Download - CIC Insurance Group Limited

Download - CIC Insurance Group Limited

Download - CIC Insurance Group Limited

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

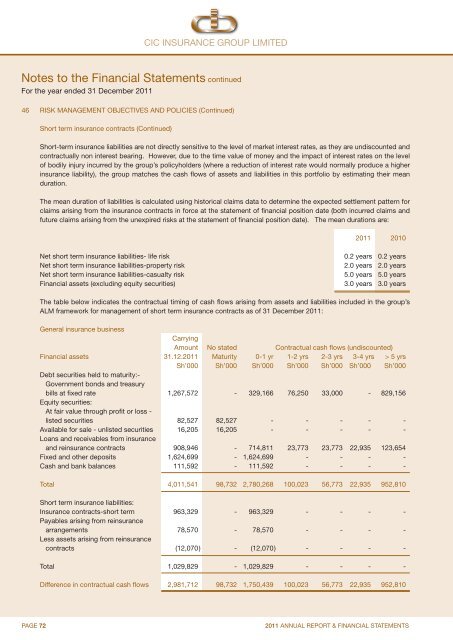

<strong>CIC</strong> INSURANCE GROUP LIMITEDNotes to the Financial Statements continuedFor the year ended 31 December 201146 RISK MANAGEMENT OBJECTIVES AND POLICIES (Continued)Short term insurance contracts (Continued)Short-term insurance liabilities are not directly sensitive to the level of market interest rates, as they are undiscounted andcontractually non interest bearing. However, due to the time value of money and the impact of interest rates on the levelof bodily injury incurred by the group’s policyholders (where a reduction of interest rate would normally produce a higherinsurance liability), the group matches the cash flows of assets and liabilities in this portfolio by estimating their meanduration.The mean duration of liabilities is calculated using historical claims data to determine the expected settlement pattern forclaims arising from the insurance contracts in force at the statement of financial position date (both incurred claims andfuture claims arising from the unexpired risks at the statement of financial position date). The mean durations are:2011 2010Net short term insurance liabilities- life riskNet short term insurance liabilities-property riskNet short term insurance liabilities-casualty riskFinancial assets (excluding equity securities)0.2 years 0.2 years2.0 years 2.0 years5.0 years 5.0 years3.0 years 3.0 yearsThe table below indicates the contractual timing of cash flows arising from assets and liabilities included in the group’sALM framework for management of short term insurance contracts as of 31 December 2011:General insurance businessCarryingAmount No stated Contractual cash flows (undiscounted)Financial assets 31.12.2011 Maturity 0-1 yr 1-2 yrs 2-3 yrs 3-4 yr s > 5 yrsSh’000 Sh’000 Sh’000 Sh’000 Sh’000 Sh’000 Sh’000Debt securities held to maturity:-Government bonds and treasurybills at fixed rate 1,267,572 - 329,166 76,250 33,000 - 829,156Equity securities:At fair value through profit or loss -listed securities 82,527 82,527 - - - - -Available for sale - unlisted securities 16,205 16,205 - - - - -Loans and receivables from insuranceand reinsurance contracts 908,946 - 714,811 23,773 23,773 22,935 123,654Fixed and other deposits 1,624,699 - 1,624,699 - - - -Cash and bank balances 111,592 - 111,592 - - - -Total 4,011,541 98,732 2,780,268 100,023 56,773 22,935 952,810Short term insurance liabilities:<strong>Insurance</strong> contracts-short term 963,329 - 963,329 - - - -Payables arising from reinsurancearrangements 78,570 - 78,570 - - - -Less assets arising from reinsurancecontracts (12,070) - (12,070) - - - -Total 1,029,829 - 1,029,829 - - - -Difference in contractual cash flows 2,981,712 98,732 1,750,439 100,023 56,773 22,935 952,810PAGE 722011 ANNUAL REPORT & FINANCIAL STATEMENTS