The Annual Report 2010-11 - Brigade Group

The Annual Report 2010-11 - Brigade Group

The Annual Report 2010-11 - Brigade Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

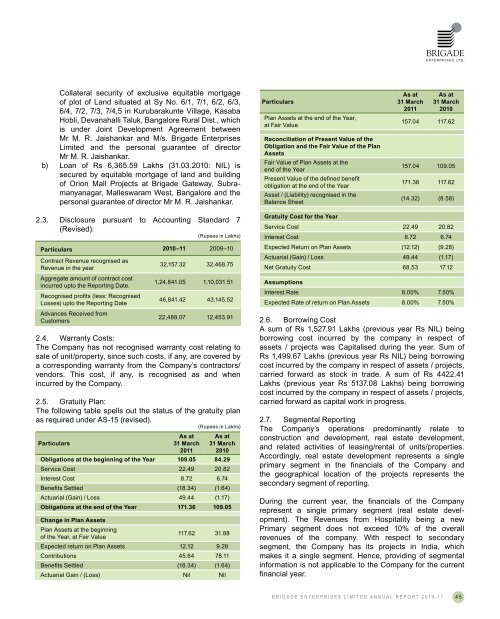

Collateral security of exclusive equitable mortgageof plot of Land situated at Sy No. 6/1, 7/1, 6/2, 6/3,6/4, 7/2, 7/3, 7/4,5 in Kurubarakunte Village, KasabaHobli, Devanahalli Taluk, Bangalore Rural Dist., whichis under Joint Development Agreement betweenMr M. R. Jaishankar and M/s. <strong>Brigade</strong> EnterprisesLimited and the personal guarantee of directorMr M. R. Jaishankar.b) Loan of Rs 6,365.59 Lakhs (31.03.<strong>2010</strong>: NIL) issecured by equitable mortgage of land and buildingof Orion Mall Projects at <strong>Brigade</strong> Gateway, Subramanyanagar,Malleswaram West, Bangalore and thepersonal guarantee of director Mr M. R. Jaishankar.ParticularsPlan Assets at the end of the Year,at Fair ValueReconciliation of Present Value of theObligation and the Fair Value of the PlanAssetsFair Value of Plan Assets at theend of the YearPresent Value of the defined benefitobligation at the end of the YearAsset / (Liability) recognised in theBalance SheetAs at31 March20<strong>11</strong>As at31 March<strong>2010</strong>157.04 <strong>11</strong>7.62157.04 109.05171.36 <strong>11</strong>7.62(14.32) (8.58)2.3. Disclosure pursuant to Accounting Standard 7(Revised):(Rupees in Lakhs)Particulars <strong>2010</strong>–<strong>11</strong> 2009–10Contract Revenue recognised asRevenue in the yearAggregate amount of contract costincurred upto the <strong>Report</strong>ing Date.Recognised profits (less: RecognisedLosses) upto the <strong>Report</strong>ing DateAdvances Received fromCustomers32,157.32 32,468.751,24,841.05 1,10,031.5146,841.42 43,145.5222,488.07 12,453.912.4. Warranty Costs:<strong>The</strong> Company has not recognised warranty cost relating tosale of unit/property, since such costs, if any, are covered bya corresponding warranty from the Company’s contractors/vendors. This cost, if any, is recognised as and whenincurred by the Company.2.5. Gratuity Plan:<strong>The</strong> following table spells out the status of the gratuity planas required under AS-15 (revised).(Rupees in Lakhs)ParticularsAs at31 March20<strong>11</strong>As at31 March<strong>2010</strong>Obligations at the beginning of the Year 109.05 84.29Service Cost 22.49 20.82Interest Cost 8.72 6.74Benefits Settled (18.34) (1.64)Actuarial (Gain) / Loss 49.44 (1.17)Obligations at the end of the Year 171.36 109.05Change in Plan AssetsPlan Assets at the beginningof the Year, at Fair Value<strong>11</strong>7.62 31.88Expected return on Plan Assets 12.12 9.28Contributions 45.64 78.<strong>11</strong>Benefits Settled (18.34) (1.64)Actuarial Gain / (Loss) Nil NilGratuity Cost for the YearService Cost 22.49 20.82Interest Cost 8.72 6.74Expected Return on Plan Assets (12.12) (9.28)Actuarial (Gain) / Loss 49.44 (1.17)Net Gratuity Cost 68.53 17.12AssumptionsInterest Rate 8.00% 7.50%Expected Rate of return on Plan Assets 8.00% 7.50%2.6. Borrowing CostA sum of Rs 1,527.91 Lakhs (previous year Rs NIL) beingborrowing cost incurred by the company in respect ofassets / projects was Capitalised during the year. Sum ofRs 1,499.67 Lakhs (previous year Rs NIL) being borrowingcost incurred by the company in respect of assets / projects,carried forward as stock in trade. A sum of Rs 4422.41Lakhs (previous year Rs 5137.08 Lakhs) being borrowingcost incurred by the company in respect of assets / projects,carried forward as capital work in progress.2.7. Segmental <strong>Report</strong>ing<strong>The</strong> Company’s operations predominantly relate toconstruction and development, real estate development,and related activities of leasing/rental of units/properties.Accordingly, real estate development represents a singleprimary segment in the financials of the Company andthe geographical location of the projects represents thesecondary segment of reporting.During the current year, the financials of the Companyrepresent a single primary segment (real estate development).<strong>The</strong> Revenues from Hospitality being a newPrimary segment does not exceed 10% of the overallrevenues of the company. With respect to secondarysegment, the Company has its projects in India, whichmakes it a single segment. Hence, providing of segmentalinformation is not applicable to the Company for the currentfinancial year.BRIGADE ENTERPRISES LIMITED ANNUAL REPORT <strong>2010</strong>-<strong>11</strong> 45