Second Quarter 2012 Results - Entel

Second Quarter 2012 Results - Entel

Second Quarter 2012 Results - Entel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

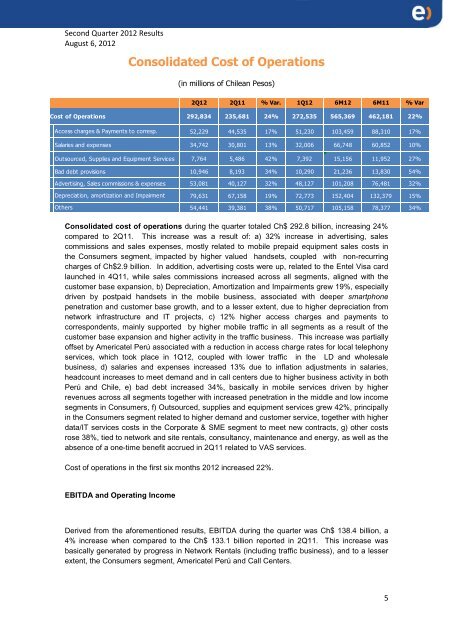

<strong>Second</strong> <strong>Quarter</strong> <strong>2012</strong> <strong>Results</strong>August 6, <strong>2012</strong>Consolidated Cost of Operations(in millions of Chilean Pesos)2Q12 2Q11 % Var. 1Q12 6M12 6M11 % VarCost of OperationsAccess charges & Payments to corresp.Salaries and expenses292,834 235,681 24% 272,535 565,369 462,181 22%52,229 44,535 17% 51,230 103,459 88,310 17%34,742 30,801 13% 32,006 66,748 60,852 10%Outsourced, Supplies and Equipment Services 7,764 5,486 42% 7,392 15,156 11,952 27%Bad debt provisions 10,946 8,193 34% 10,290 21,236 13,830 54%Advertising, Sales commissions & expenses 53,081 40,127 32% 48,127 101,208 76,481 32%Depreciation, amortization and ImpairmentOthers79,631 67,158 19% 72,773 152,404 132,379 15%54,441 39,381 38% 50,717 105,158 78,377 34%Consolidated cost of operations during the quarter totaled Ch$ 292.8 billion, increasing 24%compared to 2Q11. This increase was a result of: a) 32% increase in advertising, salescommissions and sales expenses, mostly related to mobile prepaid equipment sales costs inthe Consumers segment, impacted by higher valued handsets, coupled with non-recurringcharges of Ch$2.9 billion. In addition, advertising costs were up, related to the <strong>Entel</strong> Visa cardlaunched in 4Q11, while sales commissions increased across all segments, aligned with thecustomer base expansion, b) Depreciation, Amortization and Impairments grew 19%, especiallydriven by postpaid handsets in the mobile business, associated with deeper smartphonepenetration and customer base growth, and to a lesser extent, due to higher depreciation fromnetwork infrastructure and IT projects, c) 12% higher access charges and payments tocorrespondents, mainly supported by higher mobile traffic in all segments as a result of thecustomer base expansion and higher activity in the traffic business. This increase was partiallyoffset by Americatel Perú associated with a reduction in access charge rates for local telephonyservices, which took place in 1Q12, coupled with lower traffic in the LD and wholesalebusiness, d) salaries and expenses increased 13% due to inflation adjustments in salaries,headcount increases to meet demand and in call centers due to higher business activity in bothPerú and Chile, e) bad debt increased 34%, basically in mobile services driven by higherrevenues across all segments together with increased penetration in the middle and low incomesegments in Consumers, f) Outsourced, supplies and equipment services grew 42%, principallyin the Consumers segment related to higher demand and customer service, together with higherdata/IT services costs in the Corporate & SME segment to meet new contracts, g) other costsrose 38%, tied to network and site rentals, consultancy, maintenance and energy, as well as theabsence of a one-time benefit accrued in 2Q11 related to VAS services.Cost of operations in the first six months <strong>2012</strong> increased 22%.EBITDA and Operating IncomeDerived from the aforementioned results, EBITDA during the quarter was Ch$ 138.4 billion, a4% increase when compared to the Ch$ 133.1 billion reported in 2Q11. This increase wasbasically generated by progress in Network Rentals (including traffic business), and to a lesserextent, the Consumers segment, Americatel Perú and Call Centers.5