2823, Michigan IFTA Fuel Tax License Application - FormSend

2823, Michigan IFTA Fuel Tax License Application - FormSend

2823, Michigan IFTA Fuel Tax License Application - FormSend

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

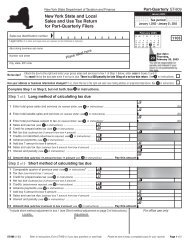

<strong>2823</strong>, Page 3Instructions for Form <strong>2823</strong>, International <strong>Fuel</strong> <strong>Tax</strong>Agreement (<strong>IFTA</strong>) <strong>License</strong> <strong>Application</strong>Complete this application only if you are a new<strong>Michigan</strong> <strong>IFTA</strong> applicant or if you are an <strong>IFTA</strong>licensee requesting additional fuel decals.Renewal applications are pre-identified and mailedaround the middle of October each year. Pleaseindicate in the boxes provided at the top of form<strong>2823</strong> whether this is a new application or you areordering additional decals. Please allow 30 daysfor processing this application.New applicants must complete all sections of the<strong>IFTA</strong> application.Applicants for additional decals need only completelines 1, 2, 3, 6 and 17 plus sign and date the application.GENERAL INFORMATION<strong>IFTA</strong> credentials are required for all "QualifiedMotor Vehicles" traveling in interstate commerce. A"Qualified Motor Vehicle" means a motor vehicleused, designed, or maintained for transportation ofpersons or property and:1. having two axles and a gross vehicle weight or aregistered gross vehicle weight exceeding 26,000pounds;2. having three or more axles regardless of weight;or3. used in combination when the weight of suchcombination exceeds 26,000 pounds gross vehicleweight or registered gross vehicle weight.Exempt vehicles include recreational vehicles notused in any business endeavor and vehicles ownedby the U.S. government.<strong>IFTA</strong> requires motor carriers based in <strong>Michigan</strong> andoperating qualifying vehicles in <strong>Michigan</strong> and atleast one other <strong>IFTA</strong> jurisdiction to obtain a <strong>Michigan</strong><strong>IFTA</strong> license and decals which will be honoredin all <strong>IFTA</strong> jurisdictions. After licensing, the motorcarrier will file with the State of <strong>Michigan</strong> onemotor carrier fuel tax report which will reflect theiroperations in all <strong>IFTA</strong> jurisdictions. All states in thecontinental United States and most Canadianprovinces are members of <strong>IFTA</strong>. The District ofColumbia is not a member of <strong>IFTA</strong>.<strong>Michigan</strong> is your base jurisdiction for <strong>IFTA</strong> licensingand reporting if you:• Have an established place of business in <strong>Michigan</strong>from which motor carrier operations areperformed;• Maintain the operational control and operationalrecords for qualified motor vehicles in <strong>Michigan</strong>or can make these records available in <strong>Michigan</strong>;• Have one or more qualified motor vehiclesbased in <strong>Michigan</strong> for vehicle registration purposes(registered with the <strong>Michigan</strong> Secretary ofState);• Have one or more qualified motor vehicleswhich actually travel on <strong>Michigan</strong> roads; and• Operate in at least one other <strong>IFTA</strong> jurisdiction.If you have any questions, contact the <strong>IFTA</strong>Section at (517) 636-4580. Deaf, hearing orspeech impaired persons should call (517) 636-4999 (TTY). Fax: (517) 636-4593.Line InstructionsLines not listed here are explained on the form.Line 1: Enter the license year for which you need<strong>IFTA</strong> credentials.Line 2: Enter your federal employer identificationnumber (FEIN) or your TR number issued by the<strong>Michigan</strong> Department of Treasury. If you do nothave an FEIN or TR#, skip to Line 3.Line 3: If you did not enter an FEIN on line 2, youmust enter the Social Security number of a companyofficer, owner or partner.Line 4: Enter your United States Department ofTransportation Number.Line 5: If you are registered under the InternationalRegistration Plan (IRP), enter the number assignedto your company by the <strong>Michigan</strong> Secretary ofState's Office.Line 6: Enter the legal name and address of yourbusiness.