Fixed Rates 60% Mortgages - Post Office

Fixed Rates 60% Mortgages - Post Office

Fixed Rates 60% Mortgages - Post Office

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

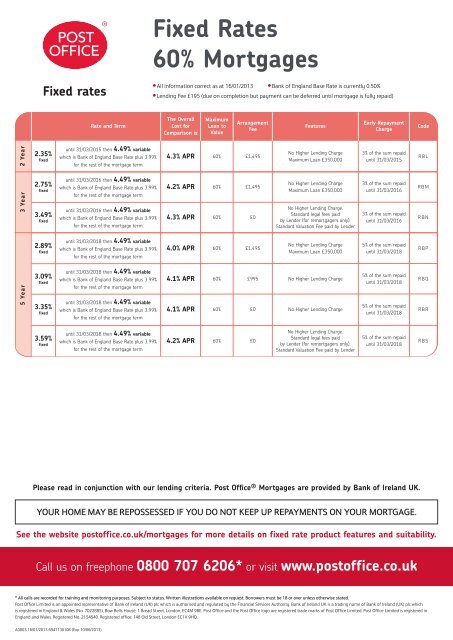

<strong>Fixed</strong> <strong>Rates</strong><strong>60%</strong> <strong>Mortgages</strong><strong>Fixed</strong> ratesl All information correct as at 16/01/2013 l Bank of England Base Rate is currently 0.50%l Lending Fee £195 (due on completion but payment can be deferred until mortgage is fully repaid)Rate and TermThe OverallCost forComparison isMaximumLoan toValueArrangementFeeFeaturesEarly RepaymentChargeCode3 Year 2 Year2.35%fixed2.75%fixed3.49%fixeduntil 31/03/2015 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage termuntil 31/03/2016 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage termuntil 31/03/2016 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage term4.3% APR <strong>60%</strong> £1,4954.2% APR <strong>60%</strong> £1,4954.3% APR <strong>60%</strong> £0No Higher Lending ChargeMaximum Loan £350,000No Higher Lending ChargeMaximum Loan £350,000No Higher Lending Charge.Standard legal fees paidby Lender (for remortgagers only).Standard Valuation Fee paid by Lender3% of the sum repaiduntil 31/03/20153% of the sum repaiduntil 31/03/20163% of the sum repaiduntil 31/03/2016RBLRBMRBN2.89%fixeduntil 31/03/2018 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage term4.0% APR <strong>60%</strong> £1,495No Higher Lending ChargeMaximum Loan £350,0005% of the sum repaiduntil 31/03/2018RBP5 Year3.09%fixed3.35%fixeduntil 31/03/2018 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage termuntil 31/03/2018 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage term4.1% APR <strong>60%</strong> £995 No Higher Lending Charge4.1% APR <strong>60%</strong> £0 No Higher Lending Charge5% of the sum repaiduntil 31/03/20185% of the sum repaiduntil 31/03/2018RBQRBR3.59%fixeduntil 31/03/2018 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage term4.2% APR <strong>60%</strong> £0No Higher Lending Charge.Standard legal fees paidby Lender (for remortgagers only).Standard Valuation Fee paid by Lender5% of the sum repaiduntil 31/03/2018RBSPlease read in conjunction with our lending criteria. <strong>Post</strong> <strong>Office</strong> ® <strong>Mortgages</strong> are provided by Bank of Ireland UK.YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.See the website postoffice.co.uk/mortgages for more details on fixed rate product features and suitability.Call us on freephone 0800 707 6206* or visit www.postoffice.co.uk* All calls are recorded for training and monitoring purposes. Subject to status. Written illustrations available on request. Borrowers must be 18 or over unless otherwise stated.<strong>Post</strong> <strong>Office</strong> Limited is an appointed representative of Bank of Ireland (UK) plc which is authorised and regulated by the Financial Services Authority. Bank of Ireland UK is a trading name of Bank of Ireland (UK) plc whichis registered in England & Wales (No. 7022885), Bow Bells House, 1 Bread Street, London, EC4M 9BE. <strong>Post</strong> <strong>Office</strong> and the <strong>Post</strong> <strong>Office</strong> logo are registered trade marks of <strong>Post</strong> <strong>Office</strong> Limited. <strong>Post</strong> <strong>Office</strong> Limited is registered inEngland and Wales. Registered No. 2154540. Registered office: 148 Old Street, London EC1V 9HQ.A0003 16/01/2013 6941130108 (Exp 10/06/2013)

