TOWN TOWN OF MADISON, NH - the Town of Madison

TOWN TOWN OF MADISON, NH - the Town of Madison

TOWN TOWN OF MADISON, NH - the Town of Madison

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

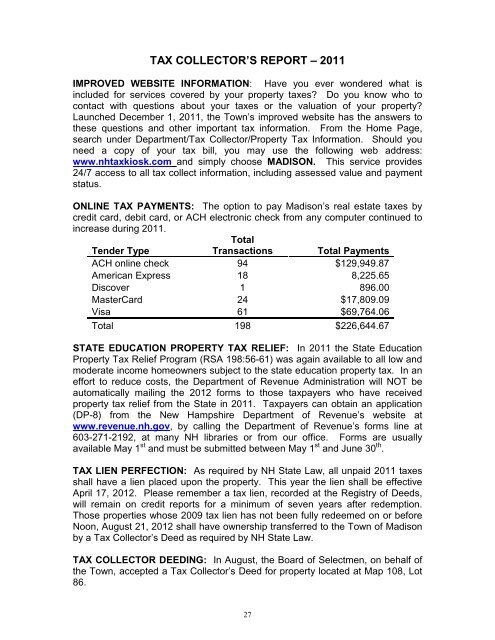

TAX COLLECTOR’S REPORT – 2011IMPROVED WEBSITE INFORMATION: Have you ever wondered what isincluded for services covered by your property taxes? Do you know who tocontact with questions about your taxes or <strong>the</strong> valuation <strong>of</strong> your property?Launched December 1, 2011, <strong>the</strong> <strong>Town</strong>’s improved website has <strong>the</strong> answers to<strong>the</strong>se questions and o<strong>the</strong>r important tax information. From <strong>the</strong> Home Page,search under Department/Tax Collector/Property Tax Information. Should youneed a copy <strong>of</strong> your tax bill, you may use <strong>the</strong> following web address:www.nhtaxkiosk.com and simply choose <strong>MADISON</strong>. This service provides24/7 access to all tax collect information, including assessed value and paymentstatus.ONLINE TAX PAYMENTS: The option to pay <strong>Madison</strong>’s real estate taxes bycredit card, debit card, or ACH electronic check from any computer continued toincrease during 2011.TotalTender TypeTransactions Total PaymentsACH online check 94 $129,949.87American Express 18 8,225.65Discover 1 896.00MasterCard 24 $17,809.09Visa 61 $69,764.06Total 198 $226,644.67STATE EDUCATION PROPERTY TAX RELIEF: In 2011 <strong>the</strong> State EducationProperty Tax Relief Program (RSA 198:56-61) was again available to all low andmoderate income homeowners subject to <strong>the</strong> state education property tax. In aneffort to reduce costs, <strong>the</strong> Department <strong>of</strong> Revenue Administration will NOT beautomatically mailing <strong>the</strong> 2012 forms to those taxpayers who have receivedproperty tax relief from <strong>the</strong> State in 2011. Taxpayers can obtain an application(DP-8) from <strong>the</strong> New Hampshire Department <strong>of</strong> Revenue’s website atwww.revenue.nh.gov, by calling <strong>the</strong> Department <strong>of</strong> Revenue’s forms line at603-271-2192, at many <strong>NH</strong> libraries or from our <strong>of</strong>fice. Forms are usuallyavailable May 1 st and must be submitted between May 1 st and June 30 th .TAX LIEN PERFECTION: As required by <strong>NH</strong> State Law, all unpaid 2011 taxesshall have a lien placed upon <strong>the</strong> property. This year <strong>the</strong> lien shall be effectiveApril 17, 2012. Please remember a tax lien, recorded at <strong>the</strong> Registry <strong>of</strong> Deeds,will remain on credit reports for a minimum <strong>of</strong> seven years after redemption.Those properties whose 2009 tax lien has not been fully redeemed on or beforeNoon, August 21, 2012 shall have ownership transferred to <strong>the</strong> <strong>Town</strong> <strong>of</strong> <strong>Madison</strong>by a Tax Collector’s Deed as required by <strong>NH</strong> State Law.TAX COLLECTOR DEEDING: In August, <strong>the</strong> Board <strong>of</strong> Selectmen, on behalf <strong>of</strong><strong>the</strong> <strong>Town</strong>, accepted a Tax Collector’s Deed for property located at Map 108, Lot86.27