Financial Statements - Hemas Holdings, Ltd

Financial Statements - Hemas Holdings, Ltd

Financial Statements - Hemas Holdings, Ltd

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

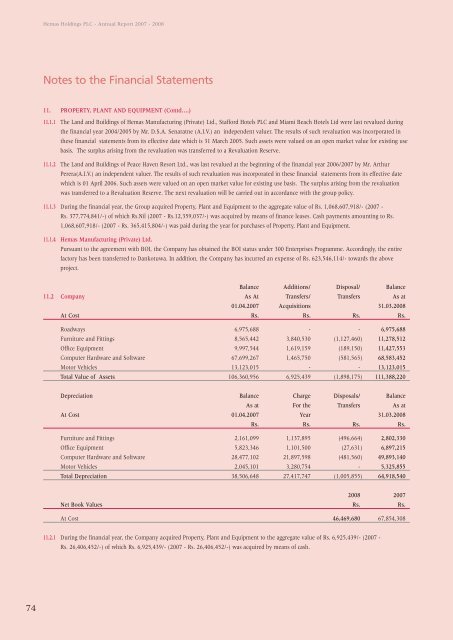

<strong>Hemas</strong> <strong>Holdings</strong> PLC - Annual Report 2007 - 2008Notes to the <strong>Financial</strong> <strong>Statements</strong>11. PROPERTY, PLANT AND EQUIPMENT (Contd….)11.1.1 The Land and Buildings of <strong>Hemas</strong> Manufacturing (Private) <strong>Ltd</strong>., Stafford Hotels PLC and Miami Beach Hotels <strong>Ltd</strong> were last revalued duringthe financial year 2004/2005 by Mr. D.S.A. Senaratne (A.I.V.) an independent valuer. The results of such revaluation was incorporated inthese financial statements from its effective date which is 31 March 2005. Such assets were valued on an open market value for existing usebasis. The surplus arising from the revaluation was transferred to a Revaluation Reserve.11.1.2 The Land and Buildings of Peace Haven Resort <strong>Ltd</strong>., was last revalued at the beginning of the financial year 2006/2007 by Mr. ArthurPerera(A.I.V.) an independent valuer. The results of such revaluation was incorporated in these financial statements from its effective datewhich is 01 April 2006. Such assets were valued on an open market value for existing use basis. The surplus arising from the revaluationwas transferred to a Revaluation Reserve. The next revaluation will be carried out in accordance with the group policy.11.1.3 During the financial year, the Group acquired Property, Plant and Equipment to the aggregate value of Rs. 1,068,607,918/- (2007 -Rs. 377,774,841/-) of which Rs.Nil (2007 - Rs.12,359,037/-) was acquired by means of finance leases. Cash payments amounting to Rs.1,068,607,918/- (2007 - Rs. 365,415,804/-) was paid during the year for purchases of Property, Plant and Equipment.11.1.4 <strong>Hemas</strong> Manufacturing (Private) <strong>Ltd</strong>.Pursuant to the agreement with BOI, the Company has obtained the BOI status under 300 Enterprises Programme. Accordingly, the entirefactory has been transferred to Dankotuwa. In addition, the Company has incurred an expense of Rs. 623,546,114/- towards the aboveproject.Balance Additions/ Disposal/ Balance11.2 Company As At Transfers/ Transfers As at01.04.2007 Acquisitions 31.03.2008At Cost Rs. Rs. Rs. Rs.Roadways 6,975,688 - - 6,975,688Furniture and Fittings 8,565,442 3,840,530 (1,127,460) 11,278,512Office Equipment 9,997,544 1,619,159 (189,150) 11,427,553Computer Hardware and Software 67,699,267 1,465,750 (581,565) 68,583,452Motor Vehicles 13,123,015 - - 13,123,015Total Value of Assets 106,360,956 6,925,439 (1,898,175) 111,388,220Depreciation Balance Charge Disposals/ BalanceAs at For the Transfers As atAt Cost 01.04.2007 Year 31.03.2008Rs. Rs. Rs. Rs.Furniture and Fittings 2,161,099 1,137,895 (496,664) 2,802,330Office Equipment 5,823,346 1,101,500 (27,631) 6,897,215Computer Hardware and Software 28,477,102 21,897,598 (481,560) 49,893,140Motor Vehicles 2,045,101 3,280,754 - 5,325,855Total Depreciation 38,506,648 27,417,747 (1,005,855) 64,918,5402008 2007Net Book Values Rs. Rs.At Cost 46,469,680 67,854,30811.2.1 During the financial year, the Company acquired Property, Plant and Equipment to the aggregate value of Rs. 6,925,439/- (2007 -Rs. 26,406,452/-) of which Rs. 6,925,439/- (2007 - Rs. 26,406,452/-) was acquired by means of cash.74