Trustees 2011_Layout 1 - Victoria and Albert Museum

Trustees 2011_Layout 1 - Victoria and Albert Museum

Trustees 2011_Layout 1 - Victoria and Albert Museum

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

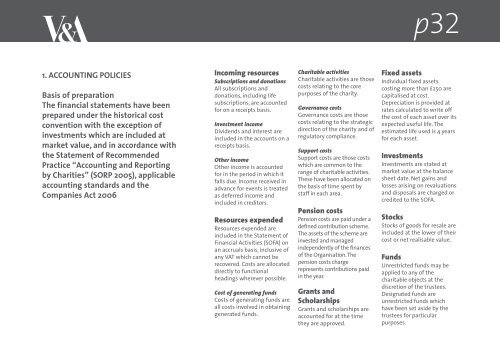

p321. ACCOUNTING POLICIESBasis of preparationThe financial statements have beenprepared under the historical costconvention with the exception ofinvestments which are included atmarket value, <strong>and</strong> in accordance withthe Statement of RecommendedPractice “Accounting <strong>and</strong> Reportingby Charities” (SORP 2005), applicableaccounting st<strong>and</strong>ards <strong>and</strong> theCompanies Act 2006Incoming resourcesSubscriptions <strong>and</strong> donationsAll subscriptions <strong>and</strong>donations, including lifesubscriptions, are accountedfor on a receipts basis.Investment incomeDividends <strong>and</strong> interest areincluded in the accounts on areceipts basis.Other incomeOther income is accountedfor in the period in which itfalls due. Income received inadvance for events is treatedas deferred income <strong>and</strong>included in creditors.Resources expendedResources expended areincluded in the Statement ofFinancial Activities (SOFA) onan accruals basis, inclusive ofany VAT which cannot berecovered. Costs are allocateddirectly to functionalheadings wherever possible.Cost of generating fundsCosts of generating funds areall costs involved in obtaininggenerated funds.Charitable activitiesCharitable activities are thosecosts relating to the corepurposes of the charity.Governance costsGovernance costs are thosecosts relating to the strategicdirection of the charity <strong>and</strong> ofregulatory compliance.Support costsSupport costs are those costswhich are common to therange of charitable activities.These have been allocated onthe basis of time spent bystaff in each area.Pension costsPension costs are paid under adefined contribution scheme.The assets of the scheme areinvested <strong>and</strong> managedindependently of the financesof the Organisation. Thepension costs chargerepresents contributions paidin the year.Grants <strong>and</strong>ScholarshipsGrants <strong>and</strong> scholarships areaccounted for at the timethey are approved.Fixed assetsIndividual fixed assetscosting more than £250 arecapitalised at cost.Depreciation is provided atrates calculated to write offthe cost of each asset over itsexpected useful life. Theestimated life used is 4 yearsfor each asset.InvestmentsInvestments are stated atmarket value at the balancesheet date. Net gains <strong>and</strong>losses arising on revaluations<strong>and</strong> disposals are charged orcredited to the SOFA.StocksStocks of goods for resale areincluded at the lower of theircost or net realisable value.FundsUnrestricted funds may beapplied to any of thecharitable objects at thediscretion of the trustees.Designated funds areunrestricted funds whichhave been set aside by thetrustees for particularpurposes.