,241 5,087,805 2,406,263 7,494,068EQUITYShare capital 30(a) 1,492,880 686,775 2,179,655 375,194 236,219 611,413Share premium 31 584,877 13,225 598,102 37,516 13,225 50,741Funds awaiting allotment of shares 30(b) - - - 928,224 4,235 932,459Statutory reserve 32 - 651,418 651,418 - 542,541 542,541Revaluation surplus 33 - 55,555 55,555 - 35,621 35,621Fair value reserve 34(a) 14,264 - 14,264 22,823 - 22,823Retained earnings 34(b) 795,566 - 795,566 412,118 - 412,118Total equity 2,887,587 1,406,973 4,294,560 1,775,875 831,841 2,607,716LIABILITIES<strong>Insurance</strong> contracts liabilities 36(a) 2,227,284 368,415 2,595,699 1,401,738 267,746 1,669,484Unearned premiums reserve 38 2,158,409 - 2,158,409 1,367,785 - 1,367,785Actuarial value of policyholder liabilities 39 - 1,273,183 1,273,183 - 880,664 880,664Payables arising from reinsurancearrangements and insurance bodies 78,570 68,318 146,888 2,474 18,668 21,142Other payables 40(b) 194,366 389,145 583,511 500,810 383,400 884,210Dividend payable 29 2,357 - 2,357 - - -Taxation payable 9(c) 58,634 - 58,634 39,123 23,944 63,067Total liabilities 4,719,620 2,099,061 6,818,681 3,311,930 1,574,422 4,886,352Total equity and liabilities 7,607,207 3,506,034 11,113,241 5,087,805 2,406,263 7,494,068The financial statements on pages 24 to 82 were approved by the board of directors on 2 March 2012 and signed on its behalf by:J A MAGOMERE (Chairman) N C KURIA (Principal Officer) J N NJOROGE (Director)PAGE 262011 ANNUAL REPORT & FINANCIAL STATEMENTS