Financial Statements - Hemas Holdings, Ltd

Financial Statements - Hemas Holdings, Ltd

Financial Statements - Hemas Holdings, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

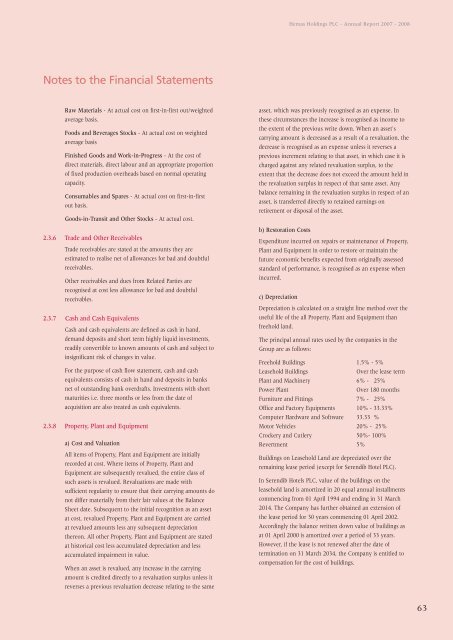

<strong>Hemas</strong> <strong>Holdings</strong> PLC - Annual Report 2007 - 2008Notes to the <strong>Financial</strong> <strong>Statements</strong>Raw Materials - At actual cost on first-in-first out/weightedaverage basis.Foods and Beverages Stocks - At actual cost on weightedaverage basisFinished Goods and Work-in-Progress - At the cost ofdirect materials, direct labour and an appropriate proportionof fixed production overheads based on normal operatingcapacity.Consumables and Spares - At actual cost on first-in-firstout basis.Goods-in-Transit and Other Stocks - At actual cost.2.3.6 Trade and Other ReceivablesTrade receivables are stated at the amounts they areestimated to realise net of allowances for bad and doubtfulreceivables.Other receivables and dues from Related Parties arerecognised at cost less allowance for bad and doubtfulreceivables.2.3.7 Cash and Cash EquivalentsCash and cash equivalents are defined as cash in hand,demand deposits and short term highly liquid investments,readily convertible to known amounts of cash and subject toinsignificant risk of changes in value.For the purpose of cash flow statement, cash and cashequivalents consists of cash in hand and deposits in banksnet of outstanding bank overdrafts. Investments with shortmaturities i.e. three months or less from the date ofacquisition are also treated as cash equivalents.2.3.8 Property, Plant and Equipmenta) Cost and ValuationAll items of Property, Plant and Equipment are initiallyrecorded at cost. Where items of Property, Plant andEquipment are subsequently revalued, the entire class ofsuch assets is revalued. Revaluations are made withsufficient regularity to ensure that their carrying amounts donot differ materially from their fair values at the BalanceSheet date. Subsequent to the initial recognition as an assetat cost, revalued Property, Plant and Equipment are carriedat revalued amounts less any subsequent depreciationthereon. All other Property, Plant and Equipment are statedat historical cost less accumulated depreciation and lessaccumulated impairment in value.When an asset is revalued, any increase in the carryingamount is credited directly to a revaluation surplus unless itreverses a previous revaluation decrease relating to the sameasset, which was previously recognised as an expense. Inthese circumstances the increase is recognised as income tothe extent of the previous write down. When an asset'scarrying amount is decreased as a result of a revaluation, thedecrease is recognised as an expense unless it reverses aprevious increment relating to that asset, in which case it ischarged against any related revaluation surplus, to theextent that the decrease does not exceed the amount held inthe revaluation surplus in respect of that same asset. Anybalance remaining in the revaluation surplus in respect of anasset, is transferred directly to retained earnings onretirement or disposal of the asset.b) Restoration CostsExpenditure incurred on repairs or maintenance of Property,Plant and Equipment in order to restore or maintain thefuture economic benefits expected from originally assessedstandard of performance, is recognised as an expense whenincurred.c) DepreciationDepreciation is calculated on a straight line method over theuseful life of the all Property, Plant and Equipment thanfreehold land.The principal annual rates used by the companies in theGroup are as follows:Freehold Buildings 1.5% - 5%Leasehold BuildingsOver the lease termPlant and Machinery 6% - 25%Power PlantOver 180 monthsFurniture and Fittings 7% - 25%Office and Factory Equipments 10% - 33.33%Computer Hardware and Software 33.33 %Motor Vehicles 20% - 25%Crockery and Cutlery 50%- 100%Revertment 5%Buildings on Leasehold Land are depreciated over theremaining lease period (except for Serendib Hotel PLC).In Serendib Hotels PLC, value of the buildings on theleasehold land is amortized in 20 equal annual installmentscommencing from 01 April 1994 and ending in 31 March2014. The Company has further obtained an extension ofthe lease period for 30 years commencing 01 April 2002.Accordingly the balance written down value of buildings asat 01 April 2000 is amortized over a period of 33 years.However, if the lease is not renewed after the date oftermination on 31 March 2034, the Company is entitled tocompensation for the cost of buildings.63