<strong>Fixed</strong> <strong>Rates</strong>75% <strong>Mortgages</strong><strong>Fixed</strong> ratesl All information correct as at 16/01/2013 l Bank of England Base Rate is currently 0.50%l Lending Fee £195 (due on completion but payment can be deferred until mortgage is fully repaid)Rate and TermThe OverallCost forComparison isMaximumLoan toValueArrangementFeeFeaturesEarly RepaymentChargeCode2.69%fixeduntil 31/03/2015 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage term4.3% APR 75% £995 No Higher Lending Charge3% of the sum repaiduntil 31/03/2015RBT3 Year 2 Year3.09%fixed3.29%fixed2.99%fixed3.25%fixeduntil 31/03/2015 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage termuntil 31/03/2015 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage termuntil 31/03/2016 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage termuntil 31/03/2016 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage term4.3% APR 75% £0 No Higher Lending Charge4.4% APR 75% £0No Higher Lending Charge.Standard legal fees paidby Lender (for remortgagers only).Standard Valuation Fee paid by Lender4.3% APR 75% £995 No Higher Lending Charge4.3% APR 75% £0 No Higher Lending Charge3% of the sum repaiduntil 31/03/20153% of the sum repaiduntil 31/03/20153% of the sum repaiduntil 31/03/20163% of the sum repaiduntil 31/03/2016RBURBVRBWRBX3.69%fixeduntil 31/03/2016 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage term4.4% APR 75% £0No Higher Lending Charge.Standard legal fees paidby Lender (for remortgagers only).Standard Valuation Fee paid by Lender3% of the sum repaiduntil 31/03/2016RBY2.99%fixeduntil 31/03/2018 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage term4.1% APR 75% £1,495 No Higher Lending Charge5% of the sum repaiduntil 31/03/2018RBZ5 Year3.19%fixed3.49%fixeduntil 31/03/2018 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage termuntil 31/03/2018 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage term4.1% APR 75% £995 No Higher Lending Charge4.2% APR 75% £0 No Higher Lending Charge5% of the sum repaiduntil 31/03/20185% of the sum repaiduntil 31/03/2018RCARCB3.79%fixeduntil 31/03/2018 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%for the rest of the mortgage term4.3% APR 75% £0No Higher Lending Charge.Standard legal fees paidby Lender (for remortgagers only).Standard Valuation Fee paid by Lender5% of the sum repaiduntil 31/03/2018RCCPlease read in conjunction with our lending criteria. <strong>Post</strong> <strong>Office</strong> ® <strong>Mortgages</strong> are provided by Bank of Ireland UK.YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.See the website postoffice.co.uk/mortgages for more details on fixed rate product features and suitability.Call us on freephone 0800 707 6206* or visit www.postoffice.co.uk* All calls are recorded for training and monitoring purposes. Subject to status. Written illustrations available on request. Borrowers must be 18 or over unless otherwise stated.<strong>Post</strong> <strong>Office</strong> Limited is an appointed representative of Bank of Ireland (UK) plc which is authorised and regulated by the Financial Services Authority. Bank of Ireland UK is a trading name of Bank of Ireland (UK) plc whichis registered in England & Wales (No. 7022885), Bow Bells House, 1 Bread Street, London, EC4M 9BE. <strong>Post</strong> <strong>Office</strong> and the <strong>Post</strong> <strong>Office</strong> logo are registered trade marks of <strong>Post</strong> <strong>Office</strong> Limited. <strong>Post</strong> <strong>Office</strong> Limited is registered inEngland and Wales. Registered No. 2154540. Registered office: 148 Old Street, London EC1V 9HQ.A0003 16/01/2013 6941130108 (Exp 10/06/2013)

