February - Feedlot Magazine

February - Feedlot Magazine

February - Feedlot Magazine

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

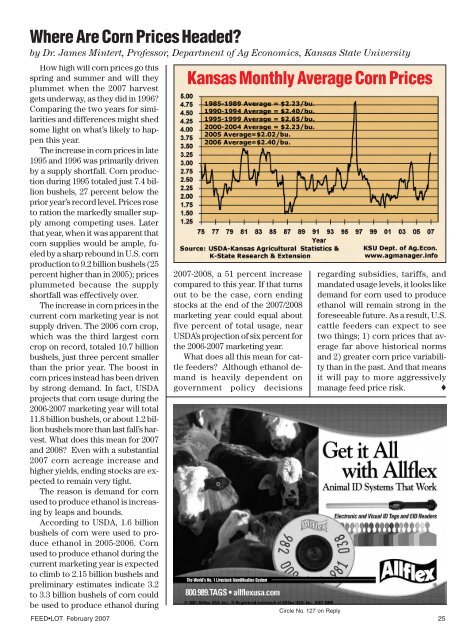

Where Are Corn Prices Headed?by Dr. James Mintert, Professor, Department of Ag Economics, Kansas State UniversityHow high will corn prices go thisspring and summer and will theyplummet when the 2007 harvestgets underway, as they did in 1996?Comparing the two years for similaritiesand differences might shedsome light on what’s likely to happenthis year.The increase in corn prices in late1995 and 1996 was primarily drivenby a supply shortfall. Corn productionduring 1995 totaled just 7.4 billionbushels, 27 percent below theprior year’s record level. Prices roseto ration the markedly smaller supplyamong competing uses. Laterthat year, when it was apparent thatcorn supplies would be ample, fueledby a sharp rebound in U.S. cornproduction to 9.2 billion bushels (25percent higher than in 2005); pricesplummeted because the supplyshortfall was effectively over.The increase in corn prices in thecurrent corn marketing year is notsupply driven. The 2006 corn crop,which was the third largest corncrop on record, totaled 10.7 billionbushels, just three percent smallerthan the prior year. The boost incorn prices instead has been drivenby strong demand. In fact, USDAprojects that corn usage during the2006-2007 marketing year will total11.8 billion bushels, or about 1.2 billionbushels more than last fall’s harvest.What does this mean for 2007and 2008? Even with a substantial2007 corn acreage increase andhigher yields, ending stocks are expectedto remain very tight.The reason is demand for cornused to produce ethanol is increasingby leaps and bounds.According to USDA, 1.6 billionbushels of corn were used to produceethanol in 2005-2006. Cornused to produce ethanol during thecurrent marketing year is expectedto climb to 2.15 billion bushels andpreliminary estimates indicate 3.2to 3.3 billion bushels of corn couldbe used to produce ethanol duringKansas Monthly Average Corn Prices2007-2008, a 51 percent increasecompared to this year. If that turnsout to be the case, corn endingstocks at the end of the 2007/2008marketing year could equal aboutfive percent of total usage, nearUSDA’s projection of six percent forthe 2006-2007 marketing year.What does all this mean for cattlefeeders? Although ethanol demandis heavily dependent ongovernment policy decisionsregarding subsidies, tariffs, andmandated usage levels, it looks likedemand for corn used to produceethanol will remain strong in theforeseeable future. As a result, U.S.cattle feeders can expect to seetwo things; 1) corn prices that averagefar above historical normsand 2) greater corn price variabilitythan in the past. And that meansit will pay to more aggressivelymanage feed price risk. ♦Circle No. 127 on ReplyFEED•LOT <strong>February</strong> 2007 25