The Annual Report 2010-11 - Brigade Group

The Annual Report 2010-11 - Brigade Group

The Annual Report 2010-11 - Brigade Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

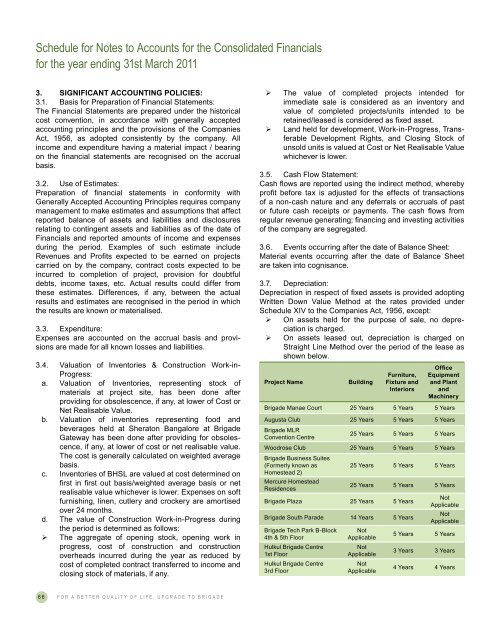

Schedule for Notes to Accounts for the Consolidated Financialsfor the year ending 31st March 20<strong>11</strong>3. SIGNIFICANT ACCOUNTING POLICIES:3.1. Basis for Preparation of Financial Statements:<strong>The</strong> Financial Statements are prepared under the historicalcost convention, in accordance with generally acceptedaccounting principles and the provisions of the CompaniesAct, 1956, as adopted consistently by the company. Allincome and expenditure having a material impact / bearingon the financial statements are recognised on the accrualbasis.3.2. Use of Estimates:Preparation of financial statements in conformity withGenerally Accepted Accounting Principles requires companymanagement to make estimates and assumptions that affectreported balance of assets and liabilities and disclosuresrelating to contingent assets and liabilities as of the date ofFinancials and reported amounts of income and expensesduring the period. Examples of such estimate includeRevenues and Profits expected to be earned on projectscarried on by the company, contract costs expected to beincurred to completion of project, provision for doubtfuldebts, income taxes, etc. Actual results could differ fromthese estimates. Differences, if any, between the actualresults and estimates are recognised in the period in whichthe results are known or materialised.3.3. Expenditure:Expenses are accounted on the accrual basis and provisionsare made for all known losses and liabilities.3.4. Valuation of Inventories & Construction Work-in-Progress:a. Valuation of Inventories, representing stock ofmaterials at project site, has been done afterproviding for obsolescence, if any, at lower of Cost orNet Realisable Value.b. Valuation of inventories representing food andbeverages held at Sheraton Bangalore at <strong>Brigade</strong>Gateway has been done after providing for obsolescence,if any, at lower of cost or net realisable value.<strong>The</strong> cost is generally calculated on weighted averagebasis.c. Inventories of BHSL are valued at cost determined onfirst in first out basis/weighted average basis or netrealisable value whichever is lower. Expenses on softfurnishing, linen, cutlery and crockery are amortisedover 24 months.d. <strong>The</strong> value of Construction Work-in-Progress duringthe period is determined as follows:‣¾ <strong>The</strong> aggregate of opening stock, opening work inprogress, cost of construction and constructionoverheads incurred during the year as reduced bycost of completed contract transferred to income andclosing stock of materials, if any.‣¾‣¾<strong>The</strong> value of completed projects intended forimmediate sale is considered as an inventory andvalue of completed projects/units intended to beretained/leased is considered as fixed asset.Land held for development, Work-in-Progress, TransferableDevelopment Rights, and Closing Stock ofunsold units is valued at Cost or Net Realisable Valuewhichever is lower.3.5. Cash Flow Statement:Cash flows are reported using the indirect method, wherebyprofit before tax is adjusted for the effects of transactionsof a non-cash nature and any deferrals or accruals of pastor future cash receipts or payments. <strong>The</strong> cash flows fromregular revenue generating; financing and investing activitiesof the company are segregated.3.6. Events occurring after the date of Balance Sheet:Material events occurring after the date of Balance Sheetare taken into cognisance.3.7. Depreciation:Depreciation in respect of fixed assets is provided adoptingWritten Down Value Method at the rates provided underSchedule XIV to the Companies Act, 1956, except:‣¾ On assets held for the purpose of sale, no depreciationis charged.‣¾ On assets leased out, depreciation is charged onStraight Line Method over the period of the lease asshown below.Project NameBuildingFurniture,Fixture andInteriorsOfficeEquipmentand PlantandMachinery<strong>Brigade</strong> Manae Court 25 Years 5 Years 5 YearsAugusta Club 25 Years 5 Years 5 Years<strong>Brigade</strong> MLRConvention Centre25 Years 5 Years 5 YearsWoodrose Club 25 Years 5 Years 5 Years<strong>Brigade</strong> Business Suites(Formerly known as25 Years 5 Years 5 YearsHomestead 2)Mercure HomesteadResidences25 Years 5 Years 5 Years<strong>Brigade</strong> Plaza 25 Years 5 YearsNotApplicable<strong>Brigade</strong> South Parade 14 Years 5 YearsNotApplicable<strong>Brigade</strong> Tech Park B-Block4th & 5th FloorHulkul <strong>Brigade</strong> Centre1st FloorHulkul <strong>Brigade</strong> Centre3rd FloorNotApplicableNotApplicableNotApplicable5 Years 5 Years3 Years 3 Years4 Years 4 Years66FOR A BETTER QUALITY OF LIFE, UPGRADE TO BRIGADE