Tracker <strong>Rates</strong>75% - 90% <strong>Mortgages</strong>2 year trackerl All information correct as at 16/01/2013 l Bank of England Base Rate is currently 0.50%l Lending Fee £195 (due on completion but payment can be deferred until mortgage is fully repaid)Rate and TermThe OverallCost forComparison isMaximumLoan toValueArrangementFeeFeaturesEarly RepaymentChargeCodewhich is Bank of England Base Rate plus 2.39%2.89%variableuntil 31/03/2015 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%4.4% APR 75% £995 No Higher Lending Charge3% of the sum repaiduntil 31/03/2015RCRfor the rest of the mortgage termwhich is Bank of England Base Rate plus 2.99%3.49%variableuntil 31/03/2015 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%4.5% APR 80% £995 Higher Lending Charge paid by Lender3% of the sum repaiduntil 31/03/2015RCS2 Year3.79%variablefor the rest of the mortgage termwhich is Bank of England Base Rate plus 3.29%until 31/03/2015 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%4.5% APR 85% £995 Higher Lending Charge paid by Lender3% of the sum repaiduntil 31/03/2015RCTfor the rest of the mortgage termwhich is Bank of England Base Rate plus 4.75%5.25%variableuntil 31/03/2015 then 4.49% variablewhich is Bank of England Base Rate plus 3.99%4.8% APR 90% £995 Higher Lending Charge paid by Lender3% of the sum repaiduntil 31/03/2015RCUfor the rest of the mortgage termPlease read in conjunction with our lending criteria. <strong>Post</strong> <strong>Office</strong> ® <strong>Mortgages</strong> are provided by Bank of Ireland UK.YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.See the website postoffice.co.uk/mortgages for more details on tracker rate product features and suitability.Call us on freephone 0800 707 6206* or visit www.postoffice.co.uk* All calls are recorded for training and monitoring purposes. Subject to status. Written illustrations available on request. Borrowers must be 18 or over unless otherwise stated.<strong>Post</strong> <strong>Office</strong> Limited is an appointed representative of Bank of Ireland (UK) plc which is authorised and regulated by the Financial Services Authority. Bank of Ireland UK is a trading name of Bank of Ireland (UK) plc whichis registered in England & Wales (No. 7022885), Bow Bells House, 1 Bread Street, London, EC4M 9BE. <strong>Post</strong> <strong>Office</strong> and the <strong>Post</strong> <strong>Office</strong> logo are registered trade marks of <strong>Post</strong> <strong>Office</strong> Limited. <strong>Post</strong> <strong>Office</strong> Limited is registered inEngland and Wales. Registered No. 2154540. Registered office: 148 Old Street, London EC1V 9HQ.A0003 16/01/2013 6941130108 (Exp 10/06/2013)

