Second Quarter 2012 Results - Entel

Second Quarter 2012 Results - Entel

Second Quarter 2012 Results - Entel

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

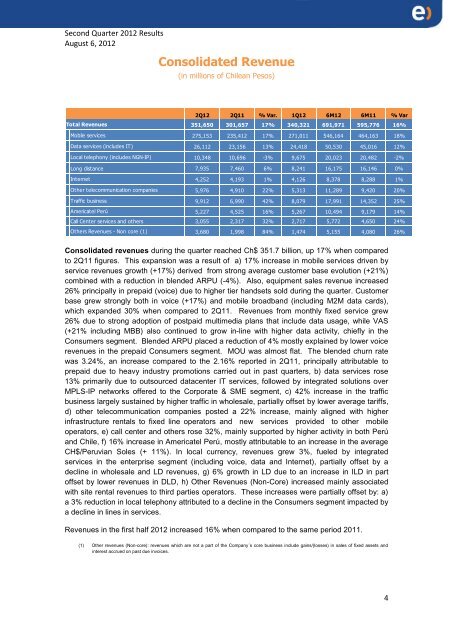

<strong>Second</strong> <strong>Quarter</strong> <strong>2012</strong> <strong>Results</strong>August 6, <strong>2012</strong>Consolidated Revenue(in millions of Chilean Pesos)Total RevenuesMobile servicesData services (includes IT)Local telephony (includes NGN-IP)2Q12 2Q11 % Var. 1Q12 6M12 6M11 % Var351,650 301,657 17% 340,321 691,971 595,776 16%275,153 235,412 17% 271,011 546,164 464,163 18%26,112 23,156 13% 24,418 50,530 45,016 12%10,348 10,696 -3% 9,675 20,023 20,482 -2%Long distance 7,935 7,460 6% 8,241 16,175 16,146 0%InternetOther telecommunication companiesTraffic businessAmericatel PerúCall Center services and othersOthers Revenues - Non core (1)4,252 4,193 1% 4,126 8,378 8,288 1%5,976 4,910 22% 5,313 11,289 9,420 20%9,912 6,990 42% 8,079 17,991 14,352 25%5,227 4,525 16% 5,267 10,494 9,179 14%3,055 2,317 32% 2,717 5,772 4,650 24%3,680 1,998 84% 1,474 5,155 4,080 26%Consolidated revenues during the quarter reached Ch$ 351.7 billion, up 17% when comparedto 2Q11 figures. This expansion was a result of a) 17% increase in mobile services driven byservice revenues growth (+17%) derived from strong average customer base evolution (+21%)combined with a reduction in blended ARPU (-4%). Also, equipment sales revenue increased26% principally in prepaid (voice) due to higher tier handsets sold during the quarter. Customerbase grew strongly both in voice (+17%) and mobile broadband (including M2M data cards),which expanded 30% when compared to 2Q11. Revenues from monthly fixed service grew26% due to strong adoption of postpaid multimedia plans that include data usage, while VAS(+21% including MBB) also continued to grow in-line with higher data activity, chiefly in theConsumers segment. Blended ARPU placed a reduction of 4% mostly explained by lower voicerevenues in the prepaid Consumers segment. MOU was almost flat. The blended churn ratewas 3.24%, an increase compared to the 2.16% reported in 2Q11, principally attributable toprepaid due to heavy industry promotions carried out in past quarters, b) data services rose13% primarily due to outsourced datacenter IT services, followed by integrated solutions overMPLS-IP networks offered to the Corporate & SME segment, c) 42% increase in the trafficbusiness largely sustained by higher traffic in wholesale, partially offset by lower average tariffs,d) other telecommunication companies posted a 22% increase, mainly aligned with higherinfrastructure rentals to fixed line operators and new services provided to other mobileoperators, e) call center and others rose 32%, mainly supported by higher activity in both Perúand Chile, f) 16% increase in Americatel Perú, mostly attributable to an increase in the averageCH$/Peruvian Soles (+ 11%). In local currency, revenues grew 3%, fueled by integratedservices in the enterprise segment (including voice, data and Internet), partially offset by adecline in wholesale and LD revenues, g) 6% growth in LD due to an increase in ILD in partoffset by lower revenues in DLD, h) Other Revenues (Non-Core) increased mainly associatedwith site rental revenues to third parties operators. These increases were partially offset by: a)a 3% reduction in local telephony attributed to a decline in the Consumers segment impacted bya decline in lines in services.Revenues in the first half <strong>2012</strong> increased 16% when compared to the same period 2011.(1) Other revenues (Non-core): revenues which are not a part of the Company´s core business include gains/(losses) in sales of fixed assets andinterest accrued on past due invoices.4