Download - CIC Insurance Group Limited

Download - CIC Insurance Group Limited

Download - CIC Insurance Group Limited

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

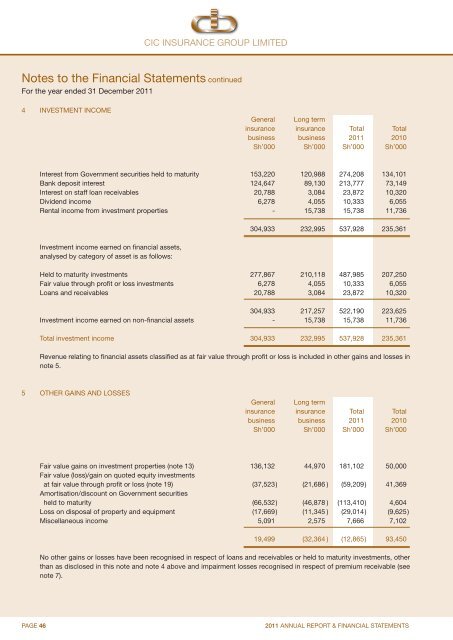

<strong>CIC</strong> INSURANCE GROUP LIMITEDNotes to the Financial Statements continuedFor the year ended 31 December 20114 INVESTMENT INCOMEGeneral Long terminsurance insurance Total Totalbusiness business 2011 2010Sh’000 Sh’000 Sh’000 Sh’000Interest from Government securities held to maturity 153,220 120,988 274,208 134,101Bank deposit interest 124,647 89,130 213,777 73,149Interest on staff loan receivables 20,788 3,084 23,872 10,320Dividend income 6,278 4,055 10,333 6,055Rental income from investment properties - 15,738 15,738 11,736Investment income earned on financial assets,analysed by category of asset is as follows:304,933 232,995 537,928 235,361Held to maturity investments 277,867 210,118 487,985 207,250Fair value through profit or loss investments 6,278 4,055 10,333 6,055Loans and receivables 20,788 3,084 23,872 10,320304,933 217,257 522,190 223,625Investment income earned on non-financial assets - 15,738 15,738 11,736Total investment income 304,933 232,995 537,928 235,361Revenue relating to financial assets classified as at fair value through profit or loss is included in other gains and losses innote 5.5 OTHER GAINS AND LOSSESGeneral Long terminsurance insurance Total Totalbusiness business 2011 2010Sh’000 Sh’000 Sh’000 Sh’000Fair value gains on investment properties (note 13) 136,132 44,970 181,102 50,000Fair value (loss)/gain on quoted equity investmentsat fair value through profit or loss (note 19) (37,523) (21,686 ) (59,209) 41,369Amortisation/discount on Government securitiesheld to maturity (66,532) (46,878 ) (113,410) 4,604Loss on disposal of property and equipment (17,669) (11,345 ) (29,014) (9,625)Miscellaneous income 5,091 2,575 7,666 7,10219,499 (32,364 ) (12,865 ) 93,450No other gains or losses have been recognised in respect of loans and receivables or held to maturity investments, otherthan as disclosed in this note and note 4 above and impairment losses recognised in respect of premium receivable (seenote 7).PAGE 462011 ANNUAL REPORT & FINANCIAL STATEMENTS