Lending CriteriaThis list is not exhaustive. Please contact us to discuss your requirementsStandardAge: Minimum: 18Term: Maximum: 35 years or the number of years it will take(the eldest) applicant to reach 70 (whichever is lower).Minimum: 10 years (shorter terms considered by exceptionwhere we are satisfied that ability to pay exists)Loan size: Minimum: £25,001, maximum: £1,000,000Loan tiers: 90% up to £500,000, 85% up to £750,000, 80% up to£850,000, 75% up to £1m. Fees may be added. Conditions applyLoan Types: Repayment, interest only or a combination of both.You can borrow a maximum of 75% of the purchase price orvaluation (whichever is lower) on an interest only basis, or acombination of repayment and interest only, with a suitablerepayment plan. If your loan exceeds 75% loan to valuethen the entire amount must be on a repayment basisProperty: We do not accept shared equity, vendor deposit schemes,right to buys, studio flats, mixed use buildings or flats in convertedblocks including speculatively converted ex Local Authority blocks. Wedo not accept ex Local Authority flats that are located in a block morethan 4 storeys high or that have open decking. Private flats located inblocks of 10 or more storeys are subject to individual assessment.Properties that are newly constructed (built or converted within thelast 12 months), being purchased for the first time since completionor conversion, or subject to first registration of a lease, are acceptableup to 80% loan to value for houses and 75% loan to value for flatsor maisonettes. We may be able to lend if the property you arepurchasing or remortgaging has solar panels. We have specificlending requirements for solar panels, please check with us tosee if you meet our criteria before you applyRefinance: Debt consolidation loans will be considered subjectto individual assessment by our underwritersStandard legal fees paid by lender: If your product is describedas 'Standard legal fees paid by Lender (for remortgagers only)' wewill pay the fees for remortgages only via our nominated solicitors.Terms and Conditions apply, see our General Lending CriteriaIncome multiples: 4.25x income for single or joint applications.Minimum household income of £20,000 (single or joint applications).We will review your application to ensure we are satisfied with yourability to payEmployment status: Employed and self employed considered(last 3 years accounts required)GeneralLending areas: England, Scotland, Northern Ireland and Wales(unless otherwise stated)Property owner: We only accept transactions where the seller is theowner or registered proprietor of the property, and has been so for atleast 12 months. For all remortgage business the registered owner orproprietor must have owned the property for a period of at least12 monthsNationality: Proof is required that applicants who are Non EUCitizens have the right to live and work in the UK. Restrictions apply;please contact us to discuss your situationEarly Repayment Charge: If you repay all or part of your loanbefore the end of the early repayment period, we may charge youan Early Repayment Charge to cover any losses we might otherwiseincur. When you repay the whole of the loan you must pay us anymortgage release fee we charge at the time of repayment. If youhave deferred payment of the lending fee you must also pay this.For part repayments, an additional administration fee appliesHigher Lending Charge: You don’t have to pay a Higher LendingCharge on any <strong>Post</strong> <strong>Office</strong> ® mortgage. Where applicable this is paidfor by the lender. No Higher Lending Charge applies for mortgagesbelow 75% loan to valueClean credit history: For last 3 years:l No mortgage/rent/loan arrears l Max 2 consecutive missedpayments on credit/store cards l Max 1 CCJ to £250, not in thelast 12 months l Comms/mail order arrears ignored unlessscale/frequency is a cause for concernPortability: All mortgages are portable when redeeming andcompleting on a new Bank of Ireland UK product. Conditions apply –please ask for detailsStandard legal fees paid by lender: If stated in the Offer of Loan,Bank of Ireland UK will pay for the legal fees and disbursements(excluding additional work, see below) providing the remortgagetransaction is handled via Legal Marketing Services, and is completed.The firm of Solicitors is instructed to act for us only. If applicants wishto arrange their own legal representation they will be responsible forthe legal costs and disbursements incurred. Please Note: Bank ofIreland UK will not pay for charges relating to additional work outsidethe scope of a standard remortgage transaction. This includes furthervaluation reports, related legal services, transfer of equity, deed ofpostponement, deed of grant, deed of variation, merger of freeholdor leasehold title, leasehold supplements, change of name, telegraphictransfer of surplus funds to borrower, local searches for loans over£1,000,000, or if an exceptional amount of work is required tocorrect a defective titleArrangement fees: Payments should not be made at applicationstage. Bank of Ireland UK will deduct the fee from the loan amountupon completion or add it to the loan amountOverpayments: You can overpay at any time during your mortgageterm. If in a promotional period, you can overpay a minimum of£500 and a maximum of 10% of the outstanding mortgage balance(as at 31st March the previous year) without incurring any earlyrepayment or administration charges. After the promotional periodthe amount you can overpay is unlimited, however if you pay off yourmortgage in full charges may apply. When overpaying you can eitherreduce your monthly repayments or reduce your mortgage term. Youcan only reduce your mortgage term after the promotional periodends and an administration fee of £60 appliesValuation fee scaleThis applies to all mortgages. The valuation fee includes anadministration fee of £90. Re-inspections minimum charge£50 per visit (this includes an administration fee of £8.50)Purchase Priceor ValuationUp to £50,000Up to £100,000Up to £150,000Up to £200,000Up to £250,000Up to £350,000MortgageValuation Report£180HomebuyersReportUp to £75,000 £200£350Up to £500,000Up to £750,000Up to £1mUp to £1.5mUp to £2mUp to £2.5mUp to £3m£220£240£270£310£360£470£610£790£890£990£1,090£1,190£310£390£430£470£520£570£770£840£930£1,090£1,230£1,440£1,590<strong>Post</strong> <strong>Office</strong> ® <strong>Mortgages</strong> are provided by Bank of Ireland UK.This document can be made available in Braille, large print or audio upon request.THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME.YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.* All calls are recorded for training and monitoring purposes. Subject to status. Written illustrations available on request. Borrowers must be 18 or over unless otherwise stated.<strong>Post</strong> <strong>Office</strong> Limited is an appointed representative of Bank of Ireland (UK) plc which is authorised and regulated by the Financial Services Authority. Bank of Ireland UK is a trading name of Bank of Ireland (UK) plc whichis registered in England & Wales (No. 7022885), Bow Bells House, 1 Bread Street, London, EC4M 9BE. <strong>Post</strong> <strong>Office</strong> and the <strong>Post</strong> <strong>Office</strong> logo are registered trade marks of <strong>Post</strong> <strong>Office</strong> Limited. <strong>Post</strong> <strong>Office</strong> Limited is registered inEngland and Wales. Registered No. 2154540. Registered office: 148 Old Street, London EC1V 9HQ.A0003 16/01/2013 6941130108 (Exp 10/06/2013)