The Annual Report 2010-11 - Brigade Group

The Annual Report 2010-11 - Brigade Group

The Annual Report 2010-11 - Brigade Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

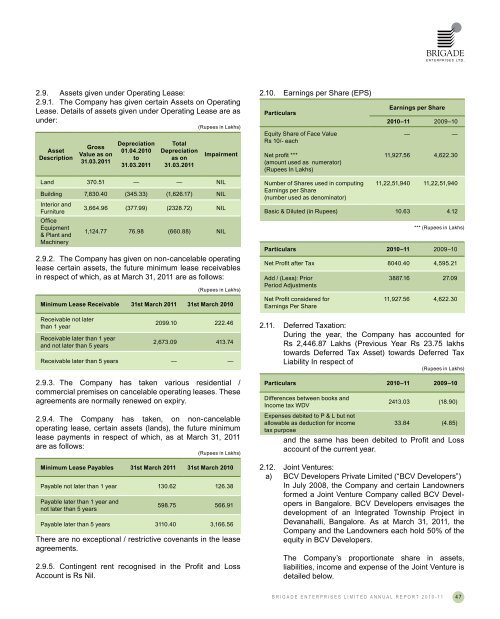

2.9. Assets given under Operating Lease:2.9.1. <strong>The</strong> Company has given certain Assets on OperatingLease. Details of assets given under Operating Lease are asunder:(Rupees in Lakhs)AssetDescriptionGrossValue as on31.03.20<strong>11</strong>Depreciation01.04.<strong>2010</strong>to31.03.20<strong>11</strong>TotalDepreciationas on31.03.20<strong>11</strong>Impairment2.10. Earnings per Share (EPS)ParticularsEquity Share of Face ValueRs 10/- eachNet profit ***(amount used as numerator)(Rupees In Lakhs)Earnings per Share<strong>2010</strong>–<strong>11</strong> 2009–10——<strong>11</strong>,927.56 4,622.30Land 370.51 — — NILBuilding 7,830.40 (345.33) (1,626.17) NILInterior andFurnitureOfficeEquipment& Plant andMachinery3,664.96 (377.99) (2328.72) NIL1,124.77 76.98 (660.88) NIL2.9.2. <strong>The</strong> Company has given on non-cancelable operatinglease certain assets, the future minimum lease receivablesin respect of which, as at March 31, 20<strong>11</strong> are as follows:(Rupees in Lakhs)Minimum Lease Receivable 31st March 20<strong>11</strong> 31st March <strong>2010</strong>Receivable not laterthan 1 yearReceivable later than 1 yearand not later than 5 years2099.10 222.462,673.09 413.74Receivable later than 5 years — —2.9.3. <strong>The</strong> Company has taken various residential /commercial premises on cancelable operating leases. <strong>The</strong>seagreements are normally renewed on expiry.2.9.4. <strong>The</strong> Company has taken, on non-cancelableoperating lease, certain assets (lands), the future minimumlease payments in respect of which, as at March 31, 20<strong>11</strong>are as follows:(Rupees in Lakhs)Minimum Lease Payables 31st March 20<strong>11</strong> 31st March <strong>2010</strong>Payable not later than 1 year 130.62 126.38Payable later than 1 year andnot later than 5 years598.75 566.91Payable later than 5 years 3<strong>11</strong>0.40 3,166.56<strong>The</strong>re are no exceptional / restrictive covenants in the leaseagreements.2.9.5. Contingent rent recognised in the Profit and LossAccount is Rs Nil.Number of Shares used in computingEarnings per Share(number used as denominator)<strong>11</strong>,22,51,940 <strong>11</strong>,22,51,940Basic & Diluted (in Rupees) 10.63 4.12*** (Rupees in Lakhs)Particulars <strong>2010</strong>–<strong>11</strong> 2009–10Net Profit after Tax 8040.40 4,595.21Add / (Less): PriorPeriod AdjustmentsNet Profit considered forEarnings Per Share3887.16 27.09<strong>11</strong>,927.56 4,622.302.<strong>11</strong>. Deferred Taxation:During the year, the Company has accounted forRs 2,446.87 Lakhs (Previous Year Rs 23.75 lakhstowards Deferred Tax Asset) towards Deferred TaxLiability In respect of(Rupees in Lakhs)Particulars <strong>2010</strong>–<strong>11</strong> 2009–10Differences between books andIncome tax WDV2413.03 (18.90)Expenses debited to P & L but notallowable as deduction for income33.84 (4.85)tax purposeand the same has been debited to Profit and Lossaccount of the current year.2.12. Joint Ventures:a) BCV Developers Private Limited (“BCV Developers”)In July 2008, the Company and certain Landownersformed a Joint Venture Company called BCV Developersin Bangalore. BCV Developers envisages thedevelopment of an Integrated Township Project inDevanahalli, Bangalore. As at March 31, 20<strong>11</strong>, theCompany and the Landowners each hold 50% of theequity in BCV Developers.<strong>The</strong> Company’s proportionate share in assets,liabilities, income and expense of the Joint Venture isdetailed below.BRIGADE ENTERPRISES LIMITED ANNUAL REPORT <strong>2010</strong>-<strong>11</strong> 47