CalFresh Special Notice 13-02 - HHSA Program Guides

CalFresh Special Notice 13-02 - HHSA Program Guides

CalFresh Special Notice 13-02 - HHSA Program Guides

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

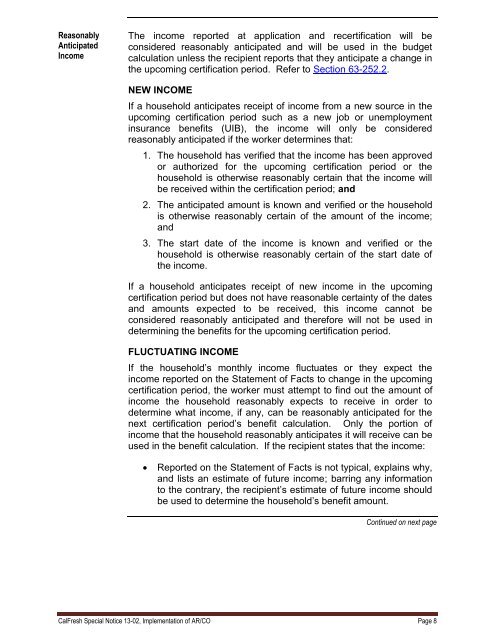

ReasonablyAnticipatedIncomeThe income reported at application and recertification will beconsidered reasonably anticipated and will be used in the budgetcalculation unless the recipient reports that they anticipate a change inthe upcoming certification period. Refer to Section 63-252.2.NEW INCOMEIf a household anticipates receipt of income from a new source in theupcoming certification period such as a new job or unemploymentinsurance benefits (UIB), the income will only be consideredreasonably anticipated if the worker determines that:1. The household has verified that the income has been approvedor authorized for the upcoming certification period or thehousehold is otherwise reasonably certain that the income willbe received within the certification period; and2. The anticipated amount is known and verified or the householdis otherwise reasonably certain of the amount of the income;and3. The start date of the income is known and verified or thehousehold is otherwise reasonably certain of the start date ofthe income.If a household anticipates receipt of new income in the upcomingcertification period but does not have reasonable certainty of the datesand amounts expected to be received, this income cannot beconsidered reasonably anticipated and therefore will not be used indetermining the benefits for the upcoming certification period.FLUCTUATING INCOMEIf the household’s monthly income fluctuates or they expect theincome reported on the Statement of Facts to change in the upcomingcertification period, the worker must attempt to find out the amount ofincome the household reasonably expects to receive in order todetermine what income, if any, can be reasonably anticipated for thenext certification period’s benefit calculation. Only the portion ofincome that the household reasonably anticipates it will receive can beused in the benefit calculation. If the recipient states that the income:Reported on the Statement of Facts is not typical, explains why,and lists an estimate of future income; barring any informationto the contrary, the recipient’s estimate of future income shouldbe used to determine the household’s benefit amount.Continued on next page<strong>CalFresh</strong> <strong>Special</strong> <strong>Notice</strong> <strong>13</strong>-<strong>02</strong>, Implementation of AR/CO Page 8