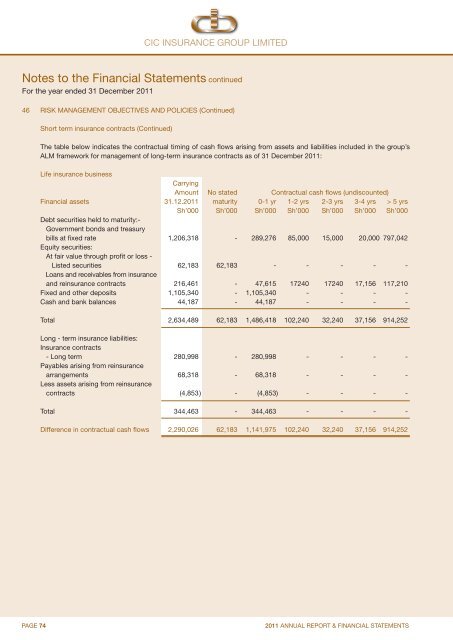

<strong>CIC</strong> INSURANCE GROUP LIMITEDNotes to the Financial Statements continuedFor the year ended 31 December 201146 RISK MANAGEMENT OBJECTIVES AND POLICIES (Continued)Short term insurance contracts (Continued)The table below indicates the contractual timing of cash flows arising from assets and liabilities included in the group’sALM framework for management of long-term insurance contracts as of 31 December 2011:Life insurance businessCarryingAmount No stated Contractual cash flows (undiscounted)Financial assets 31.12.2011 maturity 0-1 yr 1-2 yrs 2-3 yrs 3-4 yrs > 5 yrsSh’000 Sh’000 Sh’000 Sh’000 Sh’000 Sh’000 Sh’000Debt securities held to maturity:-Government bonds and treasurybills at fixed rate 1,206,318 - 289,276 85,000 15,000 20,000 797,042Equity securities:At fair value through profit or loss -Listed securities 62,183 62,183 - - - - -Loans and receivables from insuranceand reinsurance contracts 216,461 - 47,615 17240 17240 17,156 117,210Fixed and other deposits 1,105,340 - 1,105,340 - - - -Cash and bank balances 44,187 - 44,187 - - - -Total 2,634,489 62,183 1,486,418 102,240 32,240 37,156 914,252Long - term insurance liabilities:<strong>Insurance</strong> contracts- Long term 280,998 - 280,998 - - - -Payables arising from reinsurancearrangements 68,318 - 68,318 - - - -Less assets arising from reinsurancecontracts (4,853) - (4,853) - - - -Total 344,463 - 344,463 - - - -Difference in contractual cash flows 2,290,026 62,183 1,141,975 102,240 32,240 37,156 914,252PAGE 742011 ANNUAL REPORT & FINANCIAL STATEMENTS

<strong>CIC</strong> INSURANCE GROUP LIMITEDNotes to the Financial Statements continuedFor the year ended 31 December 201146 RISK MANAGEMENT OBJECTIVES AND POLICIES (Continued)Short term insurance contracts (Continued)The table below indicates the contractual timing of cash flows arising from assets and liabilities included in the group’sALM framework for management of long-term insurance contracts as of 31 December 2010:Life insurance businessCarryingAmount No stated Contractual cash flows (undiscounted)Financial assets 31.12.2010 maturity 0-1 yr 1-2 yrs 2-3 yrs 3-4 yrs > 5 yrsSh’000 Sh’000 Sh’000 Sh’000 Sh’000 Sh’000 Sh’000Debt securities held to maturity: -Government bonds and treasurybills at fixed rate 565,350 - 50,841 19,000 33,609 15,000 446,900Equity securities:At fair value through profit or loss -listed securities 73,826 73,826 - - - - -Loans and receivables from insuranceand reinsurance contracts 286,005 - 96,508 400 - - 189,097Fixed and other deposits 709,869 - 709,869 - - - -Cash and bank balances 129,920 - 129,920 - - - -Total 1,764,970 73,826 987,138 19,400 33,609 15,000 635,997Long- term insurance liabilities:<strong>Insurance</strong> contracts-Long term 243,299 - 243,299 - - - -Payables arising from reinsurancearrangements 18,668 - 18,668 - - - -Less assets arising from reinsurancecontracts (4,853) - (4,853) - - - -Total 257,114 - 257,114 - - - -Difference in contractual cash flows 1,507,856 73,826 730,024 19,400 33,609 15,000 635,997Financial riskThe group is exposed to a range of financial risks through its financial assets, financial liabilities, reinsurance assets andinsurance liabilities. In particular, the key financial risk is that the proceeds from its financial assets are not sufficient tofund the obligations arising from insurance policies as they fall due. The most important components of this financial riskare market risk (including interest rate risk, equity price risk and currency risk), credit risk and liquidity risk.These risks arise from open positions in interest rate, currency and equity products, all of which are exposed to generaland specific market movements. The risks that the group primarily faces due to the nature of its investments and liabilitiesare interest rate risk and equity price risk.2011 ANNUAL REPORT & FINANCIAL STATEMENTS PAGE 75